Non-Traded Alts Fundraising Totaled $73.1 Billion in 2023

Non-traded alternative investment fundraising totaled nearly $73.1 billion for 2023, led by non-traded business development companies at $21.2 billion, private placements at $20.2 billion, interval funds at $19.2 billion and non-traded real estate investment trusts at $9.8 billion, according to the latest research provided by investment bank Robert A. Stanger & Co. Inc.

Stanger’s survey of top sponsors tracks fundraising of all alternative investments offered via the retail pipeline including publicly registered non-traded REITs, non-traded business development companies, interval funds, non-traded preferred stock of traded REITs, Delaware statutory trusts, opportunity zone funds, and other private placement offerings. The top fundraisers in the alternative investments space during 2023 were Blackstone ($13.5 billion), Blue Owl Capital ($8.8 billion), Cliffwater ($7.7 billion), Kohlberg Kravis Roberts & Co. ($4.4 billion) and Ares Management Corporation ($3.9 billion).

Fundraising for non-traded REITs, business development companies, and interval funds contracted to an aggregate of $50.7 billion in 2023, versus $80.2 billion in 2022.

“This industry is extraordinarily creative in product structure and design, and continues to transform itself from a single product focus to a broader structure and investment strategy brought to the market by world class investment managers,” said Kevin T. Gannon, chairman of Robert A. Stanger & Co., Inc.

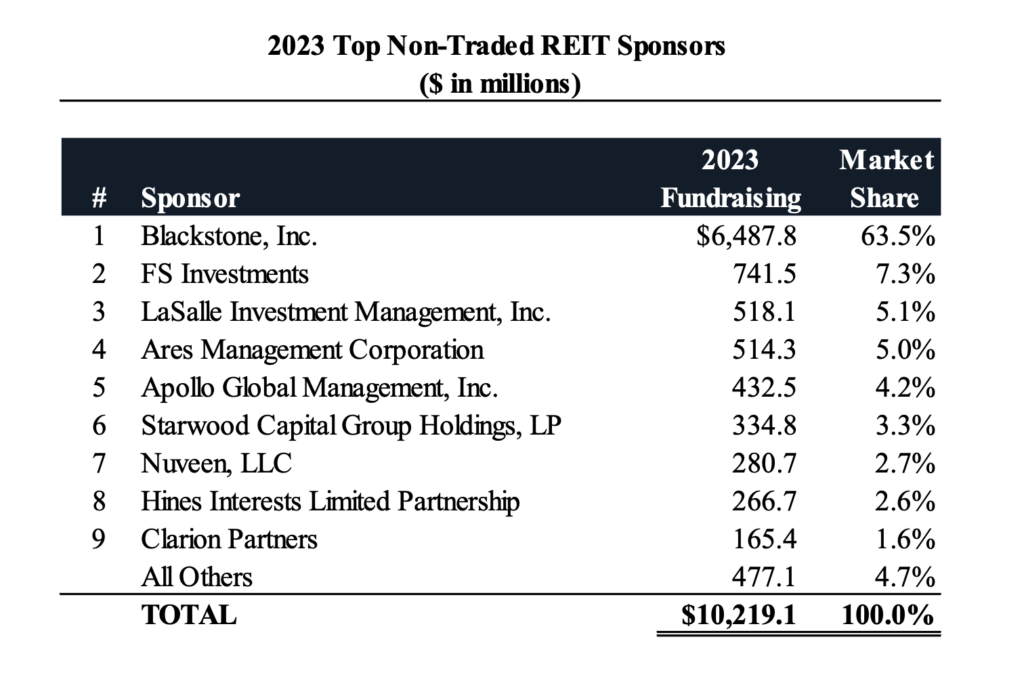

Fundraising for non-traded REITs was $10.2 billion in 2023 versus $33.2 billion in 2022, reflecting in part a decline in performance of the sector which is now converging on the five-year total return for the publicly traded REIT sector, according to Stanger. The Stanger Total Return index for non-traded NAV REITs is now 49.66% versus the MSCI five-year total return for publicly traded REITs at 42.87% through Dec. 31, 2023.

Like the third quarter of 2023, redemptions for non-traded REITs were approximately $4.6 billion again for the fourth quarter. However, numerous sponsors have reported significant declines in redemption requests from shareholders including Blackstone with requests down 80% and Starwood down 56% from their peaks in January 2023.

“The industry remains well-positioned to meet redemptions up to the 5% quarterly cap with sufficient liquidity sleeves on the balance sheets to fund redemptions,” Gannon said.

Blackstone led 2023 non-traded REIT fundraising with $6.5 billion (inclusive of a $4.5 billion University of California investment), followed by FS Investments with $741.5 million, LaSalle Investment Management ($518.1 million), Ares ($514.3 million), and Apollo ($432.5 million).

Blackstone led 2023 non-traded REIT fundraising with $6.5 billion (inclusive of a $4.5 billion University of California investment), followed by FS Investments with $741.5 million, LaSalle Investment Management ($518.1 million), Ares ($514.3 million), and Apollo ($432.5 million).

Non-traded perpetual-life business development companies raised approximately $21.2 billion in 2023, led by Blackstone with $7.0 billion raised. Blue Owl with $4.4 billion, Apollo ($2.3 billion), HPS Investment Partners ($1.8 billion estimated) and Ares ($1.7 billion) round out the top five.

Private placement offerings for public reporting companies continued their upward momentum in fundraising in 2023. The KKR Infrastructure Conglomerate LLC, and KKR Private Equity Conglomerate LLC, combined raised over $4.1 billion in 2023 while the private REIT Blue Owl Real Estate Net Lease Trust raised over $1.2 billion.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.