Non-Listed BDCs Have $78.8 Billion Combined NAV, a Year-Over-Year Increase of 65%

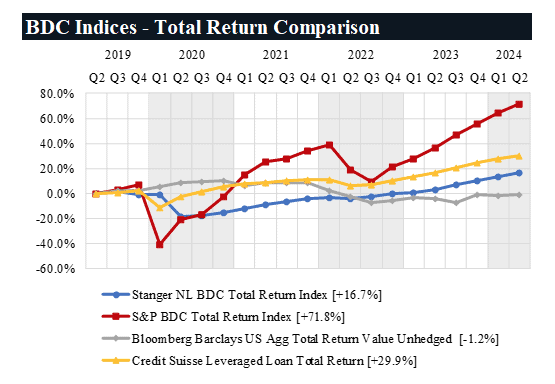

Non-listed business development companies had a combined aggregate net asset value of $78.8 billion, a 16% increase from the previous quarter and a year-over-year increase of over 65%, as of June 30, 2024. The heavily credit-focused Stanger NL BDC Total Return Index continued to climb to all-time highs, increasing 2.7% in Q2 2024 and 12.7% over the trailing 12 months. This marks its eighth consecutive quarter of growth, and the 15th time out of the past 16 quarters it has had positive returns.

These results, as well as individual performance data on non-listed BDCs, are published in the Non-Listed BDCs Edition of The Stanger Report for Q2 2024.

The Stanger NL BDC Total Return Index measures the performance of non-listed BDCs on a quarterly basis. Stanger began calculating the index on Dec. 31, 2015, with a base level of 100. Perpetually offered, non-listed BDCs that update their NAVs no less frequently than monthly and that have a minimum of one calendar quarter of performance are included in the index. All other non-listed BDCs are generally added to the index in the quarter that their first NAV is announced. As of Q2 2024, the index currently includes 21 BDCs with a total of 40 separate share classes.

“[Non-listed] BDCs continue to benefit from the current interest rate environment and have seen steady growth for the better part of four years. In Q2 2024, we witnessed over $7 billion in new offerings become effective, led by First Eagle Private Credit Fund’s $5 billion public offering. Additionally, AllianceBernstein intends to enter the alternative investment space after filing a registration statement for a $1 billion offering,” said Kevin T. Gannon, chairman and chief executive officer of Robert A. Stanger & Co., Inc.

“The appeal for sponsors is evident, as more than $31 billion has flowed into [non-listed] BDCs over the past 12 months, and this fundraising momentum shows no signs of abating,” added Gannon.

Bain Capital Private Credit topped the three-month return rankings for non-listed BDCs in Q2 2024 with a 3.6% total return. HPS Corporate Lending Fund once again led one-year total returns with an impressive 15.6%. Looking at longer-term performance, MSC Income Fund Inc. and Blue Owl Capital Corporation II both maintained their top positions in terms of three-year and five-year total return, respectively.

“NAV BDCs have significantly outperformed the earlier generation of [non-listed] BDCs this quarter. In Q2 2024, NAV BDCs dominated the rankings, securing 15 of the top 16 spots for quarterly total return, and 11of the top 12 for one-year total return. Additionally, MSC Income Fund filed a preliminary proxy statement for a potential future listing as a path to provide liquidity to its investors,” said Michael S. Covello, executive managing director at Stanger.

Non-listed BDCs are removed from the Stanger index upon listing, merger, or in the case of a liquidation by disposition of investments, upon conversion to a liquidation basis of accounting or announcement of the effectiveness of a plan of liquidation. Non-listed BDCs may also be removed from the index for other special circumstances.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.