GWG Reports Q1 Results

Sponsor of non-traded life settlement investment programs, GWG Holdings, Inc. (GWG), recently released its Q1 financials and based on the results, management remains optimistic for the company’s future growth.

GWG’s current $1 billion L Bond offering is distributed through independent broker-dealers (IBDs) and offers advisors and investors a yield generating, non-correlated asset that invests in insurance policies from seniors that no longer need, want or can afford the monthly premiums. Seniors sell these policies to GWG for typically five to eight times higher than surrender values.

“GWG’s strategy of partnering with independent financial advisors to bring value added financial solutions to the marketplace is paying off,” commented Jon Sabes, GWG Holdings, Inc.‘s Chief Executive Officer.

With only a handful of firms offering non-traded life settlement investment options through IBDs, GWG is in a position to attract interest from yield-starved advisors and investors.

Sabes added, “We have a unique suite of products and services designed to serve the huge and growing need for post-retirement financial services and we have the distribution capability of a nationwide network of trusted, independent financial advisors who deliver these products and services in a transparent, thoughtful, valued-added approach.”

GWG serves IBDs and their advisors throughout the country with a distribution team that includes 12 internals and externals, and four members that make up the national accounts and sales management team.

“The benefits of the Company’s products and services – whether the unique performance of our non-correlated fixed income investment offerings or the unmatched consumer value proposition of a senior life settlement transaction – are gaining recognition across the financial marketplace,” said Michael Freedman, GWG Holdings, Inc.‘s President.

The Minnesota-based sponsor provides advisors and investors a unique alternative investment non-correlated to the market while also helping seniors unload unwanted or unneeded life insurance policies by purchasing their contracts for typically higher than insurance companies would offer.

“GWG is uniquely positioned to help the fastest growing demographic in the United States to address their most pressing financial needs and we have the business model and financial resources to continue to execute,” added Freedman.

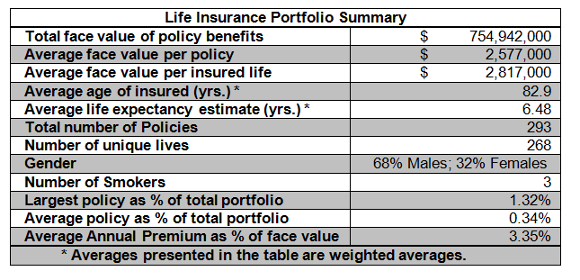

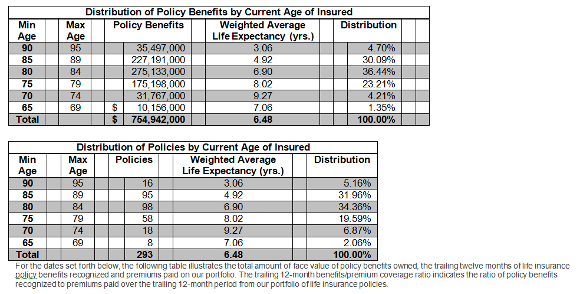

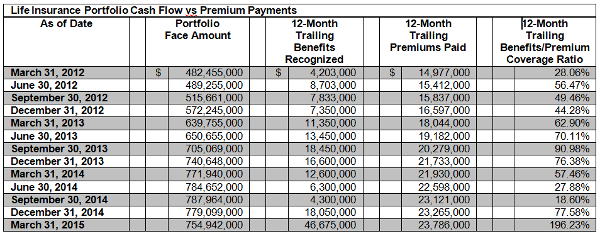

The following tables reflect Q1 results for GWG Holdings, Inc., the publicly-traded sponsor of non-traded investment programs, and offer a look into how the process works: