Guest Contributor: Tax Cuts and Jobs Act – Lost Tax Deductions & New Financial Planning Opportunities

By: Matthew Iak, Executive Vice President and Director at U.S. Energy Development Corporation

Changes to the U.S. tax code for 2018 are the most comprehensive in over 30 years, and while many high-net-worth individuals may be surprised to learn that the tax deductions they’ve relied on for years have been reduced and/or eliminated, new tax planning strategies have also emerged.

Below are some of the most notable changes to the tax code for 2018. Direct investments in oil and natural gas may be able to replace other tax deductions your clients are losing from any of the following:

- State and Local Taxes (SALT Tax)

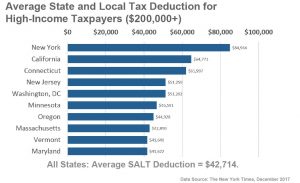

Total deductible amount is now limited to $10,000; which includes income, sales and property taxes. The new limit is most impactful on high income taxpayers ($200,000+ income), as the average SALT deduction for those individuals is $42,714.

- Creates an opportunity to use a high intangible drilling cost (IDC) drilling fund to replace tax deductions your clients are losing. Most states also allow the IDC deduction against state income tax.

- Qualified Business Income (QBI)

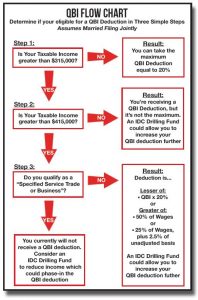

Do you have clients who are doctors, lawyers, accountants or athletes? These professionals, among other “specified service trade or business” individuals with QBI can now deduct 20 percent of their business income against their federal taxes, however this deduction begins to phase-out at incomes above $315,000 and is completely phased-out above $415,000 (for taxpayers who are married filing jointly).

- Creates an opportunity to use an oil and gas drilling fund to lower income and receive some, if not all, of the 20 percent QBI deduction. Additionally, potential income from a drilling fund partnership is subject to the 20 percent QBI deduction in future years.

- Charitable Donations

- Charitable deductions are only allowed for tax payers who itemize. With the higher standard deduction of $24,000 for individuals who are married filing jointly, unless your charitable donations are of significant value, they will no longer result in a tax deduction.

- Other Lost Deductions

Unreimbursed employee expenses, moving expenses, alimony, tax preparation, mortgage interest deduction (on mortgage debt up to $750,000, down from $1 million), casualty and theft losses.

About U.S. Energy:

Rooted in our experience as a privately held oil and gas operator dating back to 1980, U.S. Energy Development Corporation blends operational and financial innovation with a forward-looking approach. Over the past 35 years, the company has invested in, operated, and/or drilled more than 2,350 wells in 13 states and Canada; deploying more than $1.3 billion on behalf of our investor partners. Recent tax reform has created unique financial planning opportunities and strategies for high-net-worth clients in our tax advantaged drilling, acquisition and 1031 exchange funds.

For educational use only. This information is not intended to serve as investment advice.

The views and opinions expressed in the article are those of the author and do not necessarily reflect the views of The DI Wire.

Click here to visit The DI Wire directory page.