SK Research Interval Fund Credit Index Reveals 11% Returns for 2023

SK Research and Due Diligence, or SKRADD, announced the release of its Q4 2023 Interval Fund Credit Index (SKRADD-IFC), which tracks the performance of 20 of the largest interval funds primarily investing in credit strategies.

An affiliate of Snyder Kearney LLC, SKRADD manages Altidar, an online alternative investment research platform that empowers advisers by providing them with independent research covering a range of alternative investment offerings. Launched in winter 2023, Altidar is designed to help advisers explore alternative investment opportunities that are structured for the private wealth channel.

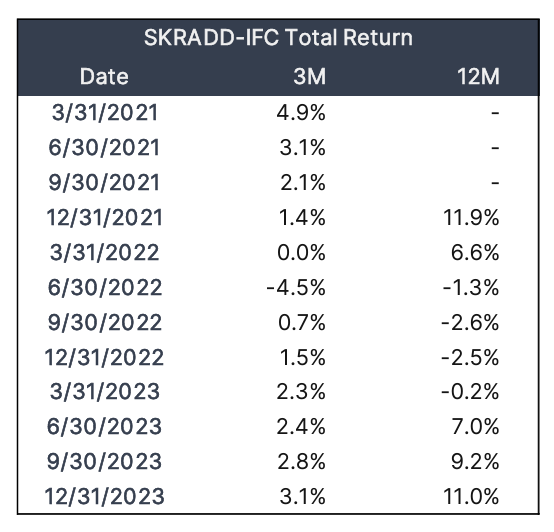

From the recent SKRADD-IFC report, last year was a favorable year for credit-focused funds, as heightened interest rates positively impacted the returns on investments in variable-rate instruments. For the three and 12 months ended Dec. 31, 2023, the index posted returns of 3.1% and 11%, respectively.

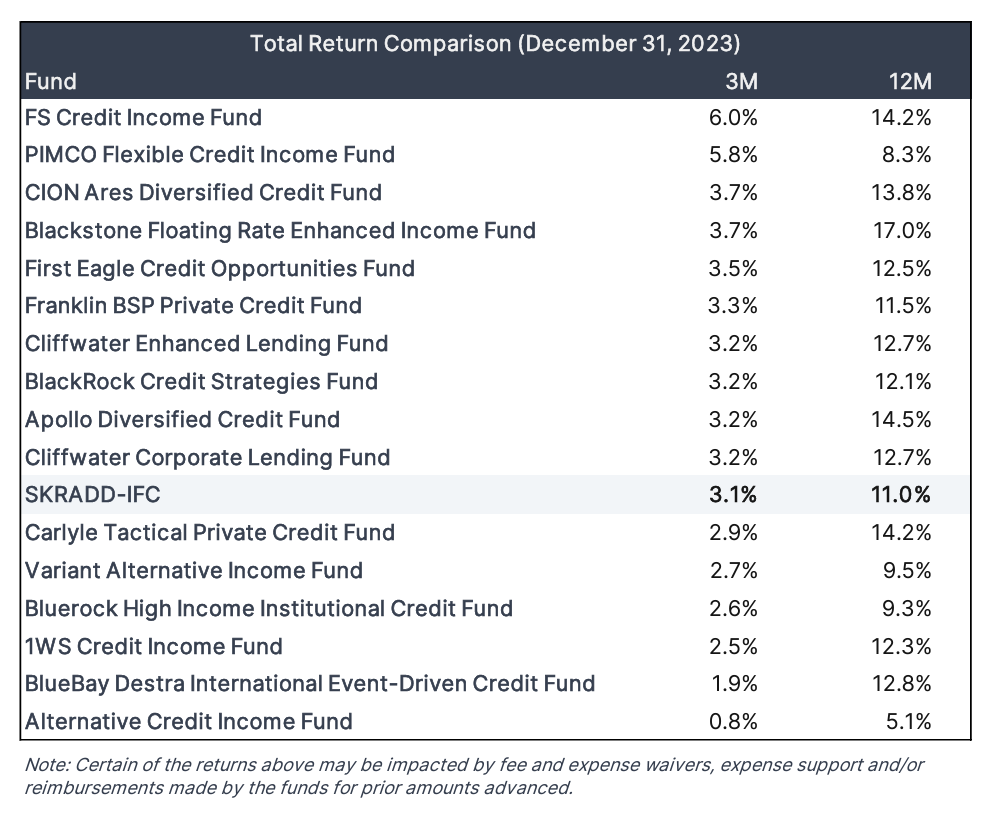

SKRADD also provided a comparison of SKRADD-IFC returns with those of a number of leading credit-focused funds, not all of which are constituents of the index. All the funds presented reported positive returns for the three- and 12-month periods. The total-return leaders in 2023 were Blackstone Floating Rate Enhanced Income Fund with a total return of 17.0%, followed by Apollo Diversified Credit Fund at 14.5%, and a tie for third with a total return of 14.2% shared by FS Credit Income Fund and Carlyle Tactical Private Credit Fund. Ten other funds in the comparative set also reported double-digit annual returns, including: CION Ares Diversified Credit Fund (13.8%), BlueBay Destra International Event-Driven Credit Fund (12.8%), Cliffwater Corporate Lending Fund (12.7%), Cliffwater Enhanced Living Fund (12.7%), First Eagle Credit Opportunities Fund (12.5%), 1WS Credit Income Fund (12.3%), BlackRock Credit Strategies Fund (12.1%), and Franklin BSP Private Credit Fund (11.5%).

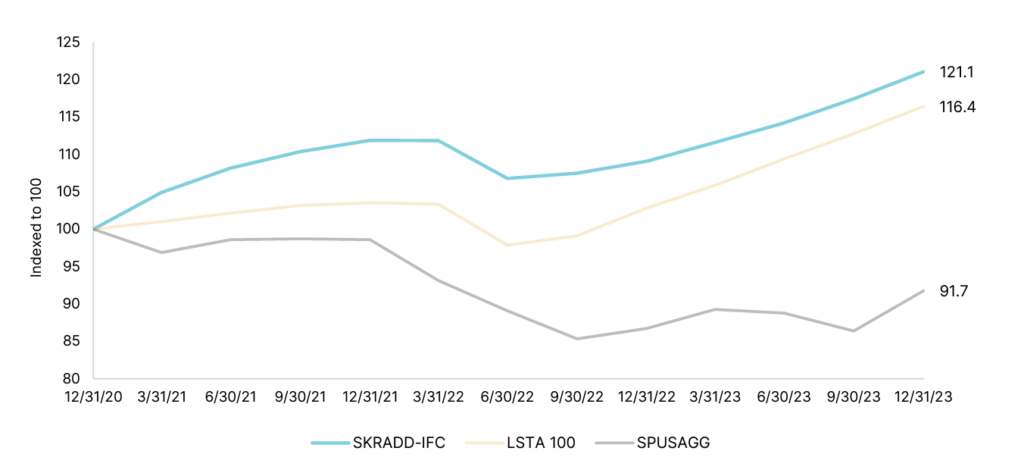

Credit-focused interval funds have generally performed well since the inception of SKRADD-IFC when comparing their performance with that of two credit investment benchmark indices.

The Morningstar LSTA US Leveraged Loan 100 Index (LSTA 100) is a market value-weighted index designed to measure the performance of the 100 largest facilities in the U.S. leveraged loan market. The S&P U.S. Aggregate Bond Index (SPUSAGG) is designed to provide broad U.S. coverage of the investment-grade U.S. fixed income market by drawing its constituents from seven major fixed income asset classes.

Indexed to 100 on Dec. 31, 2020, SKRADD-IFC grew to 121.1 as of Dec. 31, 2023, compared with 116.4 for the LSTA 100 and 91.7 for the SPUSAGG fixed income index. While strategies vary, performance by constituents of SKRADD-IFC likely benefited from greater allocations to private lending and other less liquid investments as compared with the two benchmarks, as well as a greater emphasis on variable-rate loans as compared with the SPUSAGG. In addition, interval funds may employ leverage, which is accretive to returns in a positive market.

Alternative Investment Data and Research, or Altidar, is a comprehensive research platform built to support advisers’ understanding and execution of alternative investment opportunities. Altidar.com offers access to more than 80 alternative investment funds, including interval and other closed-end funds, non-traded business development companies, and non-traded real estate investment trusts.

For more Snyder Kearney LLC news, please visit their directory page.