Traded REITs Heat Up in Summer Rally as NAV REITs Stay Cool

Investment banking firm Robert A. Stanger & Co., Inc., has published its third-quarter, non-listed real estate investment trust edition of The Stanger Report. The report includes REIT individual performance data, in-depth company profiles, and comprehensive insights on non-traded net asset value and lifecycle REITs.

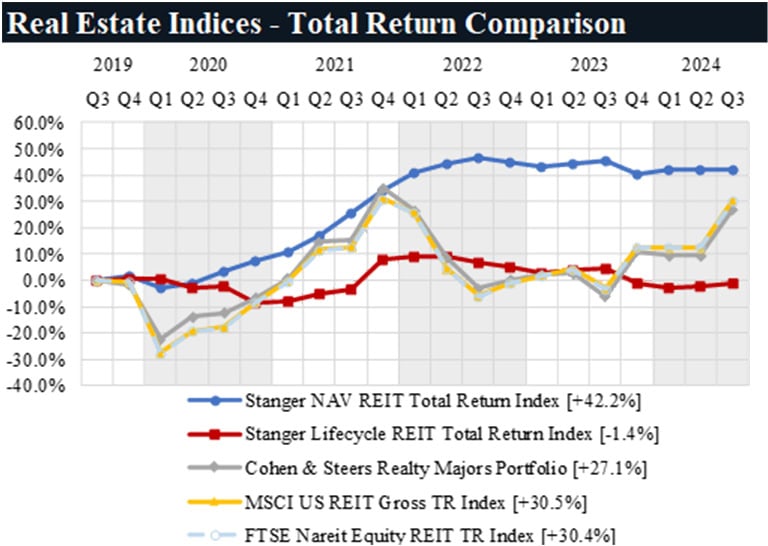

The Stanger NAV REIT Total Return Index remained flat in Q3 after beginning 2024 with two consecutive quarters of modest positive returns. NAV REITs saw a 1.7% decrease in their quarter-over-quarter total NAV, excluding those that transitioned to private NAV REITs during Q3 2024. In contrast, traded REIT indices outside of The DI Wire coverage focus experienced a robust summer rally, delivering a 16% gain in Q3 2024, according to Stanger.

The Stanger Lifecycle REIT Total Return Index posted its second consecutive quarter of positive returns, gaining 0.9% in Q3 2024.

“Traded REIT indices rallied 35% on average over the past 12 months through September 2024 while NAV REITs were down 2.4% over the same period,” said Kevin T. Gannon, chief executive officer and chairman of Stanger. “However, traded REIT indices are still down 2.2% on average from their five-year highs in Q4 2021, while NAV REITs have seen a 6% increase over the same period.”

Gannon continued: “Earlier this year, traded REITs’ discounts to NAV presented a compelling buying opportunity for investors, driving much of the recent uptick in values. Now that traded REITs have tightened the gap to analysts’ estimate of NAV, we would not expect the continued out-performance of traded REITs of the same magnitude we saw last quarter. Given that the rally in traded REITs still does not reflect a full recovery to their 2021 levels, we remain cautiously enthusiastic for what lower interest rates will mean for NAV REITs.”

- Cohen & Steers Income Opportunities REIT Inc. is off to a hot start, according to Stanger. The retail-focused NAV REIT debuted in The Stanger Reportthis quarter by topping the three-month total return chart at 3.2%.

- FS Credit Real Estate Income Trust Inc., a mortgage NAV REIT, retained its leading status in the one-year total return rankings for the third consecutive quarter while also taking over the top spot for three-year rankings.

- Blackstone Real Estate Income Trust Inc. continues to dominate the five-year return category.

- Among lifecycle REITs, Strategic Storage Trust VI emerged as the top performer over 12 months after striking its first NAV.

- Lightstone Value Plus REIT V, specializing in multifamily properties, ascended to the top of the three-year return rankings and maintained its leadership in five-year total returns.

There were no new public non-traded REIT registrations or entrants during Q3 2024. Both Ares NAV REITs commenced perpetual private offerings in Q3 2024 after previously closing their public primary offerings.

Robert A. Stanger & Co., Inc., founded in 1978, is an investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, real estate investment trusts, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations, and consolidations.