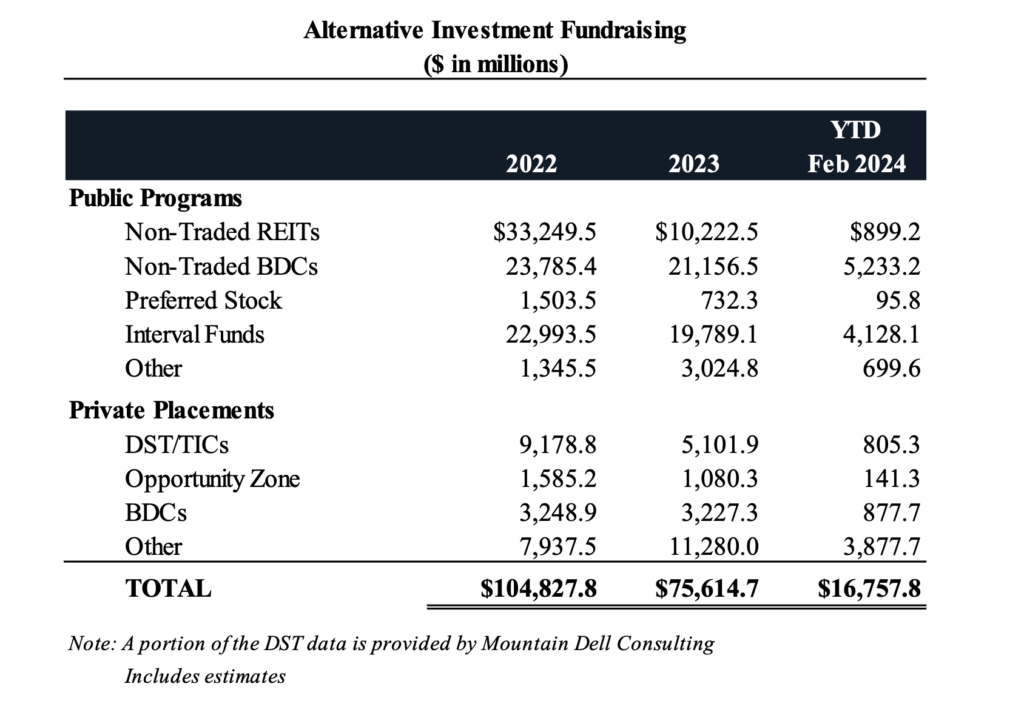

Equity Raise Among Non-Traded Alts Totals $16.8 Billion Through February

2024 investments in alternative assets totaled $16.8 billion through February 2024, according to the latest numbers from Robert A. Stanger & Co., Inc. Fundraising was led by non-traded business development companies at an estimated $5.2 billion and interval funds at $4.1 billion. Non-traded BDC monthly fundraising has exceeded $2 billion raised per month since September 2023 and is on pace to raise $30 billion dollars this year.

“Over $9 billion has already been raised in non-traded BDCs and interval funds combined this year due in great part to their generally higher yield along with a simpler regulatory environment,” said Kevin T. Gannon, chairman of Stanger.

Non-traded real estate investment trusts reported $899.2 million of fundraising year-to-date, due in part to Delaware statutory trust umbrella partnership REIT transactions in February, totaling nearly $268 million. Without these umbrella partnership REIT events, 2024 non-traded REIT fundraising is down 42% as compared to the same period last year (excluding a $4 billion investment from the Regents of the University of California in Blackstone’s BREIT in January 2023).

Blackstone leads fundraising through February with $264 million, followed by Ares Management Corporation with $219.7 million, FS Investments ($85 million), LaSalle Investment Management ($18.7 million), and Apollo Global Management ($57.1 million) representing the top five fundraising sponsors.

Non-traded business development companies raised approximately $5.2 billion year-to- date through February, led by Blackstone with almost $1.7 billion raised. The rest of the top five were Blue Owl Capital with $950 million, Apollo Global Management ($895.6 million), HPS Investment Partners ($673.1 million estimated), and Ares Management Corporation ($362.6 million).

Stanger’s survey of top sponsors tracks fundraising of all alternative investments offered via the retail pipeline including publicly registered non-traded REITs, non-traded business development companies, interval funds, non-traded preferred stock of traded REITs, DSTs, opportunity zones, and other private placement offerings. The top fundraisers in the alternative investments space year-to-date are Blackstone ($3.5 billion), Cliffwater ($1.9 billion), Blue Owl Capital ($1.4 billion), Ares Management Corporation ($1.2 billion), and Kohlberg Kravis Roberts & Co. ($1.2 billion).

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.