Inland Private Capital Corporation (IPC) specializes in offering multiple-owner, tax-focused, private placement investments for accredited investors seeking replacement property for an IRS Section 1031 exchange, as well as Qualified Opportunity Zone opportunities, throughout the United States. IPC is recognized as an industry leader in securitized 1031 Exchange transactions.

Inland Private Capital 2901 Butterfield Road Oak Brook, IL 60523

| Year | Sector | Structure | Senior Executives |

|---|---|---|---|

|

2001 |

Multifamily, Healthcare, Self-Storage, Retail, Office, Student Housing, Industrial, Hospitality |

Specializes in offering multiple-owner, tax-focused, private placement investments, including DST (Delaware statutory trust) 1031s and QOZ (Qualified Opportunity Zone) opportunities throughout the United States |

Mitchell A. Sabshon, Director, President and CEO, Inland Real Estate Investment Corporation Catherine L. Lynch, CFO, Secretary and Director, Inland Real Estate Investment Corporation Keith Lampi, President and CEO, Inland Private Capital Corporation Rahul Sehgal, Chief Investment Officer and Director, Inland Private Capital Corporation Joseph Binder, Senior Vice President, Acquisition Structure and Finance, Inland Private Capital Corporation Nati Kiferbaum, Senior Vice President, Investment Product Strategy, Inland Private Capital Corporation |

| AUM | Total Equity Raised | # of Full Cycle Offerings | # of Liquidity Events | # of Private Placements Programs |

|---|---|---|---|---|

|

$12.2 billion (as of December 31, 2022) |

305 |

| Multimedia |

|---|

|

Collateral Pieces: |

| Notes |

|---|

|

AUM Continued...

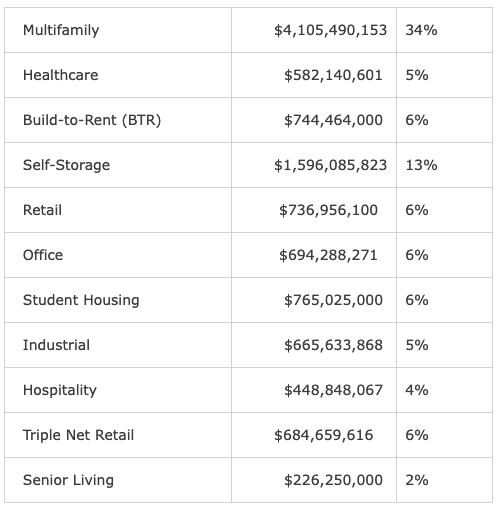

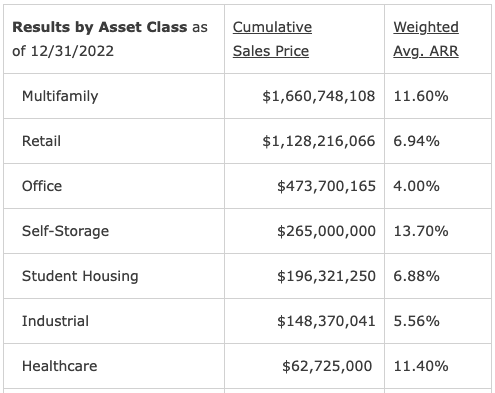

Track Record Since Inception:

*Explanation of Terms & Calculations Weighted Average Annualized Rate of Return (ARR) For each full-cycle program, the ARR is calculated by dividing (a) the sum of (i) total cash flows distributed during the term of the investment program, plus (ii) any net sales proceeds distributed less the investors’ original capital, by (b) the investors’ original capital; with the result then further divided by (c) the investment period (in years) for that program. To determine the weighted average for all programs, the ARR for each program is multiplied by the capital invested in that program, divided by the total capital invested in all full-cycle programs since inception (2001). To determine the weighted average in each asset class, the ARR for each program within that asset class is multiplied by the capital invested in that program, divided by the total capital invested in all full-cycle programs within that asset class since inception (2001). |