Guest Contributor: Why Grocery and Necessity Anchored Retail

By: Jake Bisenius, President and CIO of AmCap

Grocery and necessity-anchored retail is one of the more attractive and defensive investments in real estate because of the following: well-occupied centers generate consistent and considerable cash flow throughout market cycles, grocers draw shoppers to the centers several times a week, generating consistent cross traffic for other tenants, and with the right grocer and tenant mix these centers can be operated to maximize the potential lift from changes in technology while minimizing the negative impact.

Grocery anchored retail has proven to be a strong performer during recessions, a favorable characteristic when making late-cycle investments. Relative to other forms of retail grocery sales are remarkably stable; sales growth rarely exceeds the broad swath of retail but they rarely decline.

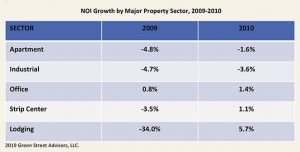

During the Global Financial Crisis, the net operating income generated by grocery-anchored retail as a sector was slightly positive. This not only outperformed all other types of retail but most every other type of real estate, proof positive that consumers will continue to shop for food and other necessities while cutting back on other discretionary purchases.

The grocery anchor serves as a draw to the center which accrues to the benefit of the rest of the center’s tenants. These retailers want to be located near a strong anchor, so not only does the grocer help boost occupancy, but with the benefit of cross-traffic overall sales should be strong as well.

Fitness centers now want to be near a grocer for the sake of convenience; dry cleaners, salons, fast casual restaurants, and medical-related tenants such as dentists and urgent care centers – all of whom are resistant to e-commerce as well as the vagaries of economic cycles – want to be located near a grocer who will draw shoppers to the center on a consistent basis.

The average U.S. consumer makes a trip to the grocery store 1.5 times per week (Brick and Mortar is Alive and Well). For this reason, it is estimated that most consumers in the U.S. have a grocery store located, on average, within two miles from where they live.And for this same reason, other retailers want to be located within the same center as a grocery store, resulting in the fact that grocery-anchored centers currently have the highest occupancy rates of all shopping center types nationally.

The threat to retail from e-commerce is real and cannot be understated. The threat to grocers from e-commerce is less so but still an ominous cloud on the horizon. Currently, e-commerce constitutes just over 2 percent of total grocery sales, versus 9.9 percent for the broader retail market. CBRE estimates that even with 20 percent annual growth, grocery e-commerce will reach 5 percent market share by 2022, altering but not replacing traditional store sales.High customer product interaction helps make grocery and necessity-anchored retail the sector with the lowest risk from ecommerce in U.S. retail.

But changes in technology also present an opportunity for grocers, especially for the dominant players who have the capital to evolve. There is a real chance that e-commerce will lead to the demise of many forms of retail including weaker grocers, but for the larger players there will be opportunities to consolidate and/or remove competitors from the landscape. As these grocers consolidate their position in the market, the value of the center in which they are located will increase, while centers with weaker grocers in lesser locations may well suffer.

For those grocers who can embrace technology, the ability to expand on online shopping with curbside or instore pickup (click-and-collect) can improve their offerings to customers, weaken competition, and provide yet another lure to shoppers for the overall center.

Technology for these grocers will allow them to improve customer offerings, decrease the costs of operating a store (robots, cashier-free checkout, etc.) and change the overall experience for a customer– yet all the while remaining as a completely relevant and necessary format which draws consumers to a shopping center, day in and day out.

Despite the strong fundamentals throughout the economy, whether measured by wage growth, low unemployment, consumer confidence, etc., retail as a whole has experienced almost no development, and this applies to grocery-anchored centers as well. net store openings (despite the headlines) will outnumber closures in 2019, boosting demand and driving up rents.

The net beneficiary of all of this is the owner of the center. And despite those positive fundamentals, grocery-anchored strip centers continue to see (or benefit from, depending on one’s perspective) expanding cap rates.

Cap rates for strip center retail have recently risen while most every other sector has fallen. Driven partially by cyclical concerns but mostly by a reaction to negative headlines, not only does this create an attractive buying opportunity but it could insulate retail from a dramatic repricing should real estate cap rates reverse course due to a recession.

Pricing for grocery and necessity anchored retail peaked around 2015 in the United States. Current pricing on many core + and light-value add assets are around 10-30 percent lower than they were during the peak years of 2015-2016. Managers that invested heavily in this space in that same time frame may be having a hard time exiting their assets at accretive pricing.

With the significant discount to peak pricing in grocery and necessity-anchored retail that we see now in 2019, groups that invest in these types of assets should increase their ability to see favorable exits if pricing and cap rates normalize in the medium term.

AmCap was founded in 1979 as an owner/operator of grocery-anchored and necessity-driven retail shopping centers. AmCap invests in properties situated in the top 100 MSA’s in the U.S., predominantly those demonstrating strong job growth, higher income and densely populated neighborhoods with high barriers to entry. As of December 31, 2018, AmCap owns approximately 5 million square feet of retail shopping centers across the U.S., with approximately $1.0 billion of assets under management.

Click here to visit The DI Wire directory sponsor page.

The views and opinions expressed in the preceding article are those of the author and do not necessarily reflect the views of The DI Wire.