Schorsch wants more of the pie – Goes after energy investments

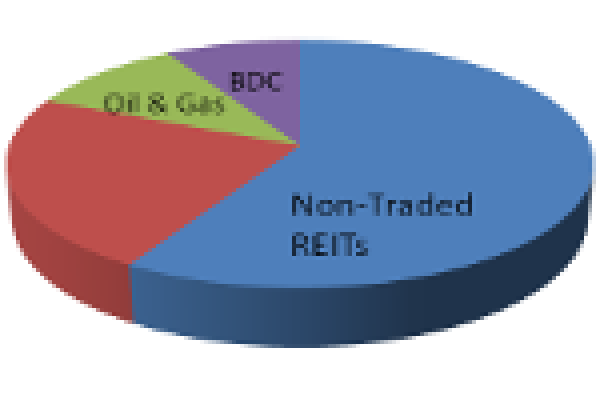

After a monumental year for the American Realty Capital (ARC) companies, Nicholas Schorsch & Co. keep on innovating and moving forward. ARC, already sponsor to 11 non-traded REITs and a business development company, wants in on the energy business.

In an S1 filing with the SEC on Friday, American Energy Capital Partners, LP, a newly formed Schorsch owned Delaware entity, filed its intent to raise up to $2 billion for an oil and gas blind pool. However, this is more than just a decision to get into the oil and gas business. This is a “go big or go home” move by partnering with one of the energy industry’s most known in Aubrey McClendon.

McClendon, Co-Founded Chesapeake Energy Corp in 1989 and worked to make it the nation’s second largest natural gas producer after Exxon Mobil Corp. He left the firm earlier this year under pressure from shareholders over aggressive spending, which at times, exceeded the company’s cash flows.

How does McClendon fit in with Nicholas Schorsch, ARC, and American Energy Capital Partners, LP?

AECP Management, LLC (the Manager), an entity owned by McClendon, will be the manager of American Energy Capital Partners, LP, responsible for “management and operating services regarding substantially all aspects of {the} operations.”

In other words, Schorsch’s wholesale broker dealer, Realty Capital Securities, LLC, will raise up to $2 billion dollars from retail investors and turn those funds over to Aubrey McClendon’s AECP Management, LLC to invest and manage as they see fit.

Another risk stated in the filing is that “the Manager and its affiliates will engage in other business activities (including acquiring, owning, operating, developing and selling oil and gas prospects and properties).”

Also, the offering will rely solely on the Manager to source and locate properties, however, does not have a “right of first refusal to acquire oil and gas properties held by the Manager in its inventory or other oil and gas properties held by third parties that come to the attention of the Manager.”

Lastly, also noteworthy, if there are not sufficient funds from operations, all or part of the distributions may come from offering proceeds or borrowings. This is more common for non-traded REITs, but seldom seen with oil and gas partnerships. The target annual distribution is 6%.

McClendon certainly has proven his abilities to find and produce oil and natural gas given the success of Chesapeake. Schorsch and his team have demonstrated their ability to raise capital and deliver liquidity to investors over the last several years. Sounds like a perfect match? Time will tell.