Sponsored: Inland Private Capital Weathers Economic Challenges to Provide Profits to Investors with Sale of Two Pre-Recession Office Holdings

Recognized as the leader in securitized 1031 exchange transactions, Inland Private Capital Corporation’s (“IPC” or “the Company”) recent sale of two office buildings highlights the Company’s unwavering dedication to its investors and ability to adapt to various market conditions.

In early October 2019, IPC announced the sale of a 377,332-square-foot Bank of America office building, located in the Hunt Valley submarket of Baltimore, Maryland. IPC, through its subsidiary which serves as asset manager, facilitated the sale on behalf of North Baltimore Office DST, one of its 1031 investment programs.

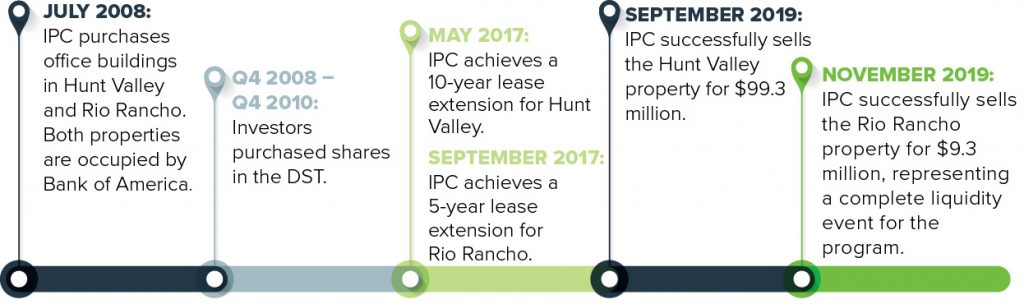

Constructed in 1974 and expanded in 1997, the Hunt Valley building represented IPC’s largest pre-recession investment holding in the corporate office sector. The Hunt Valley property was purchased in July 2008 and IPC managed the asset through the economic and real estate downturn of the Great Recession. In anticipation of the program’s liquidity event, the asset manager obtained a lease extension and completed a refinance and recapitalization in an effort to maximize value on behalf of investors.

“Several years ago, we began the implementation of our exit strategy with the Hunt Valley property by building up a substantial property reserve balance, while maintaining a consistent distribution throughout the hold period,” said Rahul Sehgal, chief investment officer of IPC. “Cash management of reserve dollars paid off during negotiations with Bank of America, as we were able to secure a 10-year lease extension which included a parking lot expansion project to construct an additional 550 spaces at the property. The vast majority of the tenant improvement dollars were funded by reserves, avoiding the need for a capital call from investors.”

Shortly thereafter, in late November, IPC announced the sale of its leasehold interest in a 76,768-square-foot Bank of America office property located in Rio Rancho, New Mexico, approximately 10 miles northwest of Albuquerque. IPC, through its subsidiary which serves as asset manager, facilitated the sale on behalf of North Albuquerque Office DST, one of its 1031 investment programs. The sales do not impact the current business operations of Bank of America, the tenant at the properties.

Both properties were purchased before the Great Recession amid rising concerns within the office sector due to technology advancements and space optimization. However, IPC remained persistent and diligent, relying on its expertise in weathering a variety of economic and real estate cycles over the years. Through IPC’s efforts, the Company was able to meet its goal of extending the leases for both properties and creating a financing structure with flexible terms that allowed for the sales of the assets.

IPC’s commitment to these assets resulted in interest from multiple buyers.

“This program is an excellent example of IPC’s commitment and determination to provide successful full-cycle transactions to its investors,” said Keith Lampi, president and chief operating officer of IPC. “IPC overcame many challenges with these two assets – the year of acquisition, challenges within the suburban office sector and complexities surrounding the DST structure – but we strived to build up our reserve accounts and stayed proactive with our management, which ultimately led to consistent income and a substantial profit on the sales. Our ability to monetize both properties at a profitable level makes the overall performance of these programs pretty remarkable.”

The Rio Rancho and Hunt Valley properties were offered to investors by RR-HV Venture Holdings DST for a fully loaded offering price of $97.42 million. The Rio Rancho property was sold for $9 million, and the Hunt Valley property was sold for $99.3 million, for a total program sales price of $108.3 million, which represents a complete liquidity event.

The investment program provided a 7.63 percent average annualized return to investors, and the sales resulted in a total return to the investors of 184.42 percent (calculated based on the aggregate amount of original capital invested in the properties).

For more Inland Private Capital Corporation news, please visit their directory page.

Inland Private Capital Corporation is a sponsor of The DI Wire, and the article was published as part of their standard directory sponsorship package.