Stanger: NAV, Lifecycle REITs Hit Lowest Index Values Since 2021

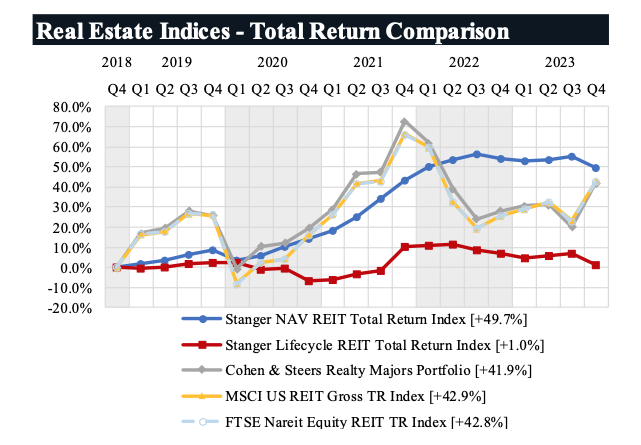

The Stanger NAV REIT Total Return Index and Stanger Lifecycle REIT Index experienced their lowest index values since 2021. Reversing their growth in Q3 2023 and throughout the year, the indexes were down 3.7% and 5.3%, respectively, by the end of December 2023.

“[Real estate investment trusts] continue to feel the effects of a steady expansion of cap rates’ drag on property values, resulting in nearly 75% of [net asset value] REITs posting negative three-month and one-year returns,” said Kevin T. Gannon, CEO and chairman at Stanger.

“Overall performance of Lifecycle REITs erased nearly all of its five-year gains as shown in the Stanger Lifecycle REIT Index. However, NAV REITs with a focus on credit investments seem to be performing well, as evidenced by Apollo, FS Credit REIT, and Clarion ranking one, two, and three, respectively, for three-month returns, and as the only NAV REITs to post positive returns for two consecutive quarters,” added Gannon.

These results, as well as individual performance data on 19 non-traded NAV REITs and 20 non-traded lifecycle REITs, are published in the newly released Q4 2023 Non-Listed REIT Edition of The Stanger Report, which was also now includes performance tracking data previously included in The IPA/Stanger Monitor, as well as profiles on currently effective and newly registered non-traded REIT stock offerings, fee structure comparisons, and other industry statistics on non-traded REITs.

The Stanger NAV REIT and Stanger Lifecycle REIT Total Return Indices measure the performance of non-listed REITs on a quarterly basis. Stanger began calculating the indices on Dec. 31, 2015, with a base level of 100.

There were three new entrants to the top five quarterly performers in Q4 2023, with Apollo Realty Income Solutions taking over the top spot from PGIM Private Real Estate Fund. The top three performers – REITs managed by Apollo, FS/Rialto, and Clarion – have portfolios with heavy weightings in mortgage and other credit investments and less emphasis on equity property investments.

“2023 was a year of correction, with the average total return of the top 10 equity NAV REITs being a loss of 7.7%, but there are two stories to be told there,” stated David Inauen, head of research at Stanger.

“On the one hand, we estimate that expanding cap rates and discount rates put downward pressure of approximately 10% on property values on average. After leverage, that can translate into roughly a 15% to 25% decline in equity invested in properties, and that is before considering the cash flow impact of any unhedged interest expense due to higher rates. However, offsetting those headwinds is the current and expected growth in property net operating incomes. Blackstone’s BREIT and Starwood’s SREIT, the two largest NAV REITs with strong residential concentrations – recently reported 6% and 7% year-over-year same property NOI growth, respectively – and that is unlevered, organic growth. Industrial heavy portfolios with shorter WALTs continue to benefit from rolling under-market leases, with Ares’ industrial-focused AIREIT generating comparable cash rent growth of 54% on leases transacted during Q4 2023. Strong operating fundamentals persist across the major asset classes held by NAV REITs, and with monetary policy expected to ease considerably over the next two years and the recent rally in traded REITs, there is certainly cause to be optimistic for equity NAV REITs in 2024 and 2025,” said Inauen.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.