Sponsored: ErisX Enables Crypto Investing for Self-Directed IRAs

By: John Denza, Chief Commercial Officer at ErisX

ErisX enables self-directed individual retirement accounts to invest in crypto assets, expanding options for IRA portfolio diversification. Self-directed IRAs are administered solely at the discretion of the account owner and disbursement of the funds are managed with IRA custodians.

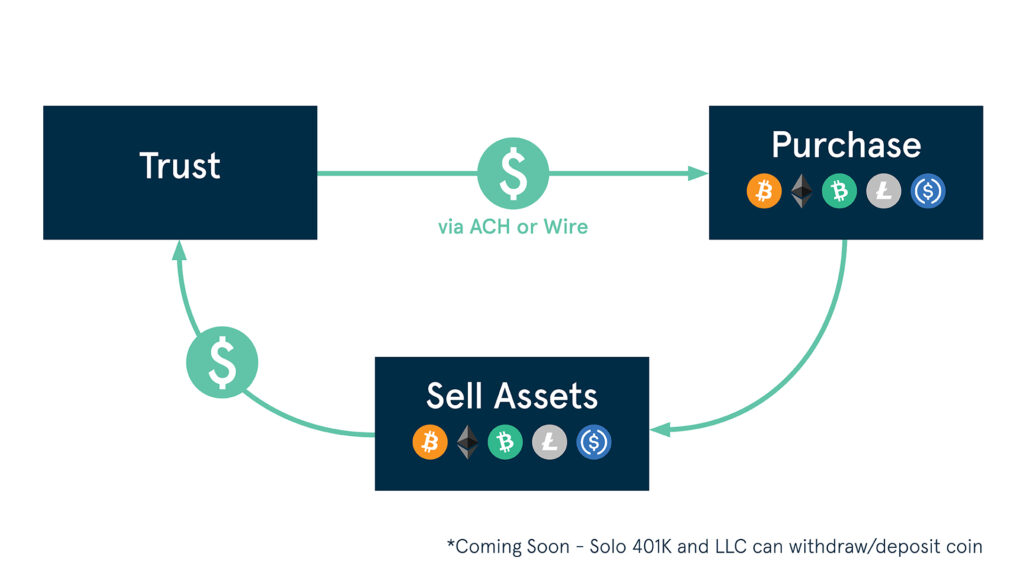

ErisX partners with IRA trusts to implement a closed loop system whereby funds are deposited into ErisX Accounts from an originating IRA trust and then withdrawn to the same originating IRA trust. Coins held in a self-directed IRA trust cannot be withdrawn to an external account/wallet at this time*. Proceeds generated by coin positions that are liquidated to fiat must be withdrawn to the originating IRA trust.

The ErisX Heritage is rooted in institutional products and services.

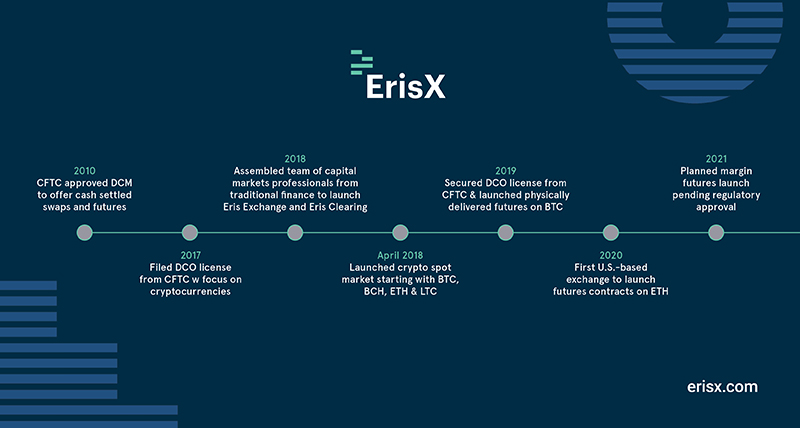

In 2018, a team of capital markets professionals from traditional finance set out to apply their experience to launch a new exchange. The ErisX brand was created to encompass the cryptocurrency spot and derivatives businesses of Eris Exchange and Eris Clearing.

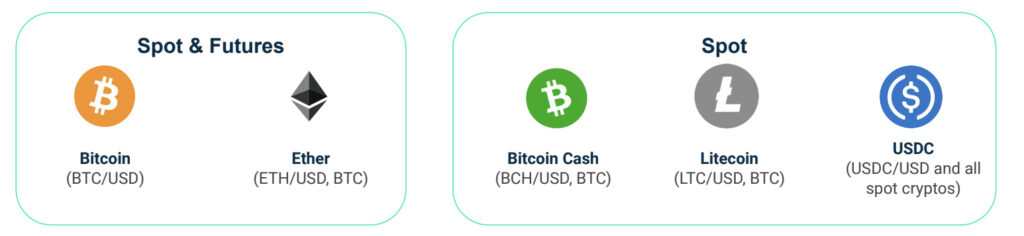

ErisX launched a cryptocurrency spot market in April 2019 with Bitcoin, Bitcoin Cash, Ether and Litecoin. The spot exchange has expanded support to include the stablecoin USDC with additional coins planned for the second half of 2021.

ErisX added a Derivatives Clearing Organization (DCO) clearinghouse license from the CFTC to its existing Designated Contract Market (DCM) exchange license in July 2019 and in December of that year launched physically delivered futures on Bitcoin. The first U.S. based exchange to launch futures contracts on Ether in May 2020, ErisX has expanded its listings to include cash settled Bounded Futures on Bitcoin and Ether. Margin futures are planned for H2 2021, pending regulatory approval.

Oversight, Safety and Controls to Protect Customer Assets

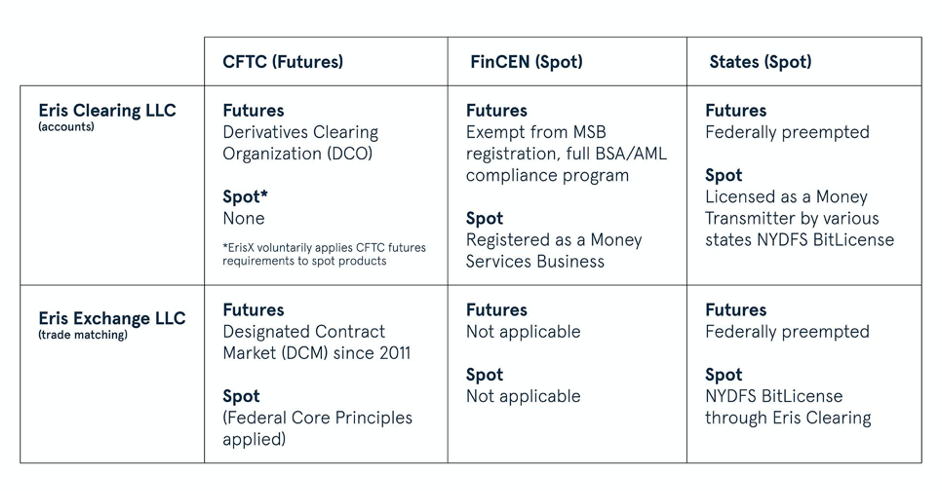

To protect member funds and assets, Eris Clearing is obligated to completely segregate customer assets from its own assets by holding them in a designated bank or custodial account, separate from the funds of ErisX, and for the benefit of our Members. This is required by CFTC regulations for futures trading and state requirements related to Money Transmitter Licenses (MTL) and Money Service Business (MSB) licenses.

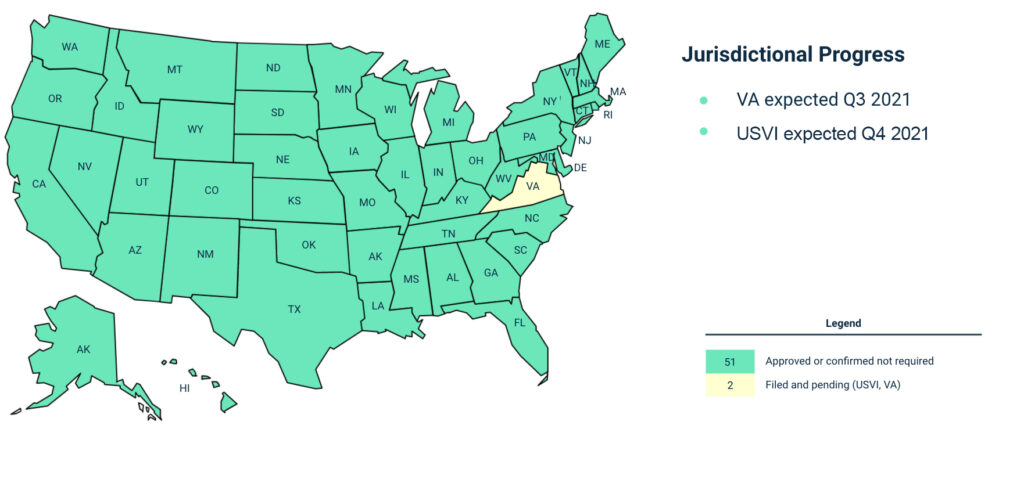

While the CFTC has oversight of our futures market, our spot market is regulated by the Financial Crimes Enforcement Network (FinCEN) via a MSB license and at the state level by Money Transmitter License MTL designations. ErisX has secured MTLs or authorizations in 51 states and territories. In addition to the MTL in New York State, ErisX secured the New York Virtual Currency “Bitlicense”.

Required under these licenses, ErisX must maintain surety bonds, conduct quarterly reporting, and is subject to individual state examinations.

Trading Interfaces

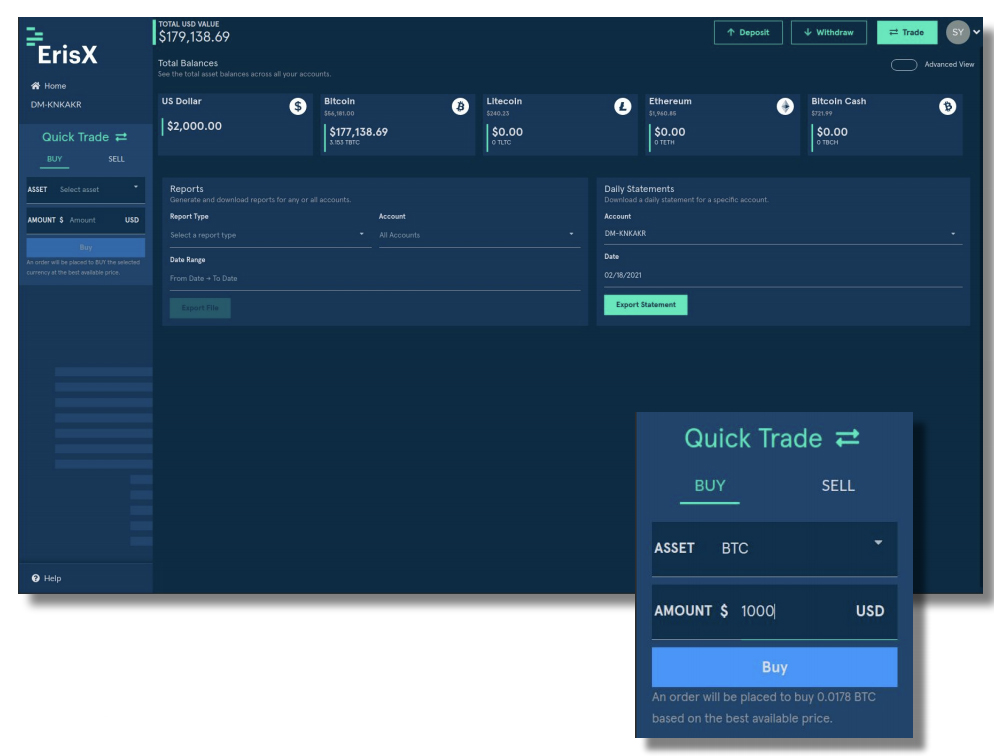

Members can access their account through the ErisX Member Portal which includes a Quick Trade widget which is always visible as well as convenient navigation to deposit/withdrawal screens.

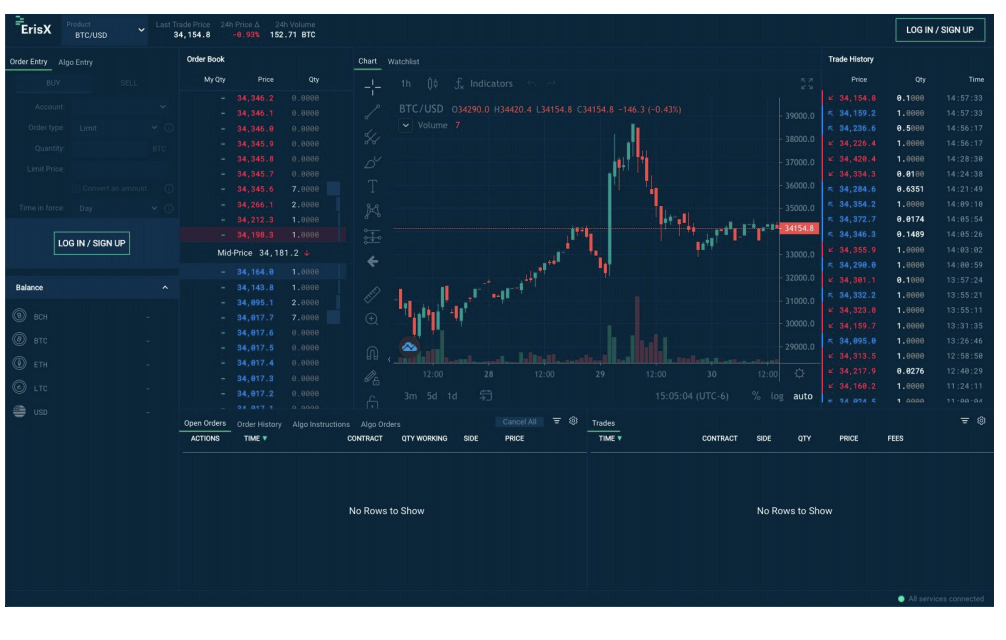

The ErisX Trading User Interface includes advanced trading tools for the trader looking to take greater control of their orders.

Key features include:

- Ability to click on the order book to populate the order price

- Ready-to-use algorithmic order types to help navigate fast moving markets

- Filters to help refine and customize displayed information

- Dollar value order submission with our convert feature

- Advanced users can place orders via our REST/Websocket APIs and can also view and take action on those orders via API or through the trading user interface screen

The ErisX Team

The ErisX team has decades of collective experience at global capital markets firms including exchanges, buy side and sell side firms, and has a deep understanding of market structure, high performance trading systems and operations.

ErisX is proud to have built a modern and advanced matching engine and clearing system and offer a 24/7 non-stop operation. Our customer service desk and FAQs are available to help answer your questions.

The ErisX onboarding process has a quick turnaround. When all KYC documents are provided, entities are typically approved within 5 business days or less and individual Direct Members can be approved within 24 hours.

Crypto for Self-Directed IRAs

ErisX supports a variety of ways to invest in crypto via self-directed IRA accounts. Investors can open an account as a direct member or work with one of our participating providers. For more information visit www.erisx.com.

ErisX Futures are offered through Eris Exchange, LLC, a Commodity Futures Trading Commission (CFTC) registered Designated Contract Market (DCM) and Eris Clearing, LLC, a registered Derivatives Clearing Organization (DCO). The CFTC does not have regulatory oversight authority over virtual currency products including spot market trading of virtual currencies. ErisX Spot Market is not licensed, approved or registered with the CFTC and transactions on the ErisX Spot Market are not subject to CFTC rules, regulations or regulatory oversight. ErisX Spot Market may be subject to certain state licensing requirements and operates in NY pursuant to Eris Clearing’s license to engage in virtual currency business activity by the New York State Department of Financial Services. For more information https://www.erisx.com/disclaimer/.

Click here to visit The DI Wire directory page.

The views and opinions expressed in the preceding article are those of the author and do not necessarily reflect the views of The DI Wire.