Bluerock Interval Fund Reports Record-Setting Monthly Return for July 2021

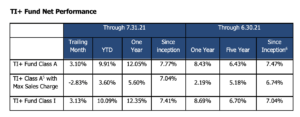

Bluerock Total Income+ Real Estate Fund, a closed-end interval fund (Tickers: TIPRX, TIPPX, TIPWX, TIPLX), has reported a record-setting monthly net return of 3.10 percent in July for its Class A shares (TIPRX) and 3.13 percent for its Class I shares (TIPWX).

Bluerock Total Income+ Real Estate Fund, a closed-end interval fund (Tickers: TIPRX, TIPPX, TIPWX, TIPLX), has reported a record-setting monthly net return of 3.10 percent in July for its Class A shares (TIPRX) and 3.13 percent for its Class I shares (TIPWX).

According to Bluerock, this is the “highest return compared to all other real estate sector interval funds for the month.”

The July 2021 return eclipses the fund’s prior monthly record of 2.68 percent for Class A shares set in January 2013. Bluerock reported that the July performance boosted the fund’s total returns from the trough of the pandemic in September 2020 to 12.84 percent (Class A shares) as of July 31, 2021, with a 95 percent up period percent (i.e. daily returns positive to neutral) over the same period.

“The fund’s performance spans multiple time periods with the fund’s [Class A] and [Class I] shares both reporting the highest total net returns in the trailing three-year and five-year periods among all active real estate sector interval funds through July 2021,” the company said, citing Morningstar Direct and IntervalFundTracker.com.

According to Bluerock, since inception in 2012 through July 2021, the fund’s Class A shares have generated shareholder net annualized returns of 7.77 percent and a 92.81 percent cumulative net return with positive net returns in each calendar year and all 12-month periods.

“The fund’s peer-leading performance is being driven in large part by continuous active management and investments in the sectors that are leading real estate returns, namely the industrial, life sciences, and multifamily sectors,” said Jeffrey Schwaber, chief executive officer of Bluerock Capital Markets. “Bluerock has a bullish long-term outlook on institutional private real estate for numerous reasons and in the short-term we note that post-recession periods have historically generated above average returns.”

*The inception dates of the Class A and Class I shares are October 22, 2012 and April 1, 2014, respectively. The maximum sales charge for Class A shares is 5.75 percent.

Net assets under management for the fund are approximately $2.9 billion as of July 31, 2021.

The Bluerock Total Income+ Real Estate Fund is a closed-end interval fund that invests the majority of its assets in institutional private equity real estate securities. As of the second quarter of 2021, the value of the underlying real estate held by the securities in which the fund is invested is approximately $239 billion, including investments managed by Ares, Blackstone, Morgan Stanley, Principal, Prudential, Clarion Partners, Invesco and RREEF, among others. The minimum investment is $2,500 ($1,000 for retirement plans) for Class A, Class C, and Class L shares.