NexPoint Multifamily Advisor to Pay Commission on High Volume Share Sales

NexPoint Multifamily Capital Trust Inc., a publicly registered non-traded real estate investment trust, has revised its commission fee structure for certain high volume sales of its class A shares of common stock.

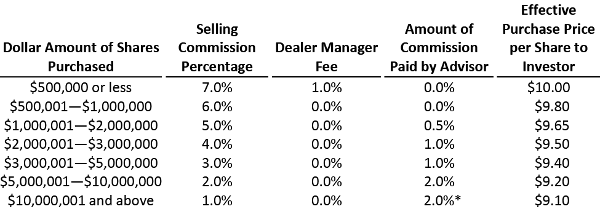

NexPoint Real Estate Advisors II, the REIT’s advisor, will pay all or a portion of the sales commissions associated with certain high volume sales of its class A shares. The new arrangement kicks in for sales over $1 million.

For sales in excess of $10 million, the advisor will pay a 1 percent selling commission to the dealer-manager, Highland Capital Funds Distributor, and an additional 1 percent to the investor. The investor portion will be used to purchase additional class A shares at $9.10 per share, with no selling commissions or dealer manager fee charged on the additional shares.

For example, if an investor purchased $15 million in class A shares, due to the extra 1 percent paid by the advisor to purchase additional shares, the investor would receive 1,648,351.65 class A shares.

As reported by The DI Wire earlier this year, the REIT reduced its dealer manager fee from 3 percent to 1 percent, and reduced the payment of organization and offering expenses from 1.5 percent to 1 percent.

NexPoint Multifamily Capital Trust commenced its $1.1 billion offering in August 2015. To date, the company has raised $2.2 million and owns one 330-unit multifamily property in Phoenix, Arizona.

For more NexPoint news, visit their directory sponsor page here.