Non-Traded BDCs Report 0.48 Percent Loss in 1Q16, Positive/Low Returns Expected

Summit Investment Research, a new research and due diligence firm founded by Michael Stubben, recently released its Non-Listed BDC Index report for the first quarter of 2016 which compares quarterly returns over the last four years.

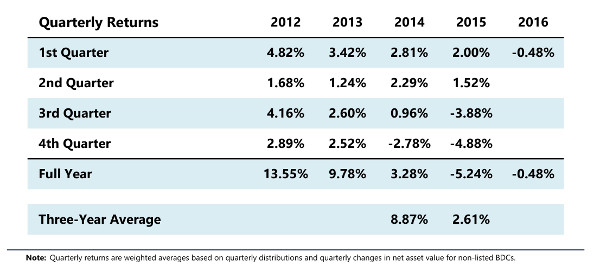

In the first quarter of 2016, non-listed BDCs reported their third consecutive quarter of losses with a negative 0.48 percent quarterly return. In the third quarter of 2015, BDCs posted a 3.88 percent loss and in the fourth quarter of 2015, losses topped 4.88 percent.

Non-listed BDC returns peaked at 13.55 percent in 2012, and have faced declining returns over the last four years. For the three-year period ended December 31, 2015, non-listed BDCs had a 2.61 percent average annual return, which was pulled down by the 5.24 percent reported loss in 2015.

Subsequent to the first quarter of 2016, several non-listed BDCs have started to report higher net asset values, which could indicate positive but low returns for non-listed BDCs in the next few quarters of 2016.

Summit Investment Research has been active since April. Its reports cover 66 non-traded real estate investment trusts, 17 non-traded business development companies, 6 interval funds, and 15 listed REITs (that acquired non-traded REITs or were once non-traded REITs). The company’s research can be utilized by a variety of industry clients including financial advisors, registered investment advisors, broker-dealers, sponsors, service providers like law firms, due diligence firms, industry organizations, and news organizations, and institutions.