Guest Contributor: Private Equity — Where the Bulls Can Run for Cover

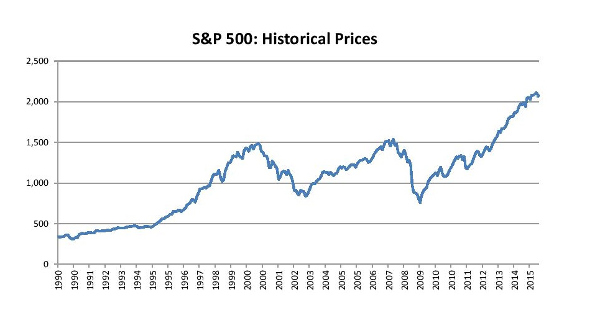

It’s been a great run for the bulls… The S&P has delivered a 144 percent cumulative return since 2009, following a tumultuous period of uncertainty during the great recession. Interest rates remain near an all-time low and real estate has enjoyed a great rebound with overall capitalization rates now in the 6 percent range. While no one has a crystal ball, it’s hard to argue that we are at or near the top of the market. In fact, we haven’t seen public company valuations at this level (S&P 500 p/e ratio is >20x) since just prior to the market crashes in 2000 and 2007. We’ve all read this chapter before and it doesn’t have a good ending.

It’s been nearly 1,400 days since the last major market correction (10 percent pullback on the S&P). The last bull market lasted just about 1,600 days and the subsequent recession ended up taking away all the gains that were created during that 4-plus year run.

Historically, investment advisers would use this opportunity to reposition a client’s portfolio to reduce exposure to the public equity markets by increasing allocations to bonds and other asset classes such as real estate. However, this time it’s different.

With bonds paying anemic yields and a general consensus that interest rates are going up, using the textbook reallocation strategy is much less appealing. Real estate, an alternative asset class that is often thought of as an attractive alternative to the public markets has had a great performance in recent years, in large part due to low interest rates.

So how does an adviser keep the bulls running in this environment? One strategy that many savvy investment advisers are utilizing is to reallocate much of the gains they made over the course of this bull market to private equity.

Private equity has been used as a tool to target large capital gains by many institutional investors for decades. As an asset class, private equity has outperformed the public markets over extended periods of time and has done so with less volatility than the public markets.

.jpg)

The low correlation that private equity enjoys when compared to the public stock markets is in large part due to less volatility in capital flows. This is particularly true in a fully priced environment for publicly traded stocks.

What causes volatility in the public markets and how does this create an opportunity to generate large capital gains in private equity when the public markets are fully priced? First, let’s start with an examination of the underlying investments. Whether a company is privately held or traded on a national securities exchange doesn’t impact the intrinsic value of the company. For private equity managers, the focus is on the underlying value of the company. For exchange-traded companies, it’s a combination of the company’s fundamentals and the supply/demand for its stock. In other words, publicly traded company valuations are heavily influenced by the supply of available shares (number of sellers) and the demand for these shares (number of buyers). By comparison, the change in price of a direct investment in a privately held company is generally not closely correlated with the value of the stock market. The potential divergence of public company valuations from their intrinsic value is further exacerbated by day traders, program trading, and geopolitical events that cause large amounts of money to flow into and out of the stock market.

As a private equity manager, operating outside of the public markets can often present greater opportunities to generate outsized returns. The focus on creating intrinsic value by focusing on organic growth, add-on acquisition opportunities, and operational improvements creates a clear path to creating greater value for private equity investors over time. In addition, when a frothy stock market does exist, it may present private equity managers more opportunities to ‘exit’ to publicly-traded companies at above average earnings multiples. This dual value creation strategy is one of many reasons private equity has outperformed the public markets and why many savvy investors look to increase their allocation to private equity during the tail end of a bull market.

Private equity has been a coveted asset class for institutional investors for some time. With the introduction of such investment vehicles, individual investors are finally able to access institutional quality private equity funds. At a time when there are few compelling investment opportunities, private equity may just be the ticket to keep the bulls running…