Sponsored: Resource Real Estate Diversified Income Fund Continues Strong Performance

The Fund releases performance as of September 30, 2018.

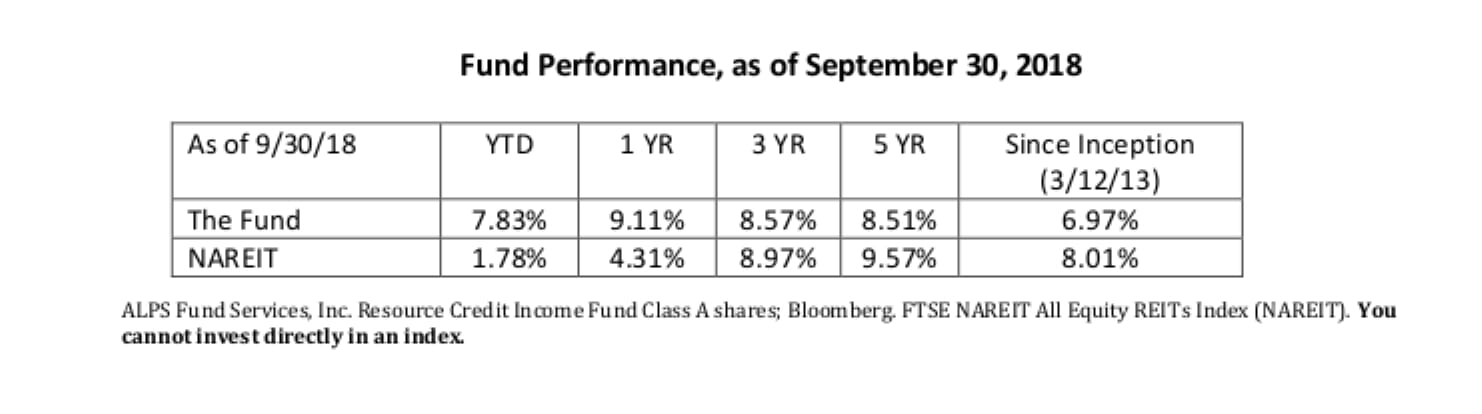

Resource Real Estate Diversified Income Fund (the “Fund”) announced its annualized and cumulative performance as of September 30, 2018, highlighting the direct results of its consistent, diversified real estate strategy. The Fund began trading on March 12, 2013 and closed the quarter as of September 30, 2018 with an inception-to-date cumulative total return of 45.4 percent.

This year, real estate markets have been tested by rising interest rates, global trade tensions, and increasing labor and construction material costs. The Fund’s closed-end interval fund structure allows it to create a long-term capital base and limits its exposure to a forced sell-off during market panic. We believe that the Fund is positioned to deliver the greatest potential value.

The Fund’s investment strategy, which includes allocations across public and private real estate equity and credit markets, enables it to take defensive positions in credit investments and to take advantage of attractive buying and selling opportunities during market dislocation.

This strategy has resulted in performance ranging from 9.11 percent to 8.51 percent in the one, three, and five-year periods, as well as significant outperformance relative to a US REIT Index during the year-to-date period when publicly traded REIT valuations came under pressure. We believe this affirms the Fund’s ability to read markets, and strategically positions it well for continued risk-adjusted total return potential.

Performance data quoted represents past performance. Past performance is no guarantee of future results and investment returns and principal value of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted above. For performance information current to the most recent month-end, please call toll-free (866) 773-4120 or visit www.ResourceAlts.com. Performance information is reported net of the Fund’s fees and expense, but does not include the Fund’s maximum sales charge of 5.75% for Class A shares. Performance would have been lowered if the maximum sales load had been reflected above. Class A gross expenses are 2.91% and net expenses are 2.70%. Net fees are based on a contractual fee waiver and reimbursement agreement of 0.21% through at least January 31, 2019.

“The Fund’s unique allocation to real estate credit has provided the opportunity to invest in floating-rate assets that may help mitigate interest rate risk and offer greater income-focused return potential,” said the Fund’s portfolio manager Justin Milberg. “At this stage of the cycle, we believe the Fund is positioned well for today’s economic and real estate backdrop.”

By investing in a portfolio of private equity, public equity, and credit real estate investments, the Fund seeks income, risk diversification, and long-term appreciation for its investors.

To learn more about the Fund, visit www.ResourceAlts.com.

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. To obtain a prospectus containing this and other information, please call (866) 773-4120 or download the file from www.ResourceAlts.com. Read the prospectus carefully before you invest.

The Fund is distributed by ALPS Distributors, Inc. (ALPS Distributors, Inc. 1290 Broadway, Suite 1100, Denver, CO 80203). Resource Real Estate, LLC (the Fund’s adviser), its affiliates, and ALPS Distributors, Inc. are not affiliated.

Investing involves risk. Investment return and principal value of an investment will fluctuate, and an investor’s shares, when redeemed, may be worth more or less than their original cost.

Visit this page to view additional Fund disclosures.

Resource is a sponsor of The DI Wire, and the article was published as part of their standard directory sponsorship package.

For more Resource news, click here to visit their directory sponsor page.