SEC Charges EIA All Weather Alpha Fund with Fraud

The Securities and Exchange Commission has charged EIA All Weather Alpha Fund I and its owner with misuse of investor funds.

The Securities and Exchange Commission has charged Detroit-based EIA All Weather Alpha Fund I Partners LLC (EIA) and its sole owner, Andrew M. Middlebrooks with fraud. The charges indicate that the fund allegedly engaged in a multi-year scheme that included the misappropriation and misuse of investors’ funds.

On May 19, 2022, the SEC obtained emergency relief from the U.S. District Court in the Eastern District of Michigan to halt the $39 million fraud. The relief includes a temporary restraining order against EIA and Middlebrooks and an asset freeze against the defendants and named relief defendants.

The SEC filed its complaint in the Eastern District of Michigan. The complaint charges EIA and Middlebrooks with violating the antifraud provisions of the federal securities laws and further charges Middlebrooks with aiding and abetting EIA’s violations of the Investment Advisers Act of 1940.

The complaint alleges that from at least mid-2017 to April 2022, EIA and Middlebrooks deceived investors in their hedge fund, EIA All Weather Alpha Fund I LP, including by making repeated false statements about the fund’s performance and total assets; providing falsified investor account statements; misrepresenting that the fund had an auditor; and creating and disseminating a fake audit opinion to investors.

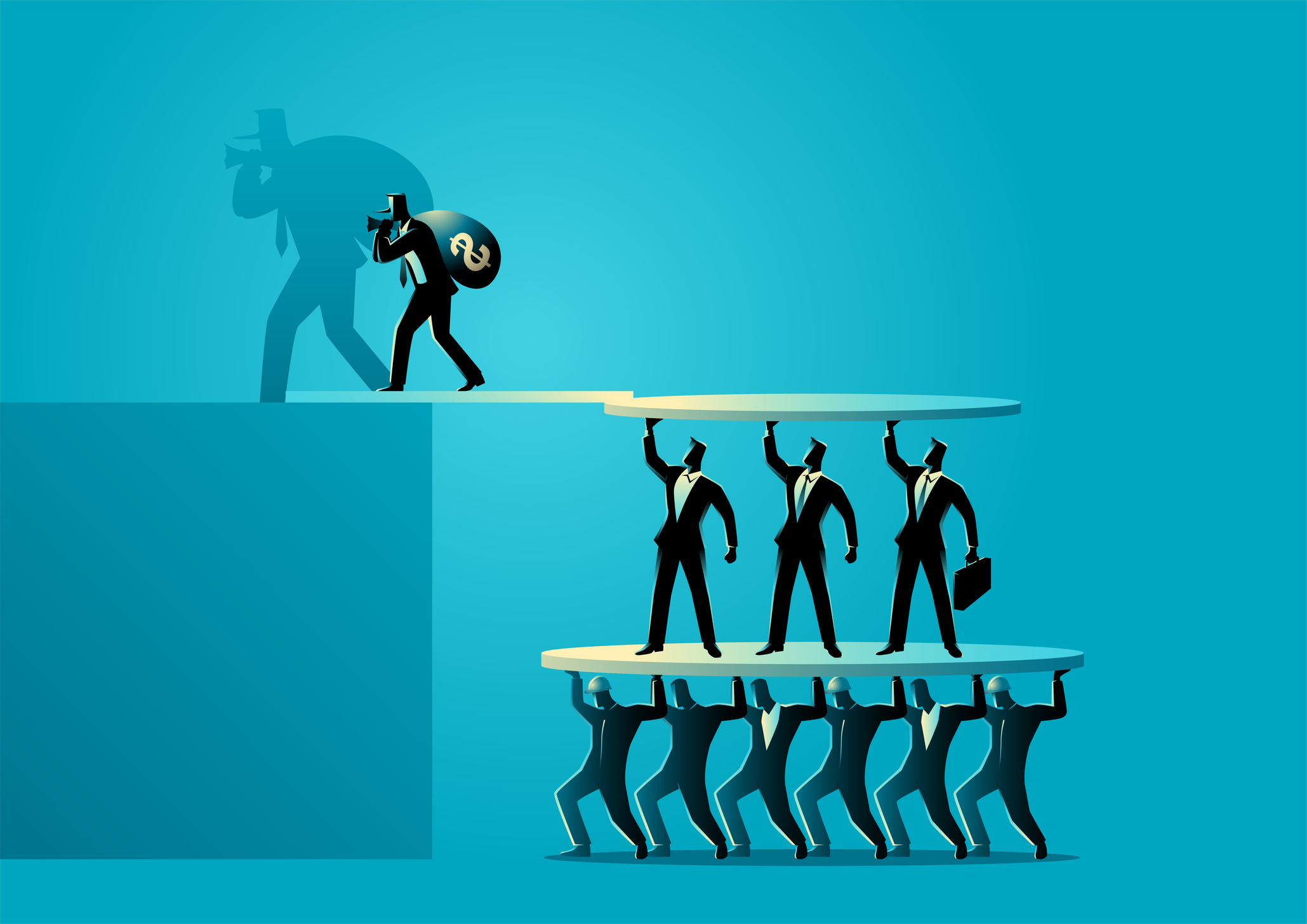

The SEC also alleges that EIA and Middlebrooks misused new investor money to make Ponzi-like payments to other investors in the fund to continue deceiving investors into believing that the fund was profitable. According to the complaint, Middlebrooks also misappropriated investor funds for personal use. The SEC is seeking injunctions, disgorgement of ill-gotten gains with prejudgment interest, and financial penalties against EIA and Middlebrooks. EIA All Weather Alpha Fund I LP, EIA All Weather Fund Partners II LLC, and Shop Style Shark LLC are also listed as relief defendants.

“As we allege in the complaint, Middlebrooks lured investors by touting extraordinary performance returns and then concealed the truth of his fraud, including by fabricating documents provided to investors,” said C. Dabney O’Riordan, co-chief of the SEC’s Asset Management Unit, Division of Enforcement.