Massachusetts Moves Forward with State Fiduciary Standard

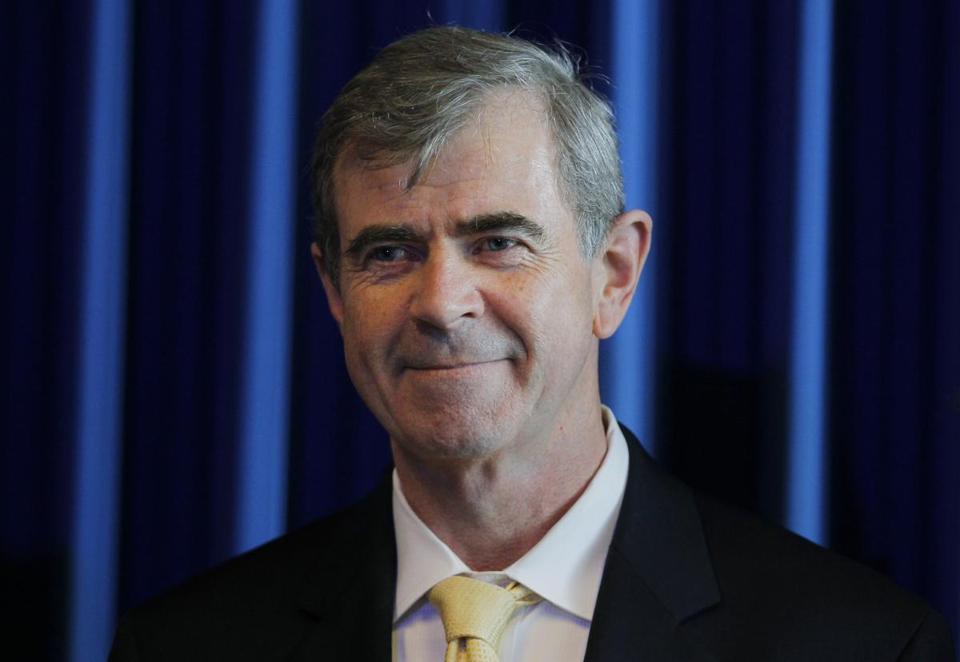

Massachusetts Secretary of the Commonwealth William Galvin, the state’s chief securities regulator, has signed off on new regulations that would impose a uniform fiduciary conduct standard.

Massachusetts Secretary of the Commonwealth William Galvin, the state’s chief securities regulator, has signed off on new regulations that would impose a uniform fiduciary conduct standard on broker-dealers, agents, investment advisers, and investment adviser representatives when dealing with their customers and clients in the state. A hearing on the proposed regulations will be announced at a later date.

According to the regulator, the proposed regulation is based on the common law fiduciary duties of care and loyalty and would require financial professionals to make recommendations and advice “based on what is best for the customers and clients, without regard to the interests of the broker-dealer, advisory firm, and its personnel.”

The proposed standard would apply to municipalities and pension plans, as well as individual investors.

“I am proposing this standard because the SEC has failed to provide investors with the protections they need against conflicts of interest in the financial industry with its Regulation Best Interest rule,” said Galvin.

Regulation Best Interest claims to go beyond the current suitability standard and requires broker-dealers to act in the best interest of their retail customers when making an investment recommendation of any securities transaction or investment. The SEC also requires brokers to provide clients with a standardized disclosure document about the nature of their relationship.

Opponents of the rule argue that it does not define the “best interest” of the customer and exacerbates existing confusion among investors who are unsure about the standards their broker must observe, while proponents believe that the rule establishes a national standard that helps protect investors while preserving access to professional financial advice.

Dale Brown, president and chief executive officer of the Financial Services Institute, an industry trade group and supporter of Regulation Best Interest, expressed concern about the Massachusetts proposal’s impact on retail investors.

“Massachusetts’ proposal creates differing requirements from those established by Reg BI,” said Brown. “This will ultimately limit services and drive up costs for investors through increased confusion and higher compliance costs for financial advisors. Our members are diligently working toward compliance with Reg BI, and we strongly encourage Massachusetts to align its requirements with those of the SEC and other existing regulations. We stand ready to work with the Securities Division on a solution.”

The Department of Labor also plans to introduce a new fiduciary rule this month after the previous version was vacated by the Fifth Circuit Court of Appeals last year.