Sponsored: Seeing the Forest Through the Trees

By: Nick Rosenthal, Co-Chief Executive Officer, Griffin Capital Company LLC

Having raised over $1.4 billion of equity for qualified opportunity zone fund (“QOF”) strategies through the private wealth channel since 2019, we engage in frequent dialogue with our stakeholders about the potential tax, financial planning, and investment benefits of the structure. When married with a compelling underlying investment opportunity, the QOF structure may present a powerful mechanism to help investors with capital gains achieve attractive outcomes, particularly in ways in which they are most focused, including tax mitigation, improving investment returns and liability planning.

The two most significant planning and economic benefits of the QOF legislation, deferral of capital gains recognition on the invested capital gain and elimination of capital gains on the QOF investment, continue to be available to investors through 2026. While there is proposed legislation in Congress to extend the investment window and capital gains deferral date to Dec. 31, 2028 (the “Extension Act”), investors should understand the existing benefit is incredibly powerful.

The ability to defer recognition of a capital gain until Dec. 31, 2026, provides investors time to plan and potentially minimize their future tax liability. Strategies employed over the next several tax periods in other parts of the portfolio, such as tax loss harvesting, could meaningfully reduce the future tax liability. It also allows investors to spread tax liability over multiple tax periods, as an investor is not required to invest the entirety of the gain in a QOF.

Instead, the investor may invest a portion of the gain in a QOF, thereby deferring tax on such gain while paying capital gains tax on the balance of the gain in the current period tax year.

By far, the most powerful benefit of a QOF is the ability to allocate capital gains to an investment that, if held for more than 10 years, receives a fair market value basis step-up upon exit, which provides the investor a way to create tax-free growth in a portfolio over the long-term, a tremendous benefit in its own right that becomes magnified if taxes should increase in the future.

All too often, I am surprised to hear financial professionals say, “Isn’t the benefit significantly reduced now?” or “I am waiting to see what happens with the proposed Extension Act,” which is no doubt a byproduct of misplaced marketing efforts from industry participants that were urging investors to place capital before arguably the most insignificant of the QOF incentives expired in 2019 and 2021, respectively.

Under the existing QOF legislation, those who held their interest in a QOF for seven years prior to Dec. 31, 2026 (i.e., invested on or before 2019) were eligible for a 15% reduction in the amount of capital gain that would be subject to tax at the end of the deferral period. If the investment was held for at least five years prior to Dec. 31, 2026, but less than seven years before such date (i.e., after 2019 but before 2022), then the investor would be eligible for a 10% reduction in the amount of capital gain that was subject to tax at the end of the deferral period.

While this is an additive benefit of the QOF legislation, the overall tax savings pales in comparison to the savings that could potentially be generated from the ability to grow the QOF investment tax free.

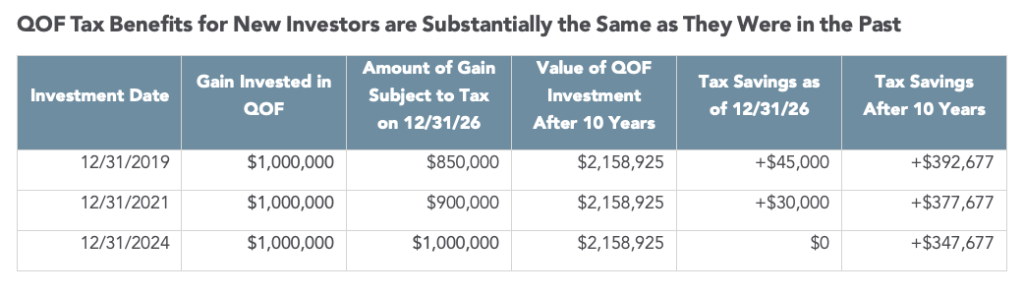

Consider three different investors that each have a combined state and federal capital gains tax rate of 30%, realize a $1 million gain and timely invest the gains into a QOF in 2019, 2021 and 2024 and earn a pre-tax, annually compounded rate of return of 8.0%.

Note: This example assumes that the investors reside in a state that conforms to the federal QOF legislation and that 100% of the return attributable to the QOF investment is attributable to growth in the value of the investment that would be considered a capital gain under the U.S. Tax Code. This hypothetical example is for illustration purposes only and does not reflect the return on any actual investment.

Note: This example assumes that the investors reside in a state that conforms to the federal QOF legislation and that 100% of the return attributable to the QOF investment is attributable to growth in the value of the investment that would be considered a capital gain under the U.S. Tax Code. This hypothetical example is for illustration purposes only and does not reflect the return on any actual investment.

In the above example, all three investors will realize tax savings of $347,677 as a result of the elimination of capital gains tax liability attributable to the appreciation of the QOF investment after 10 years. While the 2019 and 2021 investments qualified for the reduction in the amount of invested gain subject to tax at the end of 2026, 88.5% and 92.0% of their overall tax savings, respectively, is attributable to the tax-free growth of the investment. As the example clearly shows, the change in QOF tax benefits for investments after 2021 is relatively de minimis and the most powerful benefit, tax-free growth, continues to be available to investors today.

Additionally, with thoughtful tax planning, strategies like tax loss harvesting can be implemented during the deferral period, the value of which could be even more impactful in reducing the deferred tax liability relative the 10% and 15% basis step-up provisions that have expired. Capital flows have been significant for QOF strategies since the legislation was introduced, but inflows slowed in the second half of 2022. Private wealth platforms that have seen a decline of investment activity may conflate that slowdown with the sunsetting of the 15% and 10% basis step-up benefits, but this would be misguided. As interest rate increases accelerated in 2022, impacting the values of investment portfolios and pouring cold water on an M&A market that had been red-hot, capital gains generation slowed, reducing the eligible pool of capital for QOF investment. Capital gain recognition was also hampered by the broader economic uncertainty that continued through the first half of 2023. These dynamics are starting to reverse as we get closer to a consensus peak-rate environment. Private equity funds have significant uninvested capital to deploy and are increasingly active, private credit is filling the void of traditional banks to finance transactions, and capital gains generation velocity is increasing. In addition, equities have rallied through 2023, and investors are again recognizing gains to rebalance portfolios or reduce concentration risks.

The QOF solution remains a powerful structure with the two most significant benefits still intact (deferral and elimination). The ability to defer capital gains recognition, plan for it, and potentially minimize it is very compelling. To allocate capital in a way that will grow free of taxation on a long- term basis, provide investment diversification, and has the ability to produce very tax-advantageous income is a conversation that qualified investors should consider.

A PDF of this article is available on our website.

This material does not constitute tax advice to any person. a person must consult with his or her own tax advisors regarding the tax consequences to them of acquiring and owning any QOF investment.

THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY ANY SECURITIES. AN OFFERING IS MADE ONLY BY A PRIVATE PLACEMENT MEMORANDUM. THIS LITERATURE MUST BE READ IN CONJUNCTION WITH A PRIVATE PLACEMENT MEMORANDUM IN ORDER TO UNDERSTAND FULLY ALL OF THE IMPLICATIONS AND RISKS OF SECURITIES TO WHICH IT RELATES. A COPY OF A PRIVATE PLACEMENT MEMORANDUM MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH AN OFFERING. THIS MATERIAL DOES NOT CONSTITUTE TAX ADVICE TO ANY PERSON. A PERSON MUST CONSULT WITH HIS OR HER OWN TAX ADVISORS REGARDING THE TAX CONSEQUENCES TO THEM OF ACQUIRING AND OWNING AN INVESTMENT IN A QUALIFIED OPPORTUNITY ZONE FUND.

IMPORTANT RISK FACTORS

An investment in a Qualified Opportunity Zone Fund is subject to various risks, including but not limited to:

- To be eligible for the tax benefits associated with such funds, investors must comply with various requirements, as specified under Sections 1400z-1 and 1400z-2 of the U.S. Internal Revenue Code, and any U.S. Treasury and Internal Revenue Service guidance promulgated. Failure to comply with these requirements, or the failure of a given fund to qualify as a Qualified Opportunity Zone Fund, may result in a loss of all or a portion of the associated tax benefits. Investors should consult with their tax professional to determine their specific tax implications from an investment in such funds.

- Typically, no public market currently exists, and one may never exist, for the interests of any Qualified Opportunity Zone Fund. Qualified Opportunity Zone Funds are not liquid.

- Qualified Opportunity Zone Funds typically offer and sell interests pursuant to exemptions from the registration provisions of federal and state law and, accordingly, those interests are subject to restrictions on transfer.

- There is no guarantee that the investment objectives of any particular Qualified Opportunity Zone Fund will be achieved.

- Investments in real estate are subject to varying degrees of risk, including, among other things, local conditions such as an oversupply of space or reduced demand for properties, an inability to collect rent, vacancies, inflation and other increases in operating costs, adverse changes in laws and regulations applicable to owners of real estate and changing market demographics.

- The actual amount and timing of distributions paid by a Qualified Opportunity Zone Fund is not guaranteed and may vary. There is no guarantee that investors will receive distributions or a return of their capital.

- Qualified Opportunity Zone Funds that invest in for-lease properties depend on tenants for their revenue and may suffer adverse consequences as a result of any financial difficulties, bankruptcy or insolvency of their tenants.

- Disruptions in the financial markets and challenging economic conditions could adversely affect a Qualified Opportunity Zone Fund.

- Qualified Opportunity Zone Tax Benefits may not be available under state law and some states may impose their own requirements to qualify for the equivalent of the Qualified Opportunity Zone Tax Benefits under state law.

- An investment in a Qualified Opportunity Zone Fund is highly speculative.

©2023 Griffin Capital Company, LLC. All rights reserved.