Sponsored: Oil Prices are Heading Higher in 2022

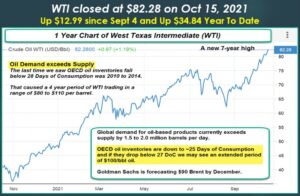

At the beginning of 2021, I estimated that the “right price“ for West Texas Intermediate (WTI) would be $65 per barrel in the post-pandemic world. Now I think the inflation-adjusted oil price will be at least $85 per barrel by year-end and may go over $100 per barrel by mid-2022.

First, let’s review why the price of oil collapsed in 2020 and rebounded to above the pre-pandemic so quickly.

- For a 4+ year period that ended mid-2014, WTI traded in a range of $80 to $110 per barrel. The high oil prices funded the U.S. shale boom that more than doubled U.S. oil production.

- In 2014, Saudi Arabia decided that U.S. shale was a threat to their control of the global oil market and that it was time for the OPEC cartel to regain market share. The cartel increased production, which drove oil prices down to $30 per barrel by early 2016. Ironically, the war over market share cost Saudi Arabia over $200 billion.

- In 2016, OPEC created an alliance with another group of oil producers led by Russia that is known today as “OPEC+.” The new, more powerful group curtailed production and stabilized the oil price. WTI quickly moved over $40 per barrel in 2017 and eventually over $70 per barrel in 2018.

- From mid-2018 through 2019, oil prices were impacted by the U.S. vs. China trade war, which ended late in 2019 with the “phase one agreement” between the world’s two largest oil consumers. WTI spiked to $65 per barrel in December 2019.

- In November 2019, U.S. oil production peaked at 12.86 million barrels per day.

- The critical point is that despite a reasonable oil price, U.S. oil production was actually on decline pre-pandemic, a sign to me that several of the significant oil-producing regions in the country might be rolling over. Today, the Permian Basin is the only U.S. oil-producing region with substantial production upside.

- When the pandemic reached the U.S. in the first quarter of 2020, WTI prices collapsed and dropped to $12 per barrel in the physical market, and even went negative in the NYMEX futures market.

- Upstream oil and gas companies worldwide shut-in production and slashed their drilling program. OPEC+ also quickly lowered their output. The price of WTI rebounded to $40 per barrel by June 2020 and back to near $50 per barrel by December 2020.

- As you can see in the chart below, WTI did move to my estimated “right price” by March 2021 before FEAR of the Delta variant caused a pullback.

I capitalize the word FEAR because now is an excellent time to tell you that commodity price movements based on fear never last. Oil prices eventually are determined by supply and demand fundaments, which brings us to why the price of WTI has moved over $80 per barrel, and why I think it will move over $100 per barrel within a few months.

Demand for all forms of energy is primarily driven by the Earth’s population, which has continued to increase even with Covid-19. In fact, the rate of population growth has not changed from where it was pre-pandemic. In 2021, the Earth’s population has grown by an average of 228,000 new humans per day to over 7.9 billion.

To confirm this for yourself, go to https://www.worldometers.info/world-population/

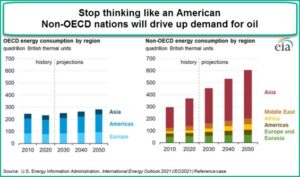

Until recently, there was a commonly believed paradigm that demand for oil had peaked and that renewable energy sources would rapidly replace hydrocarbon-based energy consumption. I can assure you that in the post-pandemic world, that will not happen unless humans significantly reduce having children and a high percentage of people are willing to have lower living standards.

More People = More Energy Demand

On October 6, 2021, the U.S. Energy Information Administration (EIA) published an update on their expected global energy consumption in 2050. Based on current laws and regulations, the EIA’s reference case concludes that global energy demand (from all sources) will increase by 50 percent from 2020 to 2050.

What surprised me was the EIA admitted that oil consumption would need to increase by 25 percent, and natural gas consumption would need to increase by 30 percent over the next 30 years.

Coal is the only hydrocarbon that might see a decline in consumption. I use the word “might” because I believe that the metals and other materials necessary for the 300 percent increase in renewable energy sources they forecast will become so expensive that they will stall the “aggressive growth” of wind and solar.

Find a summary of the new EIA report here:

https://www.eia.gov/todayinenergy/detail.php?id=49856

Oil Demand and Oil Prices will increase in 2022

- Global oil demand exceeds supply by more than 1.5 million barrels per day TODAY, which has pushed OECD oil and refined product inventories below 30 days of consumption.

- OECD inventories are the primary driver of oil prices, and the last time OECD inventories went below 28 days of supply (where they are today), WTI moved over $100 per barrel.

- OPEC+ is the only near-term source of more oil supply, and they are sticking to their plan to increase the world’s oil supply by 400,000 barrels per day each month until all of their spare capacity is gone by September 2022. More than half of the OPEC+ nations have already reached maximum production capacity.

- 2008 was the last time the OPEC cartel’s spare capacity dropped below 2.0 million barrels per day, and the price of WTI spiked to $147 per barrel. It should be noted that 2008 was before the U.S. shale oil boom and U.S. oil production was less than half of what it is today.

- Outside of OPEC+, due to lack of investment in exploration, few countries can increase oil production in 2022.

“The foundation for the upcoming oil crisis is now firmly set in place. Despite recent hiccups related to the delta variant, the world is re-opening, and global oil demand is recovering strongly. By the beginning of 2022, global oil demand should be making new highs. Non-OPEC oil supply has fallen by over 2 million barrels per day from its 2019 peak, and non-OPEC oil supply growth will turn negative as we progress through this decade. A structural gap will soon emerge between supply and demand. As early as the fourth quarter of 2022, demand will approach world oil-pumping capability — a first in 160 years of oil history. The ramifications will be huge and the investment implications monumental.” – Goehring & Rozencwajb Associates Natural Resource Investors

Adding fuel to the fire of this oil crisis is the situation in Europe, and to some extent, in Asia. A colder than average 2020-2021 Northern Hemisphere winter drained natural gas storage levels across both continents. Europe is heading into this winter with supplies of home heating fuels to low to make it through another colder than typical winter. The bidding war for fuel supplies has pushed liquified natural gas (LNG) prices in Europe to over $30 per barrel, which is the energy equivalent of more than $180 per barrel of heating oil. This is pushing up prices of oil, natural gas, and coal.

Europe shut down a lot of coal-fired and nuclear power plants to lower carbon emissions. They now realize they don’t have enough wind and solar generating facilities to replace the lost electricity. The International Energy Agency (IEA) based in Paris now forecasts that the crisis in Europe has prompted a switch from natural gas to heating oil that could boost oil demand by 500,000 barrels per day under normal weather conditions and over 750,000 barrels per day if we have a colder than typical winter like the last one. Maybe global warming isn’t so bad.

Conclusion

I have worked in the oil and gas industry for over 40 years. I have lived through many oil price cycles, but never one where the oil supply cannot meet demand. This is a “structural change” in the energy market that can only be fixed by a significant increase in the price of oil that will drive up investment in the exploration and development of new oil supplies. We need an “all of the above” energy plan, not anything close to the Green New Deal, which will never replace oil and gas.

I founded the Energy Prospectus Group in 2006 with the mission to help our members make wise investment choices that have the potential for market-beating results. Please visit this link for more information about what we do: https://energyprospectus.com/member-benefits/

If you would like to become a member of the #1 networking group for investors serious about making money in the energy sector, email me at energyprospectus@gmail.com.

APX Energy is a sponsor of The DI Wire, and the article was published as part of their standard directory sponsorship package.

The views and opinions expressed in the preceding article are those of the author and do not necessarily reflect the views of The DI Wire.