Non-Traded NAV REITs Post 70% Total Return Over Past Five Years

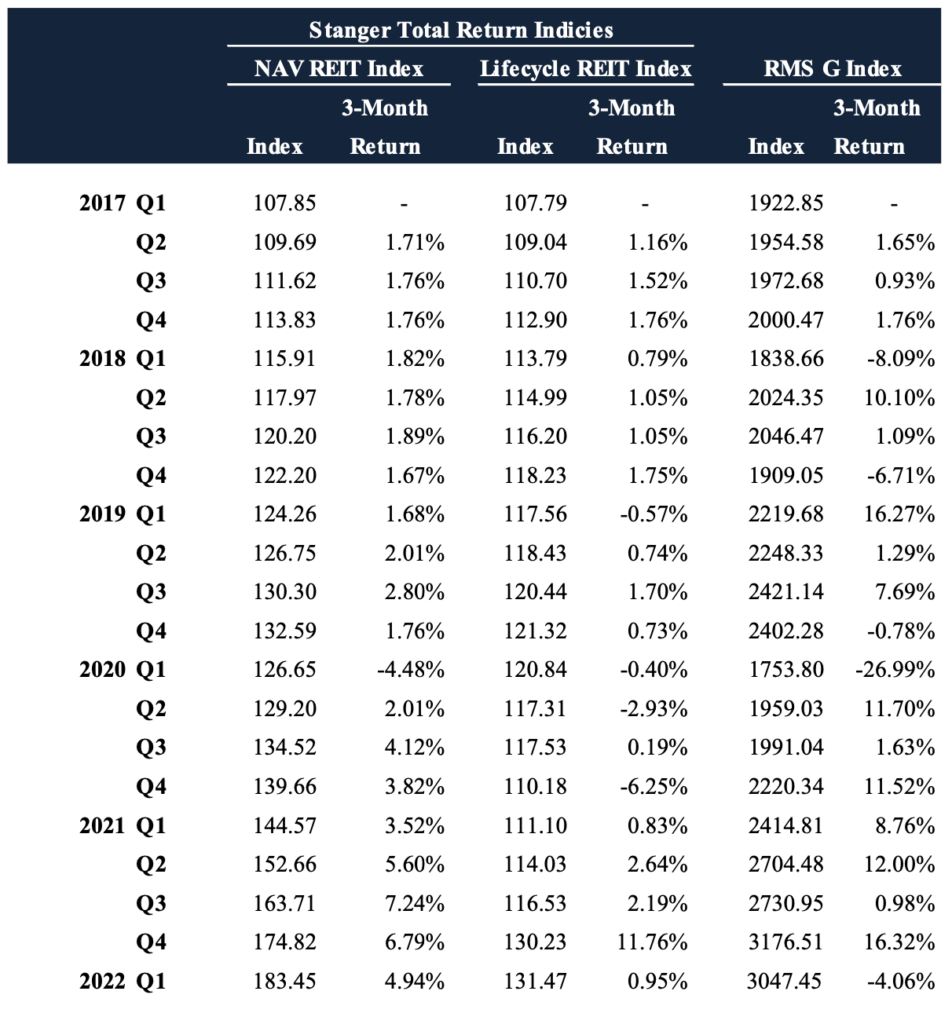

Non-traded net asset value real estate investment trusts posted a 4.94 percent return for first quarter of 2022, as measured by the Stanger NAV REIT Total Return Index.

Non-traded net asset value real estate investment trusts posted a 4.94 percent return for first quarter of 2022, as measured by the Stanger NAV REIT Total Return Index.

According to investment banking firm Robert A. Stanger & Co, the index took a moderate dip in first quarter of 2020, but has since continued on a “steady” upward trajectory.

Stanger noted that non-traded NAV REIT returns outpaced those of their traded counterparts with a cumulative total return of 70.1 percent over the last 60 months.

The momentum of the MSCI US REIT Index Gross Total Return, a measure of performance of publicly traded REITs, which rose 16.32 percent in the fourth quarter on a strong stock market, fell 4.06 percent in the first quarter. Over the last 60 months, the total return of this broader REIT market index was 58.5 percent.

The chart below illustrates the impact that stock market volatility plays in listed REIT securities values relative to non-traded REITs.

“This performance highlights the benefits of a non-listed NAV REIT vehicle, that historically has provided a mostly steady real estate-based return without the extreme ongoing volatility of the traded market,” said Kevin Gannon, chairman and chief executive officer of Stanger. “This strong performance is the driving force behind $12.1 billion of NAV REIT fundraising in first quarter 2022, and we expect this trend to continue.”

“This performance highlights the benefits of a non-listed NAV REIT vehicle, that historically has provided a mostly steady real estate-based return without the extreme ongoing volatility of the traded market,” said Kevin Gannon, chairman and chief executive officer of Stanger. “This strong performance is the driving force behind $12.1 billion of NAV REIT fundraising in first quarter 2022, and we expect this trend to continue.”

The IPA/Stanger Monitor tracks the individual performance of 38 non-traded REITs with a combined market capitalization of more than $101 billion.

According to Stanger, over the last 12 months, the top performing non-traded NAV REIT was Cottonwood Communities (Class A at 102.18 percent), and the top performing traditional lifecycle REIT was Resource REIT (67.12 percent).

Over a five-year period, Blackstone Real Estate Income Trust (Class I at 14.30 percent annualized) was the top performing NAV REIT, and Resource REIT (15.33 percent annualized) was the top performing traditional REIT.

The IPA/Stanger Monitor, sponsored by the Institute for Portfolio Alternatives and authored and published by Stanger, also covers 11 non-traded business development companies, with a combined market capitalization of $20 billion.

“Our latest data substantiates what wealthy and institutional investors have known for years, that NAV REITs deliver strong returns with less volatility risk, improving a portfolio’s overall performance,” said Gannon. “Main Street investors and America’s retirement savers need access to those same benefits. It’s time we remove the artificial barriers that are preventing that type of broad access to portfolio diversifying investments, like NAV REITs, and equip those investors with practical guidance on how to utilize these products as part of a balanced portfolio.”

In related news, Stanger reported that fundraising for non-traded alternative investments hit $32.9 billion in the first quarter of 2022.

Robert A. Stanger & Co. Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.