Webinar Recap: A Deeper Dive Into 1031-to-721 Exchange UPREITs

If we’ve learned one thing in alternative investments, it’s that change is to be expected and often provides needed and wanted optionality in the pursuit of building and managing wealth.

If you look today at “available equity, over 55% of the available product that’s out there minus what’s been sitting out there for more than 365 days is 721 [Delaware statutory trust] product,” said Nati Kiferbaum, senior vice president – head of investment product strategy, Inland Private Capital Corporation. “It’s expanding rapidly. From our house view, it wouldn’t be crazy if you were sitting here in 2025 … [and] one in every $2 was being raised by 721 DST providers.”

Internal Revenue Code Section 1031 exchanges have been around for more than 100 years and been utilized to facilitate tax-advantaged securities for more than 20 years. Increasingly, securitized 1031-to-721 exchange UPREIT investment programs are being sponsored by non-traded real estate investment trusts to provide tax-deferred exchanges to investors that are ultimately converted via a 721 exchange into REIT shares.

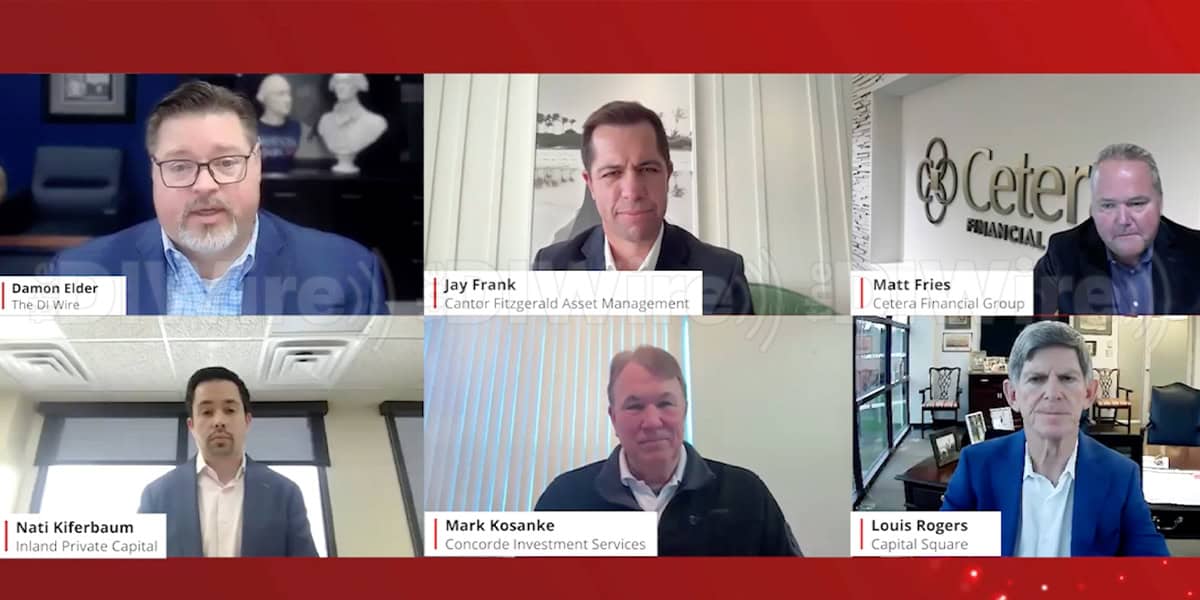

The DI Wire recently hosted a panel for financial advisers, investors, and others interested in learning more about 721 exchange UPREIT investment programs.

Watch to learn more from leaders in the industry.

Topics included what UPREITs are and how they work; the key similarities and differences between 1031 and 721 exchanges; the potential benefits and risks for investors and wealth managers; and strategies for identifying ideal properties for an UPREIT.

“721 and 1031 are very similar. 721 deals with partnership contributions, 1031 with tax deferred exchanges. They could not be more different in their purpose, but they operate in a very similar manner,” said Louis Rogers, founder and co-chief executive officer of Capital Square.

Moderated by Damon Elder, publisher of The DI Wire, leaders in the industry explored UPREITs, 1031 exchanges, and 721 exchanges – powerful options for building potential wealth in the alternatives space.

Joining Rogers, Kiferbaum, and Elder were:

Jay Frank

President and Head of Distribution, Cantor Fitzgerald Asset Management

Matt Fries

Head of Investment Products and Partner Solutions, Cetera Financial Group

Mark Kosanke

President, Concorde Financial Group

It looks very different between 1031 DSTs and 721s, Kiferbaum continued, and registered investment advisers have adopted and, in my instances, prefer the 721 DST vehicle. “As we think about what the evolution of DSTs might be going forward, I certainly could see that price discovery becomes something that might be required on a more frequent basis in order to have that parity between the investor experience. That’s our house view maybe two, three years from now. But as that RIA business continues to grow, we think that’s going to be something of a focus.”

Click here to visit The DI Wire directory page.