RCAP Downgraded by Moody’s

RCS Capital Corporation (NYSE: RCAP) (RCAP), an investment firm that owns independent broker-dealer network Cetera Financial Group and wholesale distributors of non-traded direct investments SC Distributors, LLC and Realty Capital Securities, LLC, was recently downgraded by Moody’s Investors Service.

Moody’s rating actions are as follows:

- Corporate family rating, downgraded to B3 from B2 on Review for Downgrade

- $575 million senior secured first lien term loan, downgraded to B3 from B2 on Review for Downgrade

- $25 million senior secured first lien revolving credit facility, downgraded to B3 from B2 on Review for Downgrade

- $150 million senior secured second lien term loan, downgraded to Caa2 from Caa1 on Review for Downgrade

- Outlook, negative

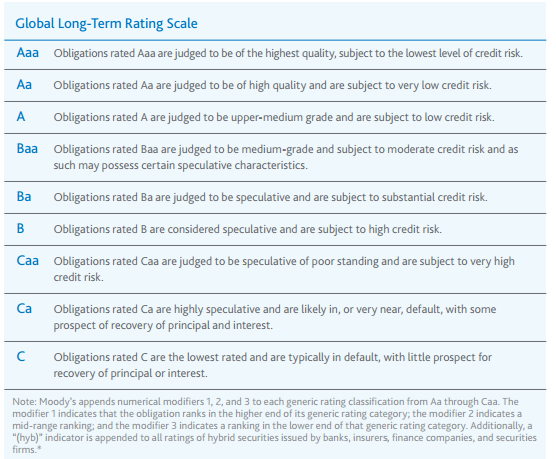

Here is a chart explaining Moody’s rating system:

The ratings agency, in its report, explains, “The adverse repercussions from the accounting and reporting issues at American Realty Capital Properties, Inc. (ARCP) on RCS’ wholesale distribution business, together with a recent slowdown in non-traded REIT transactions and liquidity events, heightens the risk of RCS potentially breaching its debt financial covenants during 2015.”

ARCP and RCAP are unaffiliated entities, however, share common roots and ownership.

Moody’s also has concerns that the various regulatory investigations and lawsuits reported by ARCP’s audit committee on March 2, 2015 could lead to negative publicity and decrease business for RCAP and affiliates, including the wholesale distribution and capital markets advisory businesses.

However, just yesterday, RCAP reported that its wholesale distribution business increased its equity raise for the fifth month in a row in March, surpassing February’s total by 47 percent.

Moody’s also has concerns over RCAP’s ability to successfully transition the recently closed acquisitions of independent broker-dealers (IBD) into Cetera Financial Group, its IBD network. However, the agency noted that Q4 2014 results demonstrated a marginal downturn and advisor retention has remained high, plus synergy benefits are expected in 2015.

For RCAP to earn a higher rating from Moody’s, the agency wants to see the newly acquired IBDs integrated successfully, improved operating results, and efficiencies and savings from planned synergies. Continued growth and diversification of the wholesale distribution business plus its capital markets operations would also be a positive.