A Deeper Dive: DST to UPREIT: Unlocking Greater Value & Optionality for Investors

By: Louis Rogers, founder and co-chief executive officer of Capital Square

Editor’s note: On April 28, 2023, The DI Wire sponsored a webinar entitled “DST to UPREIT: Unlocking Greater Value & Optionality for Investors.”

In this webinar, Louis Rogers, industry veteran and co-chief executive officer of Capital Square, discussed 721/UPREIT transactions, where real estate owners, including owners of Delaware statutory trust interests, contribute their property to the operating partnership of a real estate investment trust in a tax favored manner under Section 721 of the Internal Revenue Code.

While being interviewed by The DI Wire’s publisher, Damon Elder, Rogers explains that the DST structure has worked exceptionally well for over a decade in providing tax deferral under Section 1031 and reliable returns to investors. In discussing the future, Rogers noted that legal structures evolve over time and, that, in appropriate circumstances, UPREIT transactions under Section 721 have a number of positive features.

In this article, Rogers elaborates on his comments in the webinar and provides historical context based on his 40 years in the real estate industry. He concludes that real estate investments and structures evolve over time: from a rent house, to LLCs, REITs, TICs, DSTs and UPREITs, the trend is towards turn-key, institutional-quality real estate. The UPREIT structure has been in use for many decades; DST to UPREIT transactions are the latest variation and, over time, we will see further evolution of tax-advantaged real estate investments.

Introduction to Section 721. The starting point is Section 721 of the Internal Revenue Code that provides a favorable tax rule when property is contributed to a tax partnership in exchange for interest in the partnership. Under section 721, there is no taxable gain to the contributor (the property owner) or partnership (the recipient of the property). The contributor’s tax basis carries over and the taxable gain is deferred. This is very similar to the operation of Section 1031 governing tax-deferred exchanges of real estate.

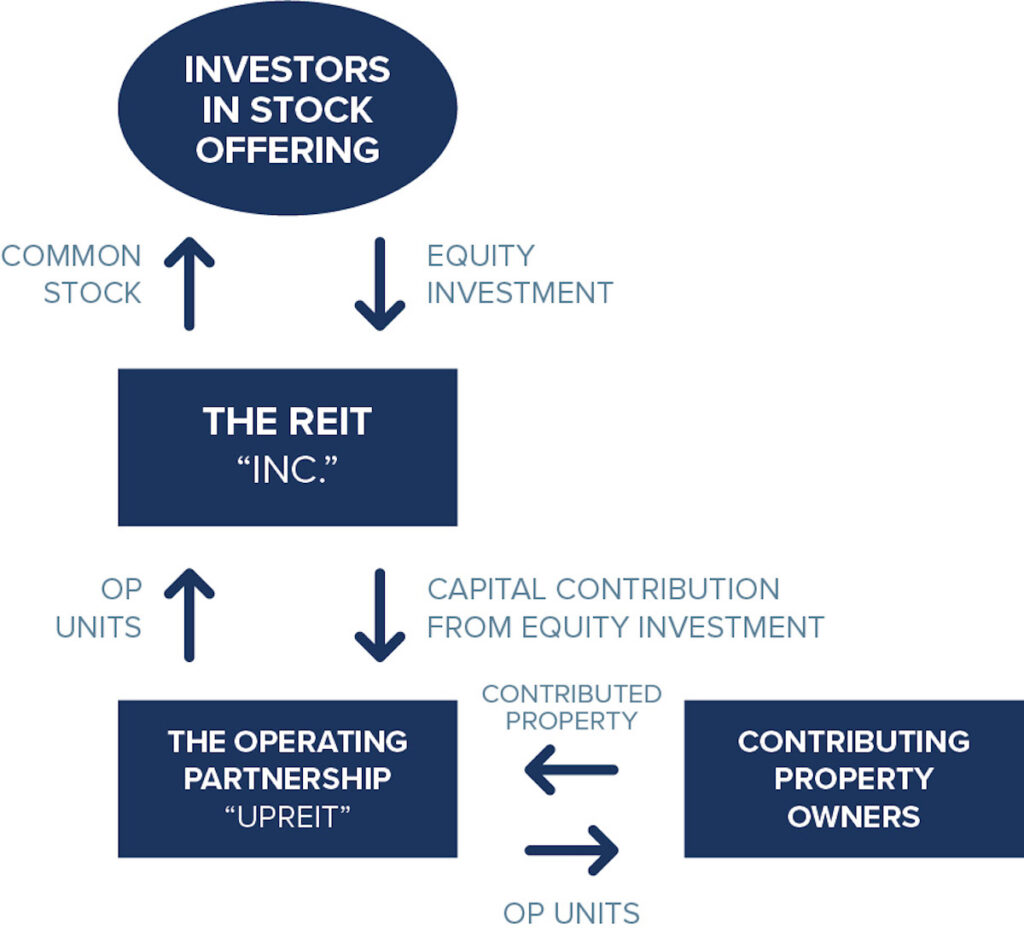

Introduction to UPREIT Transactions. UPREIT stands for “umbrella partnership real estate investment trust.” In an UPREIT transaction, the owner of real estate contributes property to the operating partnership of a REIT in exchange for operating partnership or “OP units.” The OP units received have most of the benefits of REIT shares but do not have the same voting rights as REIT shareholders.

UPREIT Structure. REITs typically adopt an UPREIT structure where the REIT’s real estate is owned in a limited partnership, known as an operating partnership. The REIT is the general partner of the operating partnership and makes decisions for the operating partnership. Each contributor to the operating partnership is a limited partner subject to the operating partnership’s agreement of limited partnership. It may be helpful to think of the operating partnership as an intermediary between the REIT and the REIT’s real estate.

REITs are taxed as corporations which typically have two levels of tax, at the corporate and stockholder levels. REITs must comply with many requirements to qualify for favorable taxation; essentially one level of tax on a portion of the dividends.

REITs typically raise equity by selling REIT stock. This may be done at the same time as the REIT is structuring, or has structured, UPREIT transactions.

Tax partnerships have extremely favorable tax treatment for real estate ownership. The UPREIT structure is used to obtain desirable partnership tax treatment, for example, tax basis for debt, pass-through of depreciation deductions and, importantly, tax-free contributions under Section 721.

In an UPREIT transaction, the owner of real estate contributes their property to the operating partnership of the REIT in exchange for OP units in the operating partnership. Section 721 provides that there is no gain recognition to the contributor (the property owner) or the recipient (the operating partnership). The operating partnership may assume the contributor’s debt or repay it at closing of the transaction. In essence, an UPREIT transaction allows a property owner to exchange one property for an equity interest in a larger, more diversified portfolio that is professionally managed by the REIT.

Most REIT-quality properties are owned in a legal entity, typically an LLC in modern times. When the target property is owned by an LLC, the LLC is the contributor that will receive OP Units in the transaction. OP units are divisible and transferrable. The manager of the LLC can liquidate some or all of the OP units by transferring them to the LLC’s members. This makes OP units a very flexible currency for gifting and estate planning.

It is important to note that the target property must satisfy the REIT’s investment objectives and buy-box. For example, the owner of a Class A multifamily property in the southeast would be a good candidate for a REIT that invests in Class A multifamily property in that region. But a net lease or mortgage REIT would not be a suitable candidate and a rent house would not be suitable for any REIT that invests in investment-grade real estate.

Once you match up the specific property to a suitable REIT, the mechanics of the transaction are fairly straight forward.

First, the target property must be valued to establish a purchase price. Typically, this is done by obtaining MAI appraisals. One of the best aspects of an UPREIT transaction – the purchase price is fair by definition because the parties engage two, or more, MAI appraisers to determine the fair market value of the target property. And if the two appraisals vary in a material way, the parties may engage a third appraiser. The average, or median, of the appraisals is the agreed fair market value. By definition, this is a fair price. In addition, the REIT typically will obtain its own “fairness” opinion from a firm in the business of providing valuations.

Once the value is set, the equity value equals the agreed fair market value less any debt assumed by the operating partnership. The contributors receive the number of OP units that equate to their equity.

OP unit holders will receive distributions from the operating partnership based on the value of their OP units. Distributions to OP units are computed on their equity at the same dividend rate paid to the REIT’s stockholders. Also, OP unit holders will have the benefit of partnership taxation, including basis for debt, interest deductions, operating expense deductions, and depreciation deductions, which help shelter distributions from taxation in the same manner as before the contribution. Taxable income and loss are reported to OP holders on Schedule K-1.

The UPREIT structure has been used for decades; it is a very efficient tool for property owners and REITs to bulk up in a tax-efficient manner. Famous real estate investor, Sam Zell, is best known for using the UPREIT structure to aggregate real estate in his REITs in a tax-efficient manner. Others have used UPREITs to aggregate real estate from developers, owners and operators who seek passive ownership in a tax-efficient manner with greater safety from the operating partnership’s diversified portfolio.

Frequently, OP holders are given tax protection: the operating partnership agrees not to sell the contributed property for a given period in a manner that would trigger recapture taxation to the contributors. Note: the operating partnership can always 1031 exchange the contributed property without recapture.

Compare Section 1031. The outcome under Section 721 is very similar to Section 1031. In a typical Section 1031 exchange, the taxpayer sells a property and, via a qualified intermediary, reinvests the net proceeds in a like-kind replacement property. The gain that would be recognized in a taxable transaction is deferred until the replacement property is sold in a taxable transaction.

Section 721 operates seamlessly – when property is contributed to a partnership in exchange for partnership interests. There is no qualified intermediary and the many rules governing delayed exchanges do not apply. However, in both cases, the taxpayer’s tax basis carries over to the replacement property under Section 1031 or the OP units under Section 721 and there is no gain recognition. Hence, both provisions are similar in outcome but operate much differently. Also, the step up in basis on death applies equally to DST interests, OP units and REIT stock.

DST/UPREIT Transaction. There is a new twist on the traditional UPREIT — the DST/UPREIT transaction. You start with a property owned by a Delaware statutory trust or DST. The background is important.

In this scenario, each beneficial owner acquired their interests in the DST as replacement property in a Section 1031 tax-deferred exchange. The exchangers formerly owned an investment property, or an interest in a DST that was acquired in a prior exchange. The DST interests are their 1031 replacement property. It is important to note that exchangers typically have low tax basis and are very sensitive to any transaction that would subject them to taxation.

Under Section 1031, the gain that would be taxable in a sale transaction is deferred until the replacement property is sold in a taxable transaction. This is technically tax deferral, but the exchangers can exchange over and over again, over years and even decades, in a series of transactions sometimes called “swap ‘til ya drop.” Yes, this is technically tax deferral (federal and state), but the taxes may be deferred essentially forever by exchanging over and over again. And, when the taxpayer dies, his or her heirs obtain a step up in tax basis and the taxes are, essentially, forgiven.

Back in 2004, the IRS issued Revenue Ruling 2004-86 on the use of a Delaware statutory trust as the vehicle for fractionalized Section 1031 replacement property. The DST structure provides tax deferral under Section 1031, typically with a turn-key, institutional-quality replacement property. With low investment minimums, it is easy for exchangers to diversify by acquiring a number of DST replacement properties. The leading sponsors use the DST structure and the results over the past decade have been nothing short of phenomenal– tax deferral under Section 1031 in a turn-key investment, with stable income and capital appreciation. Even during the COVID pandemic and current economic challenges, the DST structure has worked exceptionally well. The DST structure has been stress-tested and has proven to succeed even in the face of challenges. Of the various legal structures used over the past 40 years, the DST structure has proven to be the best for taxpayers seeking tax deferral under Section 1031.

The DST structure has taken off, with billions of dollars of equity raised each year. The DST structure is a major improvement over the former TIC structure.

The Revenue Ruling provides numerous requirements to qualify as a fixed investment trust in which the beneficial interests in the DST are like kind to real estate to qualify for tax deferral under Section 1031. Several of the requirements are relevant to the discussion of DST to UPREIT transactions.

First, DST properties must be sold when their mortgage matures. Most investors will structure another 1031 exchange when the DST property is sold.

Second, in a DST, there is no way to recapitalize or refinance the property, even when it would be in the best interests of investors to do so. And investor capital calls are not permitted. DST properties are structured with substantial reserves to cover all the known needs of the property and a contingency. But once the funds are expended, it is not possible to fund capital to make additional improvements.

REITs do not have the same structural issues and have a number of additional potential benefits. For this reason, some DST programs include a DST to UPREIT feature after a safe harbor holding period (typically two years).

REIT Benefits. REITs provide a high degree of transparency: majority of the board is comprised of independent directors; the board approves all major decisions for the REIT and has to approve the sponsor’s compensation, and financial statements are audited by a top CPA firm.

Liquidity. REITs typically provide a liquidity option that is not available under the typical DST structure. An OP holder has an option to exchange some or all of their OP units for REIT stock. The REIT stock can be sold on the market or to the REIT under a redemption program, thereby creating liquidity. The exchange of OP units for REIT stock is taxable, but the option is only exercised by the investor in connection with a sale that provides liquidity.

Case study – Saltmeadow Bay Apartments. Saltmeadow is an excellent case study. Capital Square is the sponsor of Saltmeadow Bay Apartments DST located in Virginia Beach, Virginia. The property was acquired by Capital Square in 2019 using the DST structure for investors seeking Section 1031 replacement property to defer gains from the sale of investment property.

Saltmeadow is a Class A, institutional-quality apartment community located in an irreplaceable location approximately one mile from the ocean front in Virginia Beach, Virginia. The community has enjoyed strong rent growth and occupancy. Capital Square used capital improvement reserves to improve the property. Occupancy and rent growth have been strong and the financial results have been exceptional.

Saltmeadow was originally purchased in 2019 for $48,600,000 and had a fair market value in April of 2023, of $72,000,000, based on MAI appraisals. This represents over a 161% return on equity.

Benefits of DST to UPREIT Transaction. The following is a summary of the potential benefits to participating Saltmeadow DST owners:

- Economics–42% Increase in Distributions: Distributions from the OP Units increased 42% and the $72,000,000 valuation represents over a 161% return on equity. Participating DST owners realized Saltmeadow’s significant appreciation without current taxation.

- Safety Net/Diversification: Participating DST owners have the safety net of a more diversified investment because the REIT intends to own a larger portfolio of multifamily properties. In the current challenged economic environment, the OP structure provides safety through increased diversification.

- Ability to Capture Future Appreciation: Saltmeadow will benefit from additional capital improvements to further increase value beyond the funds currently in the DST’s reserves. The REIT has capital to upgrade Saltmeadow and add more value to the property.

- Numerous REIT Benefits, including Potential Liquidity: The REIT provides a high degree of transparency with a majority of independent board members and financial statements audited by top firm plus a liquidity option.

- Long-Term Hold: Saltmeadow is a quality asset that should be held long-term, but the revenue ruling mandates sale of the property when the current Fannie Mae loan matures. Saltmeadow can be held long-term in the UPREIT.

- Ability to Assume favorable Long-Term Debt: In a rising interest rate environment, there is a benefit to assuming favorable loans, such as Saltmeadow’s existing Fannie Mae loan.

- No Taxable Gain: All of this was accomplished without any taxable gain, federal or state, under Section 721.

Optionality and Equality. Capital Square provided each DST investor complete optionality and equality regardless of their individual choice. The results were exceptional — 85% of investors (by value) selecting the UPREIT option, with roughly 10% structuring another DST/1031 exchange and only a small number who cashed out, some with step up on death.

Capital Square afforded investors multiple disposition options and provided equal treatment regardless of the option selected. DST Investors could elect to:

- exchange all (or a portion) of their DST interests for OP Units in the REIT on a tax deferred basis under Section 721,

- structure another Section 1031 exchange for all (or a portion) of their investment to continue the tax deferral, or

- cash out (all or a portion) of their investment on a taxable basis.

Regardless of the option selected, all investors were treated equally, with an identical fee structure and receipt of the same fair market value purchase price based on the MAI appraisals. It is important to note that in some UPREIT transactions, investors who fail to participate in the UPREIT are charged higher fees, resulting in a lower total return.

Historical Perspective. From my perspective over the past 40 years, the Saltmeadow UPREIT transaction is the next phase in the progression and institutionalization of tax-advantaged real estate. Here is the story:

Back in the day, a “whole property,” frequently a rent house, was the typical 1031 replacement property. It is hard to imagine a less institutional property than a rent house managed by the taxpayer.

Then, starting in the late 1990’s, the TIC industry developed to provide fractionalized, institutional-quality real estate to regular folks, but many TIC investments became challenged during the great real estate recession starting in 2008. Since 2012, the DST structure has worked exceptionally well. The major sponsors use the DST structure, and the many successes are reported daily in The DI Wire.

Back in the 80’s, the goal for corporate and tax lawyers was to combine two critical attributes in a single investment vehicle – limited liability like you would have in a corporation, with pass-through (one level) taxation that you would have in a tax partnership. Back then, this was accomplished in a very cumbersome way by using a limited partnership with a corporate general partner. The analysis was so complicated that tax opinion were needed, at substantial cost, just to verify the structure. That was a very long time ago.

Beginning in the early 90’s, Virginia and other states began to adopt a more modern form of entity; the limited liability company or LLC was born. By combining the attributes of limited liability and pass through (partnership) taxation in a single entity, the LLC became the entity of choice for real estate ownership. No more complicated structures or expensive tax opinions were needed. That was phase one in the evolution of tax-advantaged real estate.

Next, in the 1990’s, non-traded REITs became a popular vehicle for aggregating real estate assets in a tax efficient manner. While REITs are taxed as a corporation, they have the benefit of using depreciation deductions to shelter dividends on the REIT’s stock, creating, in essence, one level of tax on earnings, and have large portfolios of real estate for greater diversification. Non-traded REITs were sold by many independent broker-dealers nationwide, making them mainstream.

About the same time, the tenant-in-common, or TIC, industry began with the goal of creating a structure for individual investors to exchange into a portion of an institutional-quality property as their 1031 replacement property. From humble beginnings, the TIC industry was born. The TIC structure took off and was commercialized when the IRS issued the famous Revenue Procedure 2002-22 and CMBS lenders approved the structure for non-recourse lending. That was the second phase in the evolution of tax-advantaged real estate.

The third phase developed after the great real estate recession of 2008 decimated much of the real estate industry. The TIC structure worked well to create a tax structure that qualified for 1031 treatment. But the TIC structure was cumbersome and inefficient from an operational standpoint. The stress of the great recession caused many investments to fail, and foreclosures were common, especially suburban office properties.

Back in 2004, the IRS issued Revenue Ruling 2004-86 on the use of a Delaware statutory trust as another vehicle for 1031 exchanges. The revenue ruling imposes a number of strict requirements for a DST to qualify as a fixed investment trust in which the beneficial interests in the DST are like kind to real estate. The DST structure is a major improvement over the TIC structure from an operational standpoint. The TIC structure was disfavored following the great recession, and the DST structure became the preferred choice starting around 2012. And the DST structure has taken off, with billions of dollars of equity raised each year. The results have been phenomenal. The DST era for 1031 exchanges is the third phase in the evolution of tax-advantaged real estate.

Now, in 2023, we have DST to UPREIT transactions that combine favorable tax treatment with the potential for additional benefits to investors. However, only certain properties are candidates for UPREIT transactions and the target property must satisfy the REIT’s buy-box. Over time, you are likely to see more DST to UPREIT transactions being offered to DST investors after a safe harbor holding period, typically two years. Each investor should decide, with guidance from their financial and tax advisors, what is in their best interests. In the right circumstances, UPREIT transactions can be a valuable tool for financial planners and investors seeking a turn-key, investment grade replacement property solution. The industry should remain open to new structures, so long as they provide full optionality and equality for all investors. This is not a one-size-fits all; each investor should make their own determination of what is best for them (and their family and estate). It is gratifying that the REIT and DST structures have been stress tested and proven to be solid, even during periods of economic turmoil. Having more investment options is a nice benefit for investors and their advisors. DST to UPREIT transactions are the next phase in the progression and institutionalization of tax-advantaged real estate.

Conclusions. Of the various legal structures used over the past 40 years, the DST structure has proven to be the best for taxpayers seeking tax deferral under Section 1031. The DST structure provides tax deferral under Section 1031 with a turn-key, institutional-quality replacement property. For the past decade, DST sponsors have done a superb job of providing tax deferral along with stable returns and capital appreciation. Even during the COVID pandemic and economic challenges, the DST structure, with strong sponsors of institutional-quality real estate, has proven to work exceptionally well. The DST structure has been stress-tested and has proven to succeed even in the face of challenges.

In conclusion, real estate investments and structures evolve over time: from a rent house, to LLCs, REITs, TICs, DSTs and UPREITs, the trend is towards turn-key, institutional-quality real estate. The UPREIT structure has been in use for many decades; DST to UPREIT transactions are the latest variation that provide a number of positive features for investors. Over time, we will see further evolution of tax-advantaged real estate investments. This is an exciting time to be in the real estate business.

Louis Rogers is the founder and co-CEO of Capital Square, one of the leading sponsors of 1031 exchanges and other tax-advantaged real estate investment programs. A former partner at the Hirschler Fleisher law firm, he is an acknowledged expert on the legal history and application of Internal Revenue Code Section 1031.

For more Capital Square news, please visit their directory page.