First Quarter 2024 Non-Traded Alts Fundraising Up 69% Year-Over-Year

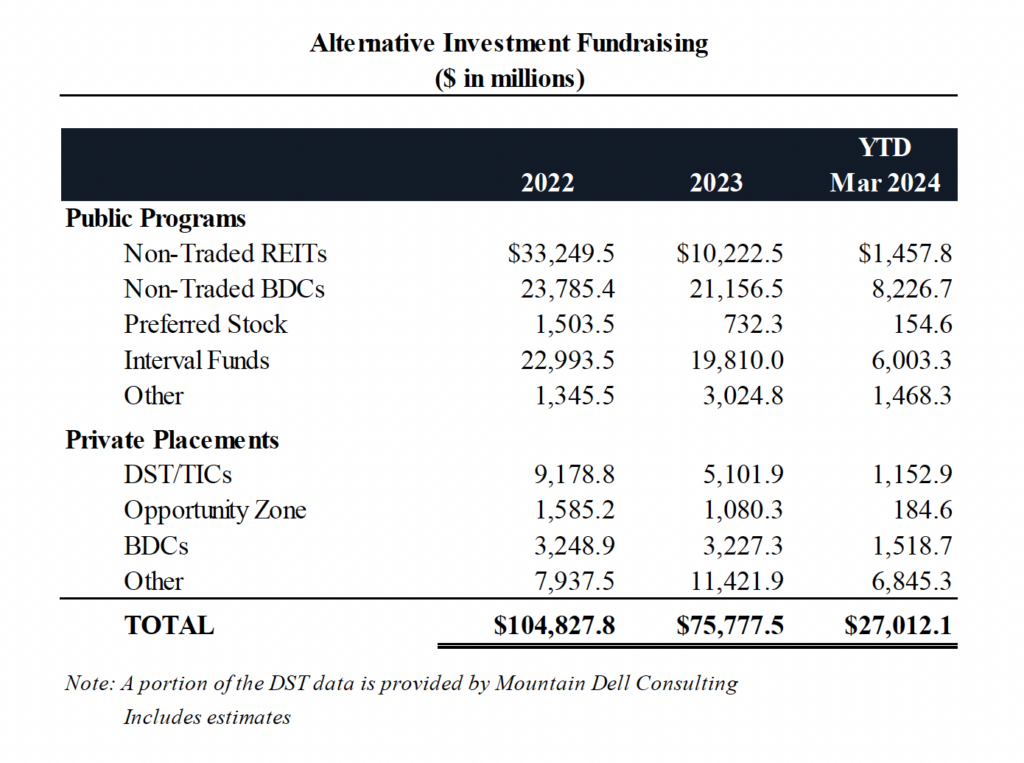

Non-traded alternative investments fundraising totaled nearly $27 billion through March, led by non-traded business development companies at an estimated $8.2 billion and interval funds at $6 billion, according to research provided by investment bank Robert A. Stanger & Co. Monthly fundraising in public non-traded BDCs, interval funds, and private placements (including infrastructure and private equity) continues to outpace non-traded real estate investment trusts, which have previously dominated the space over the last seven years.

“In the first quarter of 2024, retail investors have contributed $27 billion into alternative investments as compared to the $16 billion at this time last year. We expect this trend to continue and estimate fundraising to exceed $100 billion in 2024 as investors continue to seek alternatives generating higher yields,” said Kevin T. Gannon, chairman of Robert A. Stanger & Co., Inc.

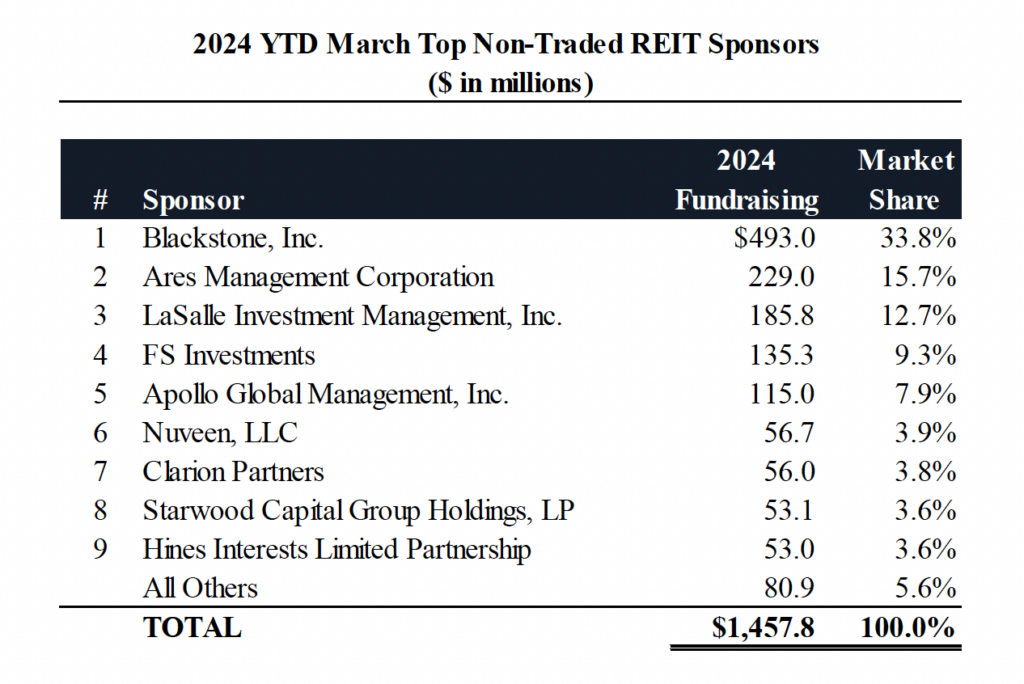

Non-traded REITs reported $1.5 billion of fundraising year-to-date, due in part to Delaware statutory trust UPREIT transactions by Ares and JLL totaling nearly $369 million. Without these UPREIT events, 2024 non-traded REIT fundraising is down 69% as compared to the same period last year (excluding a $4.5 billion investment from the Regents of the University of California in Blackstone’s BREIT in 2023). Blackstone leads fundraising through February with $493 million, followed by Ares Management Corporation with $229 million, LaSalle Investment Management ($185.8 million), FS Investments ($135.3 million) and Apollo Global Management ($115 million) to round out the list of top five fundraising sponsors.

Non-traded BDCs raised approximately $8.2 billion year-to-date through March, led by Blackstone with $2.5 billion raised. Rounding out the list of top five fundraising sponsors are Blue Owl Capital with $1.5 billion, Apollo Global Management ($1.4 billion), HPS Investment Partners ($1 billion estimated), and Ares Management Corporation ($584.9 million).

Non-traded BDCs raised approximately $8.2 billion year-to-date through March, led by Blackstone with $2.5 billion raised. Rounding out the list of top five fundraising sponsors are Blue Owl Capital with $1.5 billion, Apollo Global Management ($1.4 billion), HPS Investment Partners ($1 billion estimated), and Ares Management Corporation ($584.9 million).

Stanger’s survey of top sponsors tracks fundraising of all alternative investments offered via the retail pipeline including publicly registered non-traded REITs, non-traded BDCs, interval funds, non-traded preferred stock of traded REITs, DSTs, opportunity zone, and other private placement offerings. The top fundraisers in the alternative investment space year-to-date are Blackstone ($5.0 billion), Cliffwater ($3.1 billion), Blue Owl Capital ($2.4 billion), Kohlberg Kravis Roberts & Co. ($2.3 billion) and Ares Management Corporation ($2.1 billion).

Private placement offerings for public reporting companies continued their upward momentum in fundraising in 2024. Year-to-date through March, other private placements (including infrastructure, private equity, and net lease real estate offerings) raised approximately $6.8 billion. The newly effective private equity offering by Blackstone, the Blackstone Private Equity Strategies Fund, has raised nearly $1.9 billion while KKR Infrastructure Conglomerate LLC and KKR Private Equity Conglomerate LLC raised almost $2.3 billion combined.

“While there are downward trends in public non-traded REIT fundraising, we are seeing investment managers in this space evolving their product focus and creatively designing different investment strategies that are bringing in new capital and recapturing investor redemptions as well,” according to Randy Sweetman, executive managing director at Stanger.

“While there are downward trends in public non-traded REIT fundraising, we are seeing investment managers in this space evolving their product focus and creatively designing different investment strategies that are bringing in new capital and recapturing investor redemptions as well,” according to Randy Sweetman, executive managing director at Stanger.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.