Non-Listed BDCs Finish 2023 Strong, Still Trail Listed Counterparts

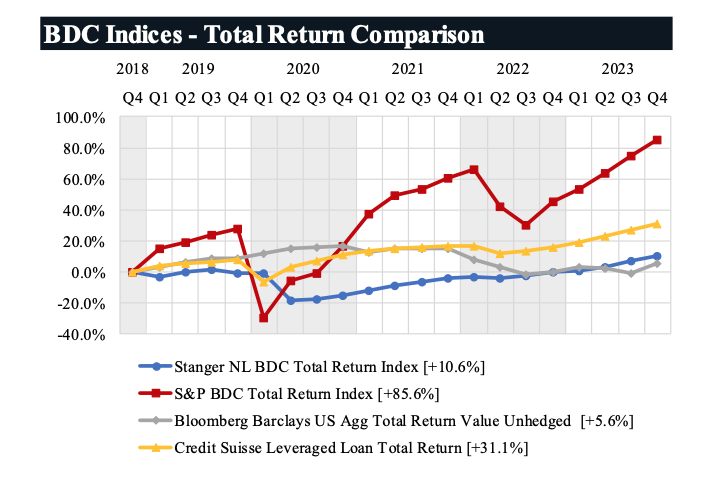

Non-listed business development companies had a combined aggregate net asset value of $60.8 billion, a year-over-year increase of nearly 50%. The Stanger NL BDC Total Return Index – heavily credit-focused – hit an all-time high, growing 2.9% in the fourth quarter of 2023 and 10.8% overall for the year.

“NL BDCs finished the year strong, with all currently open offerings posting positive returns for a second consecutive quarter and combined aggregate net asset value growing more than 10% quarter-over-quarter. Despite this, NL BDCs finished the year well behind their publicly traded counterparts, with the S&P 500 BDC Total Return Index increasing by 27.6% in 2023…” said Kevin T. Gannon, chairman and chief executive officer of investment bank Robert A. Stanger & Co.

Gannon offered context for the increase, due in part “to the public market overreaction in 2022, and traded BDCs moving closer to book value in 2023. NL BDCs posted positive returns for the 13th time out of the past 14 quarters and continue to benefit from the current interest rate environment, with Q3 and Q4 2023 bringing their best and second-best quarterly returns, respectively, in the past two years.”

These results, as well as individual performance data on non-listed BDCs, are published in the Non-Listed BDCs Edition of The Stanger Report for Q4 2023.

Blue Owl Credit Income Corp. was the top three-month performer among NL BDCs in Q4 2023, with a total return of 3.7%. BlackRock Private Credit Fund led NL BDCs in terms of one-year performance with 17.8% total return through NAV appreciation and regular and special distributions provided to investors.

Looking at longer-term performance, MSC Income Fund Inc. and Blue Owl Capital Corporation II both maintained their top positions in terms of three-year and five-year total return, respectively.

“While there were no new public registrations in Q4 2023, there has been a surge in the amount of private placement BDCs coming to market. This trend was highlighted by Franklin BSP Lending Corp’s merger into Franklin BSP Capital Corp, a private BDC with $3.8 billion in combined total assets,” said Michael S. Covello, executive managing director at Stanger.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.