Guest Contributor: How to Use Asset Allocation in Real Estate Advising

By: Joshua Ungerecht, managing partner at ExchangeRight

Clients expect their advisors and representatives to diversify their liquid holdings based on the combination of their total financial picture and overall market conditions. The approach to clients’ real estate holdings should be no different.

Given the average age of real estate investors in our industry, the reduced liquidity of real estate, and current market conditions, it is critical to apply a robust asset allocation approach to clients’ real estate investments.

The Average Accredited Real Estate Investor

According to a U.S. News and World Report survey conducted earlier this year, the average age of retirement in the U.S. is 62. A broad survey of over 2,000 accredited real estate investors reveals that while individual situations vary greatly, the average age of investors seeking assistance with their 1031 exchange and alternative investments is a little over 72. According to the World Bank, the average life expectancy in the U.S. is approximately 76 as of 2021. Digging further into the data reveals that women outlive men by five years, with an average life expectancy of 79 versus 74 for men.

This means that the average investor in the alternative investments industry:

› is retired and reliant on their assets to generate the income they need,

› is advanced in age and may have health concerns now or on the near-term horizon,

› has approximately four to seven more years of average life expectancy remaining, and

› may have a spouse or other dependents who are statistically likely to outlive them.

Given these needs, it is no wonder that the average investor in our industry is primarily seeking capital preservation and stable income.

Even before taking into account late-cycle and worsening macroeconomic conditions, most accredited real estate investors need conservative solutions based on their age and financial circumstances alone. While some may additionally want growth, they don’t want it at the expense of their investment capital and income.

The Traditional Asset Allocation Approach

An asset allocation approach takes these factors into account to ensure a client’s investment portfolio is properly aligned with their goals and needs. For example, a 72-year-old investor would generally have a very conservative liquid asset weighting, with a much larger allocation of their assets in fixed income rather than equities to reduce risk and generate the income they need.

The traditional method subtracts an investor’s age from 100 to determine how much of their portfolio should be allocated to riskier assets like equities. Another strategy is to roughly match an investor’s allocation to fixed-income investments with their age. Either way, the idea is that the younger the investor is, the larger their allocation to stocks will be. As an investor gets older, their equities weighting moves lower and the fixed income allocation grows proportionally larger.

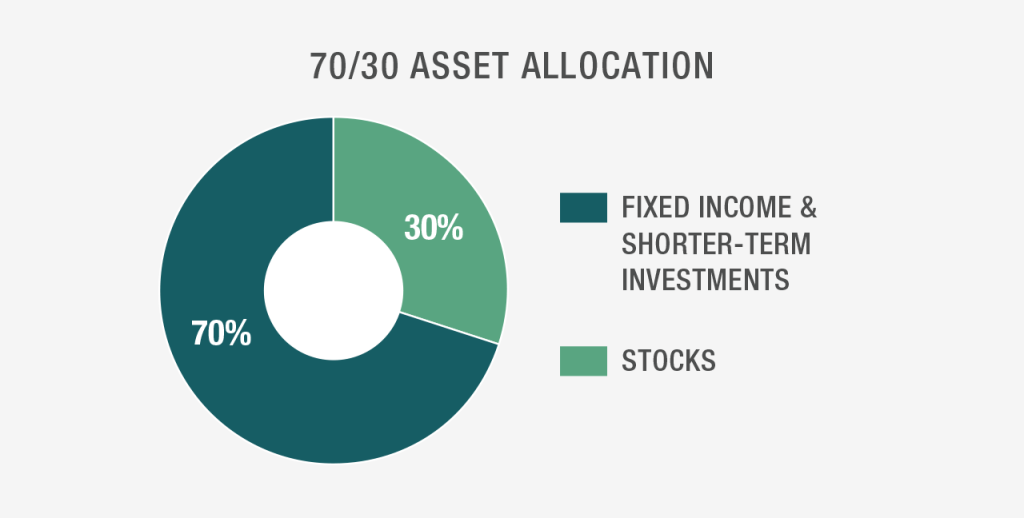

The goal of this shift over time is to incrementally reduce risk and increase income to investors so that, by the time they retire, they have less exposure to significant downside risks that could permanently impair their capital and their ability to generate the income that they need. By the time an investor is 72, they would have approximately 30% of their capital in equities, and approximately 70% of their capital in fixed-income and shorter-term investments for increased income and liquidity.

An Asset Allocation Approach to Real Estate

How does this translate to real estate? In essence, the younger an investor is, the more aggressive they can be in their investments, including their real estate investments. They can allocate a larger portion of their capital to economically sensitive asset classes, like apartments or non-credit industrial, which are riskier and that may provide more growth potential over the long-term.

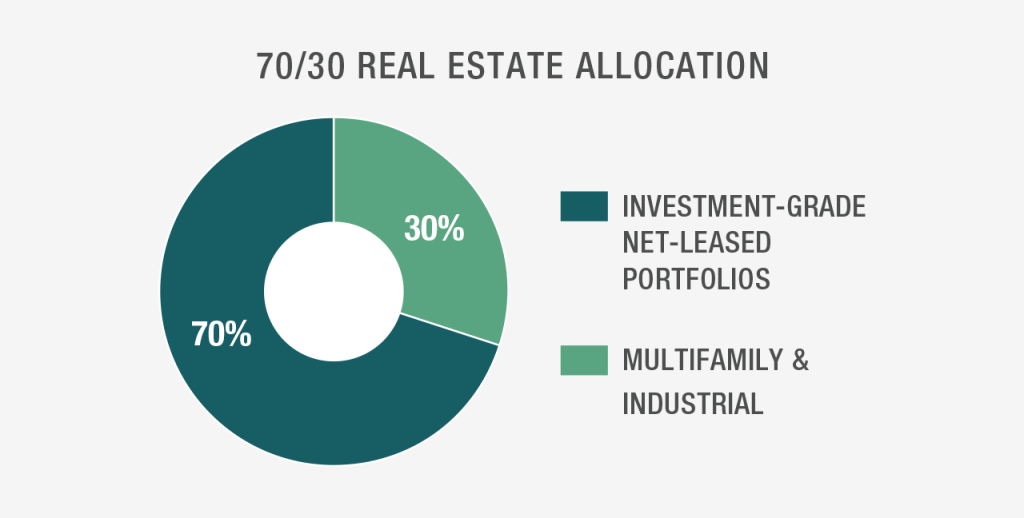

However, as these clients get to retirement age, it is imperative that they shift their real estate holdings increasingly to more conservative, fixed-income investments, such as diversified portfolios of long-term net-leased properties. Properties with long-term net leases can potentially lock in stably increasing rent rates and favorable lease terms over a period of 8–12 years, backed primarily by investment-grade tenants operating essential businesses in historically recession-resilient industries such as necessity retail and healthcare, thereby providing income stability and downside protection.

Based on their age, the average investors in the alternative investments industry would generally need to allocate approximately 70%+ of their real estate holdings to more conservative and economically resilient fixed-income options. This would limit their exposure to no more than 30% of the more aggressive and economically sensitive investments that carry more downside risk.

In an industry where the average investor is 72 years old and facing a limited time horizon, it’s crucial for advisors and representatives to safeguard investor assets and income. Avoiding downside risk is vital for protecting investors whose livelihoods depend on the income generated by their investments and who are at a stage in life when they have little ability to recoup material losses.

Whether customizing age-sensitive risk profiles or balancing portfolios with both liquidity and estate planning needs in mind, representatives and advisors have an exceptional opportunity to make a meaningful impact in the lives of their clients by implementing an asset allocation approach.

As gatekeepers of alternative investment advice, it’s not just about maximizing returns—it’s about minimizing risk in a stage of life when stability is paramount.

Joshua Ungerecht currently serves as a managing partner of ExchangeRight. ExchangeRight and its affiliates’ vertically integrated platform features more than $5.7 billion in assets under management that are diversified across over 1,200 properties, and 23 million square feet throughout 47 states.

The views and opinions expressed in the preceding article are those of the author and do not necessarily reflect the views of The DI Wire. Past performance does not guarantee future results.

For more ExchangeRight news, please visit their directory page.