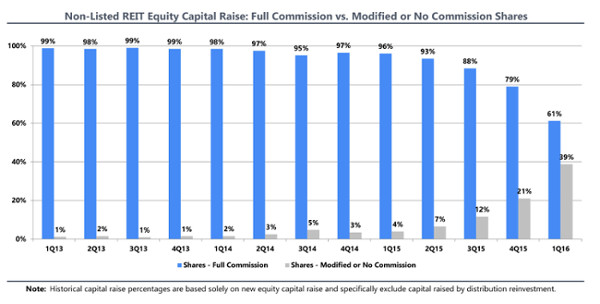

No- and Low-Commission NTR Shares Reached a Record 39 Percent in 1Q16

Summit Investment Research, a new research and due diligence firm founded by Michael Stubben, recently released its Non-Listed REIT Equity Raise report that compares sales of full commission shares to their modified and no-commission counterparts.

As a result of the approval and implementation of FINRA 15-02 in 2015, equity sales for modified commission and no commission shares are growing in popularity.

In the first quarter of 2016, modified commission shares, such as class T shares, or no commission shares, such as class I shares, represented a record 39 percent of non-listed REIT equity capital raised.

From 2013 through the first quarter of 2015, the sale of modified commission shares or no commission shares was limited to daily NAV non-listed REITs, which struggled to gain any significant traction in the market.

According to Summit, within the new FINRA 15-02 environment, three trends are behind this rapid rise over the last three quarters:

First, Jones Lang LaSalle Income Property Trust, a daily NAV non-listed REIT, has gained increasing market share and established itself as the leader among daily NAV non-listed REITs that offer a variety of modified commission or no commission share classes.

Second, most new non-listed REITs offer both full commission shares, typically class A shares, and modified commission shares, typically class T shares. class T share commission structures vary, but they generally have a lower 2-3 percent upfront commission with a capped commission trail. The ratio of sales between class A and class T shares varies significantly by non-listed REIT, but recent trends point to higher percentages of class T shares in the future. Also, according to the research firm, this specific dual share class structure has inherent conflicts of interest that should result in future changes.

Third, certain non-listed REITs now only offer class T shares. Griffin Essential Asset REIT II has established itself as a market leader with its transition to only offering class T shares back in November 2015. Based on recent trends, full commission class A shares will lose its majority position in 2016, as modified commission and no commission share classes become the industry standard in response to the regulatory changes under FINRA 15-02.

Summit Investment Research has been active since April. Its most recent reports cover 66 non-traded real estate investment trusts, 17 non-traded business development companies, 6 interval funds, and 15 listed REITs (that acquired non-traded REITs or were once non-traded REITs). The company’s research can be utilized by a variety of industry clients including financial advisors, registered investment advisors, broker-dealers, sponsors, service providers like law firms, due diligence firms, industry organizations, and news organizations, and institutions.