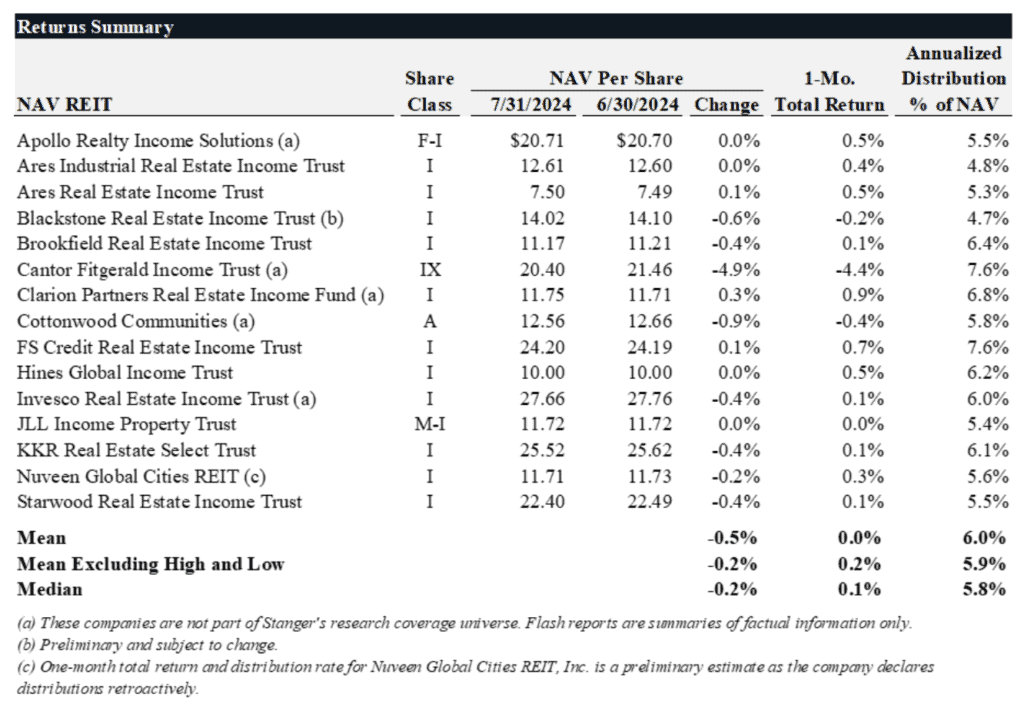

Twelve of the 15 Largest NAV REITs Post Positive Returns in July

Investment banking firm Robert A. Stanger & Co., Inc., reported that 12 of the 15 largest net asset value real estate investment trusts reported positive total returns in July 2024.

Responding to the positive trends and tracking opportunities, Stanger expanded its flash reports to include five small cap NAV REITs, bringing the total number of NAV REITs included in its monthly summaries to 15. The companies added include Apollo Realty Income Solutions Inc., Cantor Fitzgerald Income Trust Inc., Clarion Partners Real Estate Income Fund, Cottonwood Communities Inc., and Invesco Real Estate Income Trust Inc.

“We are seeing more positive momentum for NAV REITs, with 12 of the 15 largest players posting positive total returns in July,” said David J. Inauen, head of research at Stanger.

Each of the NAV REITs identified in the table below reported updated NAVs per share as of July 31, along with updated portfolio information.

“With the widely anticipated interest cuts and market rally, the stage is set for renewed interest in NAV REITs, and we are excited to be expanding the scope of our monthly flash reports, which will now address 99% of the entire NAV REIT universe,” Inauen added.

Stanger already summarizes the NAV activity, distribution rate, total shareholder return, fundraising, redemptions, and other metrics along with recently reported events of the following 10 REITs.

- Ares Industrial Real Estate Income Trust Inc.

- Ares Real Estate Income Trust Inc.

- Blackstone Real Estate Income Trust Inc.

- Brookfield Real Estate Income Trust Inc.

- FS Credit Real Estate Income Trust Inc.

- Hines Global Income Trust Inc.

- JLL Income Property Trust Inc.

- KKR Real Estate Select Trust Inc.

- Nuveen Global Cities REIT Inc.

- Starwood Real Estate Income Trust, Inc.

Last month, Stanger issued an updated research report on JLL Income Property Trust. The REIT reported $6.6 billion in total asset value as of June 30, 2024, and the report reiterated Stanger’s JLL REIT’s rating as overweight. Also in July, Stanger upgraded its rating for KKR Real Estate Select Trust to overweight. Structured as a ’40 Act closed-end fund that qualifies for tax treatment as a REIT, the company has a property portfolio exceeding $3.3 billion, supplemented by $250 million in credit investments.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.