Sponsored: How to Successfully Defer Taxes in a 1031 Exchange

By: Joseph Crossett, Senior Analyst, Acquisitions at Four Springs Capital Trust

By: Joseph Crossett, CFA — Senior Analyst, Acquisitions at Four Springs Capital Trust

- WHAT IS A 1031 EXCHANGE?

In the simplest terms, a 1031 exchange is a tax deferred swap of one asset for another of like-kind. Though not exclusive to real estate, it is widely used by property investors, and net lease properties have become popular replacement properties for investors due to the long- term nature of the leases, the durability of the rental income and the limited management responsibilities.

However, despite their prevalence, 1031 exchanges can be complex and remain confusing to many investors. In order to navigate the process and achieve 1031 success, investors should be mindful of the following considerations:

- THE EXCHANGE MUST BE “LIKE-KIND”

With real estate, the Internal Revenue Code guidance on “like-kind” properties is broad and most real estate will qualify for an exchange. For example, vacant land may be exchanged for commercial real estate or a residential rental property. While it is most common for an investor to reinvest their proceeds into a single asset, the code also allows for a swap into multiple properties. In this way investors can more easily match sale proceeds with their re-investment opportunities.

However, the IRS does specify a few primary restrictions, namely properties located outside the United States, primary residences, and improvements not conveyed with land do not qualify as like-kind real estate.

- EXCHANGES ARE TIME SENSITIVE

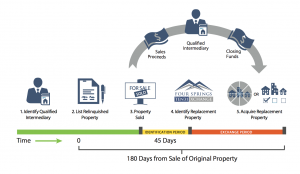

Although the term “swap” is used to describe 1031s, most transactions feature a delayed exchange and involve the sale of one investment property followed by the subsequent purchase of another. In order to qualify for the tax deferral, investors must meet the following deadlines:

Identification Period (45 Days) – After sale of the original investment, investors have 45 days to identify the replacement properties. The identification must be in writing, signed, and delivered to a person involved in the exchange such as the seller or a qualified intermediary.

Closing Period (180 days) – Following the original sale, the investor has 180 days to complete the purchase of one or more of the replacement properties that were named in the identification period. However, this time limit is overridden if the tax returns for original investment sale are due (including any extensions) prior to the 180th day.

- NO RECEIPT OF CASH

Investors are prohibited from taking control of cash from the original investment sale. If the proceeds pass directly to the investor prior to the purchase of the replacement property, the exchange may be disqualified and the gains made taxable. Note, however, that an investor may receive cash or other property that is not considered like-kind property (often referred to as “boot”) as part of the exchange, and the exchange will still qualify for tax deferral under Section 1031. In those cases, the investor is taxed only to the extent of the boot that they receive.

To avoid this, investors commonly use an exchange facilitator or qualified intermediary to hold sale proceeds until the exchange is completed. It is important to remember that this agent cannot be you or your real estate agent, broker, accountant, attorney, or anyone who has worked for you in these capacities during the prior two years.

- FINAL THOUGHTS

In a 1031 transaction the capital gains taxes are deferred, not eliminated. It is important to note that when the replacement property is ultimately sold the original deferred gain and any additional gains on the replacement property will be subject to tax. The exception being if the replacement property is sold as part of another 1031 exchange. Taxpayers must report an exchange to the IRS on Form 8824, Like-Kind Exchanges and file it with their tax return for the year in which the exchange occurred. While 1031 exchanges require careful planning and close oversight, they are a powerful tool to preserve an investor’s purchasing power.

Disclaimer: Four Springs Capital Trust (FSCT) is a single tenant net lease REIT seeking investments in industrial, retail, medical, and other office properties. Note that Section 1031 of the Internal Revenue Code of 1986, as amended, contains specific requirements that must be met in order to qualify for the tax deferral provided by such provision. Nothing contained in this article constitutes tax advice, and individuals should consult their own tax and other advisors when considering such transactions.

SPEAK WITH YOUR FINANCIAL PROFESSIONAL TO LEARN MORE ABOUT FOUR SPRINGS CAPITAL TRUST

Email: info@fsctrust.com | Phone: 877-449-8828 | www.fsctrust.com

Disclaimers and Risk Factors

This brochure has been prepared by Four Springs Capital Trust (FSCT) and Four Springs TEN31 Xchange, LLC (FSXchange). It is intended to be general information only and not to provide personal investment advice and it does not take into account the specific investment objectives, financial situation and the particular needs of any specific person. The information herein is believed to be reliable, however, the accuracy and completeness of the information is not guaranteed. Tax deferred real estate exchange transactions are complex. Failure to comply with the specific requirements of tax deferred real estate exchange transactions may result in the incurrence of taxes and a loss of the ability to defer taxes. Accordingly, investors should consult with their tax and legal counsel in connection with tax deferred exchanges.

IRS Circular 230 Notice: To ensure compliance with requirements imposed by the Internal Revenue Service, we inform you that any U.S. tax advice contained in this communication is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein.

Investments in real estate are subject to known and unknown risks, uncertainties and other factors, and should be considered only by sophisticated investors who can bear the economic risk of their investment for an indefinite period and who can afford to sustain a total loss of their investment. Investors should perform their own due diligence before considering any investment in a FSCT and/ or FSXchange program. Investment objectives may not be reached if there are significant changes

in the economic and regulatory environment affecting real estate. Many investments in real estate, including the programs offered by FSCT and/or FSXchange, are illiquid by nature. There is no recognized secondary market for ownership interests in FSCT and/or FSXchange programs, and transfer of interests in these programs may also be legally restricted. Therefore, you may be unable to sell your interests prior to liquidation.

This brochure is neither an offer to sell nor a solicitation to purchase interests in FSCT and/or FSXchange programs and is intended solely for informational purposes. Specific offerings can only be made through a Private Placement Memorandum (‘PPM’). Prospective investors should carefully review the “Risk Factors” section of any PPM. Past performance and/or forward looking statements are never an assurance of future results. FSCT and/or FSXchange do not guarantee ongoing distributions or overall investment performance. Securities offered through Third Seven Capital LLC, Member FINRA/SIPC. Four Spring Capital and Third Seven Capital are not affiliated.

The properties pictured in this presentation may not be owned by FSCT nor FSXchange and may be merely representative of the properties that FSCT, FSXchange and its affiliates may purchase.

© 2018 Four Springs Capital Trust

The opinions in the preceding commentary are those of the author alone and do not necessarily reflect the views of The DI Wire. Four Springs is a sponsor of The DI Wire, and the article was published as part of their standard directory sponsorship package.

Click here to visit the Four Springs Capital Trust directory page.