Walton Global Launches Texas Growth 1 DST, Seeks $4.7 Million Capital Raise

Global real estate investment and land asset management company Walton Global launched Texas Growth 1 DST, a private placement offering which seeks to raise approximately $4.7 million from accredited investors seeking capital gains tax deferment via a Section 1031 exchange.

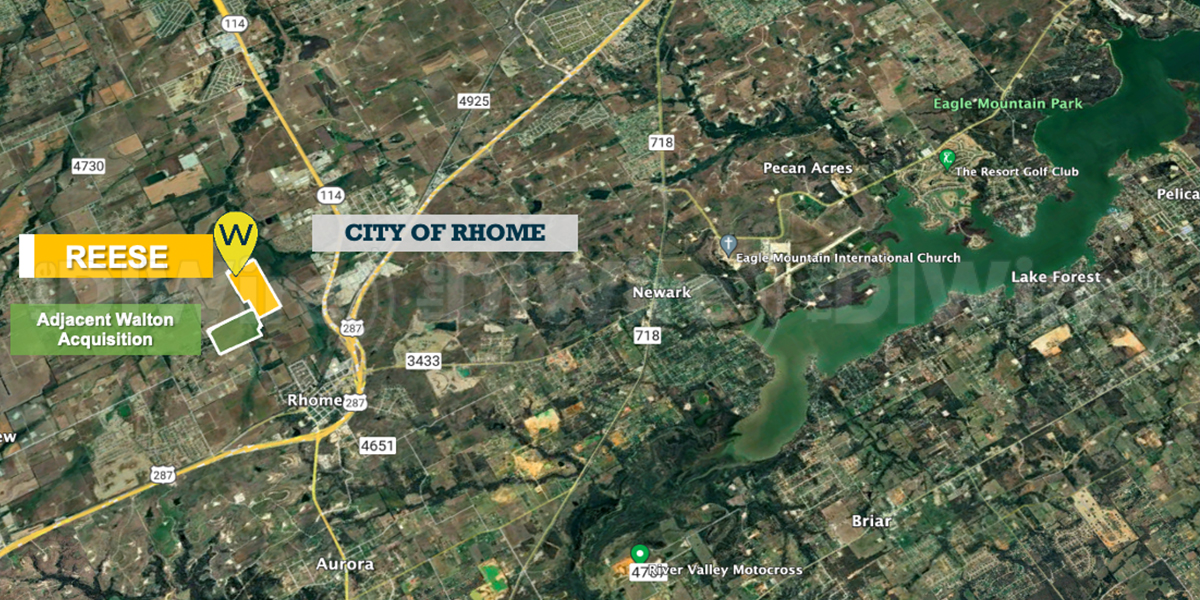

The Delaware statutory trust offers investors ownership of 130 acres of land known as “Reese” within the extra territorial jurisdiction of Rhome, Texas. The acreage is zoned for agricultural use and a potential for a future public improvement district or municipal utility district. Upon completion, the site is estimated to build out to approximately 390 homesites.

With the competitive cost of living and robust job availability in Texas, Reese was strategically selected to boost residential inventory, said Walton, a sponsor of private placement investments. The property will offer access to major urban centers with direct proximity to Interstate 35W and State Highway 114. This allows for a 25-minute drive to Fort Worth, 30 minutes to Dallas Fort Worth International Airport, and under an hour to Arlington and Dallas.

The Texas Growth 1 DST exit strategy is targeted to be three to five years and offers opportunities for financial advisers to further diversify their clients’ DST portfolios with a growth investment. The minimum investment accepted from an outside investor is $25,000.

Originally launched in March 2023, Walton’s strategy for its DST offerings focuses on all-equity growth opportunities targeting potentially higher investor returns than traditional DSTs, along with hold periods that are not artificially lengthened due to repayment restrictions applicable to most traditionally financed alternatives.

“We chose this parcel for our DST 1031 exchange offering as the area boasts a pro-business environment with a consistent population increase and houses over 50 international companies within the Dallas Fort Worth region,” said Todd Woodhead, executive vice president of capital markets at Walton Global. “The enhanced economic diversity and job prospects of the region makes this land highly desirable for new home development and a strong candidate for our land investment opportunity.”

According to Walton, new residents of the future property will also benefit from quick access to several recreational offerings and employment opportunities. Reese is situated 20 minutes away from Alliance Town Center, 22 minutes from the Amazon Fulfillment Center and FedEx Shipping Center and offers convenient travel time to Rhome Family Park, Veterans Memorial Park, and Lee’s Country Campground.

“Texas is leading the country in both population and job growth. With the existing home supply significantly below balanced market levels, new construction now represents about 34% of the for-sale inventory, highlighting the critical role of new developments in meeting housing demand,” Woodhead added. “With the entry of over 80 million millennials into their prime homebuying years, we believe the demand for new housing will only increase, and the DST 1031 exchange model will continue to see a rise in popularity as there is strong potential for traditional appreciation based on market conditions.”

According to Walton, it continues to acquire a strong pipeline of DST properties in growth regions across the country, hold the properties for growth in value as contemplated by 1031 tax regulations and market the property after the hold period ends to its established network of top U.S. home builders.

Walton Global is a privately owned land asset management and real estate investment company with $3.3 billion in assets under management and more than 90,000 acres of land under ownership, management, and administration in the United States and Canada. A total of $2.3 billion has been distributed to investors located in 83 countries.