Bluerock Capital Markets Reports $986 Million of New Equity Capital Inflows in 2020

Bluerock Capital Markets LLC, a distributor of alternative investment products and the dealer manager for Bluerock Real Estate, reported total equity inflows of approximately $986 million in 2020 across all investment programs.

Bluerock Capital Markets LLC, a distributor of alternative investment products and the dealer manager for Bluerock Real Estate, reported total equity inflows of approximately $986 million in 2020 across all investment programs, including distribution reinvestment. The company also reported approximately $1 billion of average annualized equity capital raise over the prior four-year period. According to Robert A. Stanger & Company, Bluerock Capital Markets has ranked among the top sponsors in total capital raise in the direct investments industry from 2017-2020.

2020 Highlights of Bluerock’s Investment Programs Include:

Citing Stanger and Morningstar Direct, Bluerock reported that its Total Income+ Real Estate Fund was the top performing real estate interval fund in 2020 and the #1 capital raising real estate interval fund in the direct investment industry from the onset of the pandemic (April – December), raising more than $646 million of new investor capital in 2020.

The Bluerock Total Income+ Real Estate Fund invests the majority of its assets in institutional private equity real estate securities. The value of the underlying real estate held by the securities in which the fund is invested is approximately $223 billion, and include investments managed by Ares, Blackstone, Morgan Stanley, Principal, PGIM, Clarion Partners, Invesco and RREEF, among others.

The fund’s Class I shares (Ticker: TIPWX) had a total annualized return of 1.64 percent in 2020, the highest total return of all real estate interval funds and more than 900 basis points higher than the MSCI U.S. REIT Index, an index of leading listed public real estate.

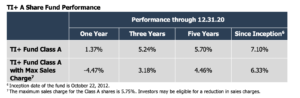

The fund’s Class A shares (Ticker: TIPRX), its longest running share class, had a 7.10 percent annualized total return since its inception in October 2012. The annualized total return for Class A shares was 6.33 percent with a maximum sales charge of 5.75 percent for the same period.

Bluerock also noted that the fund has delivered eight consecutive years of positive returns, 29 of 32 positive quarters, and has made 32 consecutive quarterly distributions to shareholders at a 5.25 percent annualized rate.

The company said that its no load Class A shares received the highest Sharpe Ratio among approximately 890 open-end, closed-end, and exchange-traded funds in the global real estate sector equity category for the five-year period ending December 31, 2020. The Sharpe Ratio would have been lower if the calculation reflected the load.

Bluerock indicated that its Bluerock Residential Growth REIT (NYSE: BRG) had the top return among the publicly traded multifamily real estate investment trusts in 2020, with a 14.7 percent total shareholder return, and closed at $12.72 at the end of the year. The REIT’s assets totaled more than $2.4 billion and included 17,200 apartment units.

“We are extremely pleased to have delivered to our valued financial advisors and shareholders the #1 return performance in both of our flagship investment products,” added Ramin Kamfar, founder and chief executive officer of Bluerock Real Estate. “I am proud of the extreme hard work of our entire organization and their dedication to the more than the 77,000 shareholders we serve.”

Bluerock Residential Growth REIT also issues non-traded preferred stock through its Series T preferred stock offering, which raised more than $242 million of new investor capital and had approximately 42 percent market share of the non-traded preferred stock sector, according to Stanger. BRG has raised more than $740 million of non-traded preferred stock over time and has retired and/or converted more than $110 million of previously issued preferred stock.

The company said that Bluerock Residential Growth REIT has paid 57 consecutive monthly dividends, all of which were paid from cash flows from operations, to its preferred stock shareholders at the annual dividend rate of 6.15 percent. In addition, the REIT recently announced 26 tranches of BRG warrants being “in the money,” which occurs when the exercise price is less than the current share price.

Bluerock Value Exchange, a national sponsor of syndicated 1031-exchange offerings, has fully subscribed three sponsored Delaware statutory trust programs in 2020 resulting in total acquisition of more than $220 million in multifamily assets. Bluerock Value Exchange has structured 1031 exchanges on more than $1.8 billion in total property value and in excess of 10 million square feet of property.

Bluerock is an alternative asset manager with approximately $8.8 billion of acquired and managed assets headquartered in Manhattan with regional offices across the U.S.

For more Bluerock Real Estate news, click here to visit their directory page.