Meager Net Returns for Daily NAV REITs During First Quarter

Summit Investment Research, a new research and due diligence firm founded by Michael Stubben, recently released its dNAV REIT Index report for the first quarter of 2016 that compares quarterly returns of daily NAV real estate investment trusts over the last three years.

Daily NAV non-listed REITs are not actively traded on a market and typically have lower volatility than listed REITs, but they also have lower returns due to their higher front-end and on-going fee structures, according to the report.

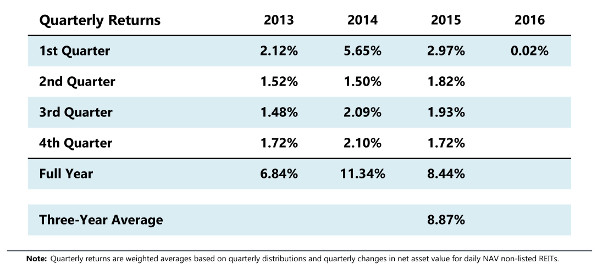

In the first quarter of 2016, the Summit dNAV REIT Index reported 0.02 percent quarterly returns. Daily NAV non-listed REITs had a weighted average 0.99 percent quarterly distribution in the first quarter, but reported a 0.97 percent decline in net asset values.

For the three years ended December 31, 2015, the Summit dNAV REIT Index reported an 8.87 percent average annual return. For the same three-year period, the FTSE NAREIT All Equity Index reported a 10.63 percent average annual return for listed equity REITs.

While listed equity REITs reported higher three-year returns, listed equity REITs have significant volatility with returns of 2.86 percent in 2013, 28.03 percent in 2014, and 2.83 percent in 2015, according to the FTSE NAREIT All Equity Index.

Summit Investment Research has been active since April. Its most recent reports cover 66 non-traded real estate investment trusts, 17 non-traded business development companies, 6 interval funds, and 15 listed REITs (that acquired non-traded REITs or were once non-traded REITs). The company’s research can be utilized by a variety of industry clients including financial advisors, registered investment advisors, broker-dealers, sponsors, service providers like law firms, due diligence firms, industry organizations, and news organizations, and institutions.