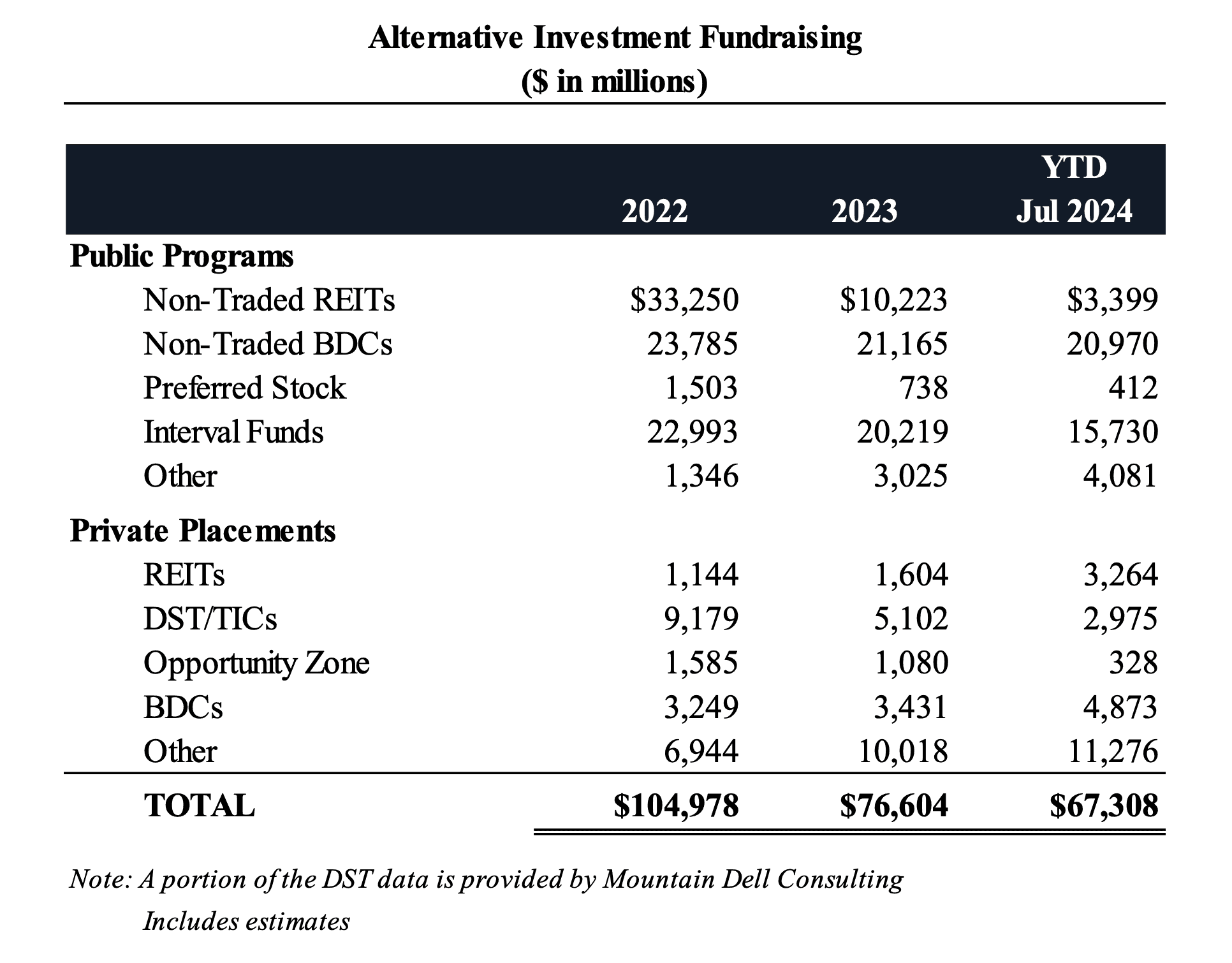

2024 Alts Fundraising Totals $67.3 Billion Through July; Non-Traded BDCs Surpass $20 Billion for Third Consecutive Year

Alternative investment fundraising totaled approximately $67.3 billion through July, led by non-traded business development companies at an estimated $21 billion, interval funds at $15.7 billion and other private placements, including infrastructure and private equity offerings, at $11.3 billion, according to investment banking firm Robert A. Stanger & Co., Inc.

Non-traded BDC fundraising is up nearly 121% as compared to this time last year while non-traded real estate investment trust fundraising is down 59%, respectively. As an example of that, The DI Wire previously reported that Ares Management closed both of its public NAV REIT offerings and commenced fundraising in perpetual private placement offerings of the REITs on July 2, 2024. Private REITs have raised nearly $3.3 billion year-to-date, which is inclusive of nearly $371.5 million of Delaware statutory trust UPREIT transactions by these Ares REITs.

“After a robust first half of the year in alternative investment capital formation, we are continuing to see strong fundraising by non-traded BDCs, interval funds and all categories of private placements,” said Kevin T. Gannon, chairman of Stanger.

Stanger’s survey of top sponsors tracks fundraising of all alternative investments offered via the retail pipeline including publicly registered non-traded REITs, non-traded BDCs, interval funds, non-traded preferred stocks, DSTs, opportunity zone funds, private BDCs, private REITs, and other private placement offerings. The top fundraisers in the alternative investment space year-to-date are Blackstone ($10.7 billion), Cliffwater ($7.7 billion), Blue Owl Capital ($6.3 billion), Ares Management Corporation ($5.8 billion), and Kohlberg Kravis Roberts & Co. ($5.4 billion).

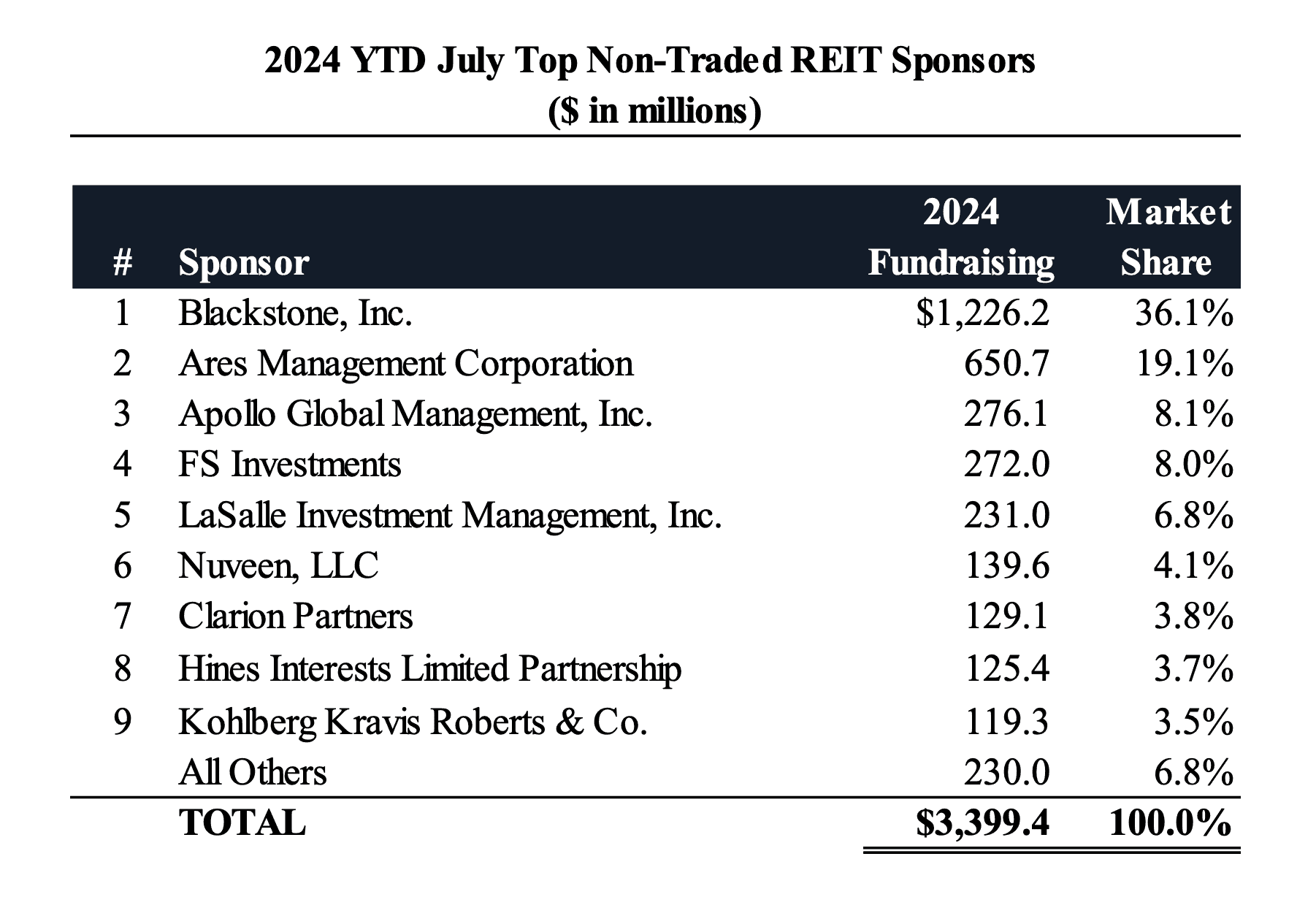

Public non-traded REITs reported $3.4 billion of fundraising year-to-date, with $317 million being raised in July. Blackstone leads fundraising year-to-date with nearly $1.2 billion, followed by Ares Management Corporation with $650.7 million, Apollo Global Management ($276.1 million), FS Investments ($272 million), and LaSalle Investment Management ($231 million) rounding out the list of top five fundraising sponsors.

In addition, heightened levels of redemption activity continue in the public NAV REIT space. In the second quarter of 2024, NAV REIT redemptions were approximately $4.3 billion and have remained at $4 billion or greater for the seventh consecutive quarter. Stanger expects that the redemption overhang will continue to drag on public NAV REIT net fundraising for the remainder of 2024.

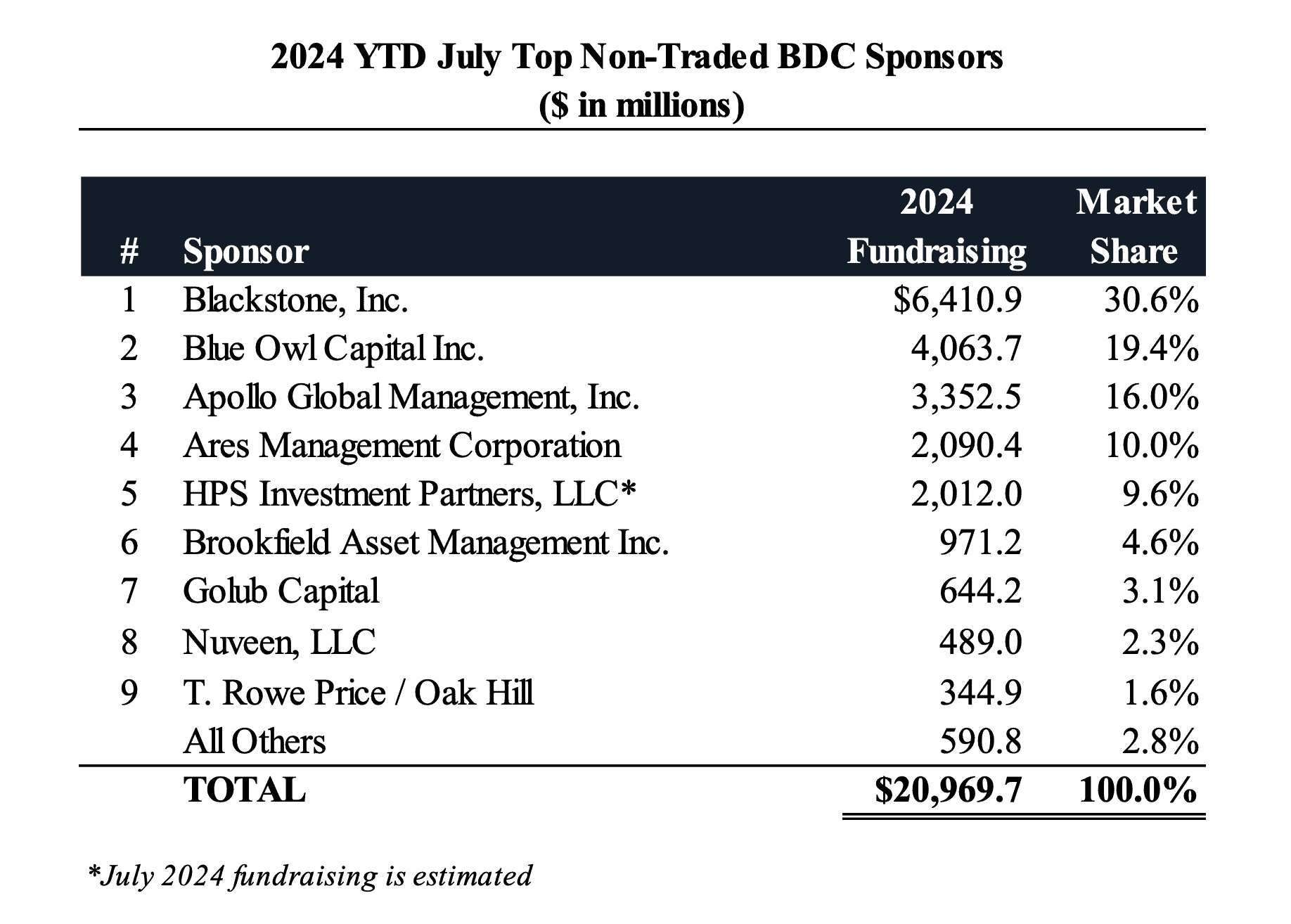

Non-traded BDCs raised approximately $21 billion year-to-date through July, led by Blackstone with $6.4 billion raised. Blue Owl Capital with $4.1 billion, Apollo Global Management ($3.4 billion), Ares Management Corporation ($2.1 billion), and HPS Investment Partners ($2 billion, estimated) round out the list of top five fundraising sponsors.

“Fundraising in public and private business development companies has continued its blistering pace and is expected to remain strong with newcomers AllianceBernstein, Kennedy Lewis, and First Eagle recently launching public offerings,” said Randy Sweetman, executive managing director at Stanger.

Private placement offerings of NAV REITs, BDCs, and infrastructure and private equity investments continue to gain traction in 2024. Year-to-date through July, other private placements raised approximately $11.3 billion and private BDCs raised approximately $4.9 billion. Kohlberg Kravis Roberts & Co. leads in overall private placement fundraising year-to-date with nearly $5.2 billion, followed by Blackstone with $3.1 billion, Ares Management Corporation ($2.3 billion), Blue Owl ($2.2 billion) and Goldman Sachs ($1.6 billion) rounding out the list of top five fundraising sponsors.

Private placement offerings of NAV REITs, BDCs, and infrastructure and private equity investments continue to gain traction in 2024. Year-to-date through July, other private placements raised approximately $11.3 billion and private BDCs raised approximately $4.9 billion. Kohlberg Kravis Roberts & Co. leads in overall private placement fundraising year-to-date with nearly $5.2 billion, followed by Blackstone with $3.1 billion, Ares Management Corporation ($2.3 billion), Blue Owl ($2.2 billion) and Goldman Sachs ($1.6 billion) rounding out the list of top five fundraising sponsors.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.