Sponsored Content: Tighter Credit Conditions Likely Lead to Tailwinds for the Multifamily Sector

By Nick Rosenthal, co-chief executive officer, Griffin Capital Company

In response to a near economic collapse due to a global pandemic that created a surge in unemployment and a massive contraction across global markets, the Federal Reserve cut its target for the federal funds rate by a total of 1.5% in March of 2020, to a range of 0.0%-0.25%, a move intended to support spending by lowering borrowing costs. At the same time, the Federal Reserve resumed purchasing significant amounts of bonds, both treasuries and mortgage-backed securities, later expanding that purchasing program to other types of securities and introducing additional programs to support and stimulate the economy. Shortly thereafter, bills approved by Congress opened the gates for the largest flood of federal money into the U.S. economy recorded in history, totaling nearly $5 trillion to support households, industries, local governments, and other institutions impacted by the pandemic. Economists credit these unprecedented actions as helping to ensure the “Pandemic Recession” was the shortest on record, lasting only three months. The impacts of these spending programs had additional consequences.

What has happened in the housing market as a function of these events, coupled with long-building supply production deficits, has led to a set of dynamics that underpin the foundation of a very constructive outlook for rental housing demand, and a potentially opportunistic period for multifamily investors.

On March 17, 2022, after realizing inflationary pressures were not simply transitory, the Federal Reserve embarked on a rate hiking cycle that was one of the steepest and most significant in history. Between March 17, 2022, and July 26, 2023, the Federal Reserve raised rates 11 times to 5.25%, the impacts of which are still reverberating across financial markets.

The housing market has been a segment of the economy most impacted by borrowing cost volatility. Shifting demographics, single- family housing production deficits, and now a tighter credit market environment have all contributed to a set of dynamics that underpin the foundation of a very constructive outlook for rental housing demand, and a potentially opportunistic period for multifamily investors. High barriers to homeownership mean that demand for rental housing is likely to remain elevated over the intermediate and long term. At the same time, due to higher borrowing costs and significantly tighter credit conditions, multifamily starts are declining dramatically which will lead to an appreciable reduction in new deliveries. With strong demand and an impending decline in new deliveries, it is likely that occupancy and rent growth fundamentals will remain steady in 2024, despite the recent influx of new supply, and will be quite strong thereafter.

DEMOGRAPHICS

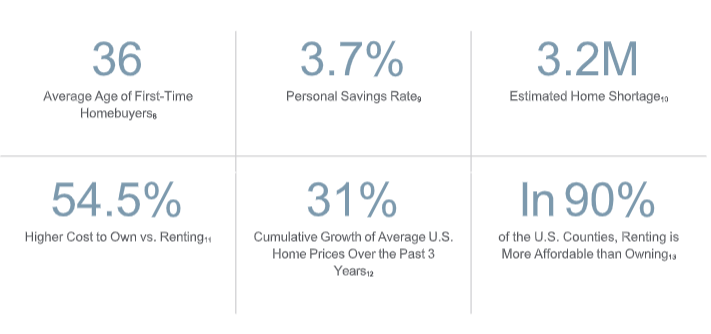

The percentage of Americans renting as opposed to owning is growing, and it is not isolated to younger population segments. Across all age groups, the percentage of the population that rents rather than owns has increased over the last 20 years. When we look specifically at younger cohorts, a recent survey found that 67% of millennial renters, which represent a core first-time homebuyer segment, report that they have no money saved for a down payment on a home. Pandemic-level personal savings rates that peaked north of 30.0% now sit at 3.7%, well below the long-term average of 8.5%. Part of the attribution for the decline in personal savings rates is the increase in consumer debt. At the end of 2022, Americans had debt per household of 1.75X their median income. Total consumer debt has increased 24% since the end of 2019 and reached an all-time high of $17.5 trillion as of the end of 2023.4 The percentage of consumer loans that are now 30 or more days delinquent has increased across almost all major categories reflecting a population that is increasingly debt burdened. The average age of a new homebuyer has increased to 36 years old, and first- time homebuyers represent only 26% of new home sales. The significant shift in borrowing costs from pandemic-era lows, which stimulated household formation, record refinancing activity, high personal savings rates and increased wealth creation for those with financial assets like homes and securities portfolios, has given way to higher borrowing costs, weaker consumer balance sheets and decreasing affordability for prospective homeowners. These dynamics are disproportionately impacting younger cohorts who did not start with financial assets and therefore did not participate in the wealth effect created by several years of low rates. Today, the National Association of Home Builders/Wells Fargo Housing Opportunity Index reflects the least affordable housing market in recent history, shutting an increasing portion of the population out of the market and keeping them in the rental pool.

SINGLE-FAMILY HOUSING SUPPLY SHORTAGES

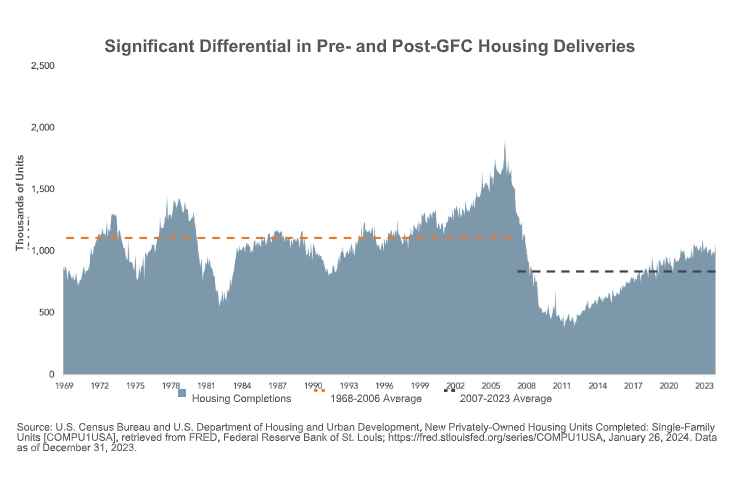

Affordability has been a major challenge for prospective homeowners, and one of the most significant contributors to this dynamic has been the systemic underproduction of single family housing since the Global Financial Crisis (“GFC”). After peaking in January 2006, new home starts declined nearly 80% through April 2009. Following the GFC, homebuilders never recovered to their 2002-2005 production levels and most housing pundits believe the shortage of supply sits at roughly 3.2 million units. Skilled-labor shortages along with extended lead times for zoning, entitlement and permitting have made it less attractive for homebuilders to produce entry-level housing. Increases in land and labor costs as well as steep government induced fees have exacerbated this issue. Further, housing policy is driven at the local level and voters generally support less development which ensures their property values stay elevated. As the affordable end of the single-family housing market has continued to get squeezed from every angle, only approximately 8% of new single- family homes being produced are 1,400 square feet or less, a steep decline from 1940 when 70% of new homes were that size. While home values increased meaningfully during the low interest rate pandemic-era environment and existing owners locked-in below current market borrowing costs, this has created additional barriers for first-time home buyers to exit the rental pool. The environment reflects a materially more expensive and tighter credit market, and a higher entry-point for homebuyers dissuading homebuilders from meaningfully ramping up their pipelines to increase production, a dynamic that will continue to lead to more renters for longer. 2023 saw the fewest single-family home sales since 1995.

RELATIVE HOUSING AFFORDABILITY

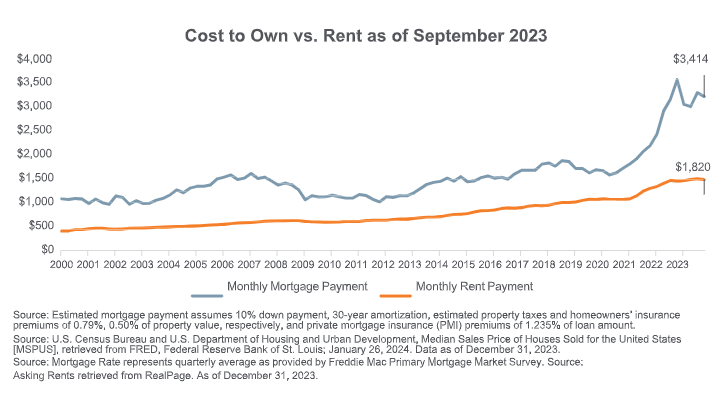

Housing represents shelter and, as such, is a necessity. As Americans prioritize how they spend money, food and shelter are generally the most senior in the decision-making order of operations. For those that are fortunate, housing is a choice between owning and renting, but for most, it is not a choice at all. As home prices have increased, the relationship between wage inflation and home value appreciation has deviated dramatically, making it less affordable to own. Higher home values, higher mortgage costs and larger required down payments are key ingredients to a stickier and deeper rental pool. Conversely, rental rates have grown at more parity with wages. The relative affordability between owning and renting now skews dramatically in favor of renting, and it is more affordable to rent than it is to own in 90% of U.S. counties. As Americans save less and are increasingly burdened by their consumer debt, the relative affordability of renting will drive more renters for longer.

DECLINE IN NEW MULTIFAMILY STARTS

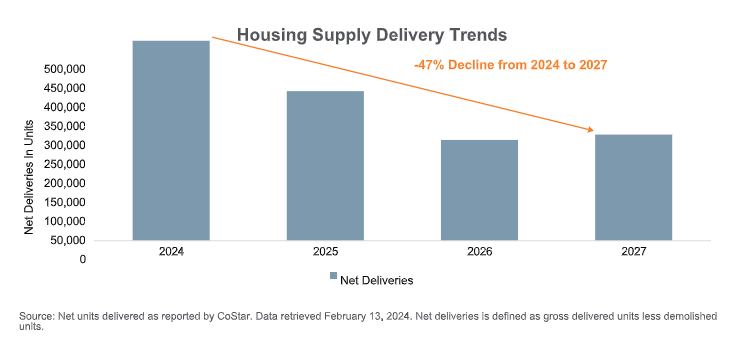

One of the many contributors to high levels of inflation has been shelter. As household formation accelerated after the pandemic, a large cohort that was living at home moved out, catalyzing demand for additional rental housing without the corresponding new supply that generally lags demand based on housing cycles. In addition, the seismic shifts in population mobility driving more Americans to the Southwest and Southeast have resulted in outsized demand for housing in growth markets, pushing up home values and rental rates. As the country recovered from the pandemic and borrowing costs stayed low for a prolonged period, the credit markets went through an exceptionally accommodative period. Responding to the strong fundamentals and clear line of site to future rental housing demand, multifamily developers became increasingly active. Smaller market participants utilized their new-found access to credit to borrow higher levels of debt to finance larger projects, and the increase in market participants created an outsized multifamily development cycle. While new multifamily deliveries are expected to peak in 2024, driven by starts that occurred from 2020–2022, it is the reversal in the credit markets that represents an increasingly attractive future dynamic for investors that are well-capitalized today. As credit markets have materially tightened, these same smaller developers are driven to the sidelines as they do not have deep capital markets relationships and are unable to contribute at least 50% of the equity to prospective developments. In addition, many are facing challenges in their existing portfolios due to soft and hard cost increases that they did not anticipate or could not control over the prior cycle. New multifamily starts declined by approximately 34% year-over-year as of November 2023, and many expect starts to further decline in 2024. The relationship between starts and deliveries is clear and foreshadows a large decline in new deliveries from 2025–2027, which is likely to result in strong leasing fundamentals for those that are able to deliver units to the market.

TAKEAWAYS

Tighter credit conditions are likely to lead to strong investment opportunities for a subset of well-capitalized multifamily market participants. As new multifamily starts decline, but the characteristics that are catalyzing demand for rental housing such as demographics, lack of single-family housing supply and relative housing affordability persist, those that can be active today should be very encouraged about their investment prospects over the intermediate and long-term. While most investment decisions require courage in periods of dislocation, the case for increased investment in rental housing by those that are able, seems straightforward.

To access a pdf of this article, click here.

Griffin Capital Company is a sponsor of The DI Wire, and the article was published as part of their standard directory sponsorship package.

For more Griffin Capital news, please visit their directory page.