Highland Capital’s BDC NexPoint Declares June Distribution

Non-traded business development (BDC) company NexPoint Capital (NexPoint), Inc. recently declared a cash distribution of $.058 per share of common stock which based on its public offering price of $10 per share, represents an annualized rate of about 7 percent.

Shareholders of record on June 22, 2015 will receive the distribution on June 30, 2015.

NexPoint is a healthcare-focused BDC sponsored by an affiliate of Highland Capital Management, NexPoint Advisors, L.P. Highland and affiliates have about $20 billion in assets under management, including $2.3 billion in healthcare related assets.

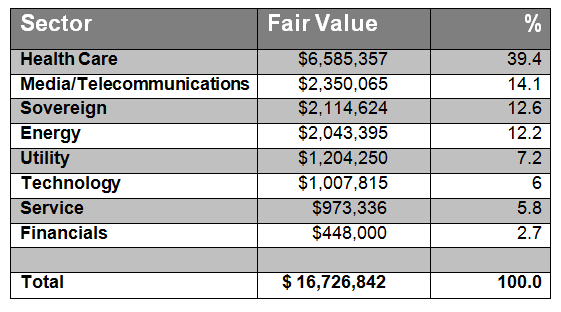

As of March 31, 2015, the BDC’s portfolio carried a fair value of $16.7 million with close to 40% of its assets in healthcare related investments and the balance across many sectors as seen in the chart below.

As of December 31, 2014, NexPoint’s portfolio had interests in 11 companies of which 18 percent were first lien senior secured loans, 51 percent second lien senior secured loans, 9 percent corporate bonds, 4 percent asset-backed securities , and 1 percent in a sovereign foreign bond fund.

For more information on NexPoint, click here.