Non-Traded REIT Fundraising Plummets to $310 Million in April 2020

Sales of non-traded REITs declined to $310 million in April 2020, compared to $780 million in March 2020 and $2.5 billion in February and January, reflecting a major pullback of capital placement into alternative investment real estate, according to investment bank Robert A. Stanger & Company.

Sales of non-traded REITs declined to $310 million in April 2020, compared to $780 million in March 2020 and $2.5 billion in February and January, reflecting a major pullback of capital placement into alternative investment real estate, according to investment bank Robert A. Stanger & Company.

“While we consider this curtailment in capital formation an intelligent reaction to the healthcare crisis, we expect it to subside with a recommencement of real estate capital formation in coming months as the impact of the pandemic subsides and state economies reopen,” said Kevin T. Gannon, chairman and CEO of Stanger. “Investors will once again be drawn to the stable performance of non-listed REITs, NAV REITs in particular, that have continued to outperform listed REITs throughout this pandemic.”

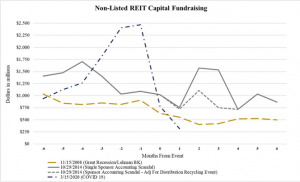

Stanger claims that non-traded REITs are following a theme park projection model exhibited following previous major events effecting the market. Fundraising took a precipitous decline after the great recession in 2008, and again after the announcement of accounting irregularities at American Realty Capital Properties, a major non-traded REIT sponsor, in 2014. The graph below follows fundraising beginning 6 months before each event, through the decline and subsequent leveling off of fundraising in the 6 months after each event.

“We expect capital formation to recover and challenge the previous pre-January/February 2020 monthly run rate of $1.2 billion by 2021,” according to Gannon.

Blackstone Group continues to lead 2020 fundraising with $4.3 billion, followed by Black Creek Group with $704 million in sales ($657 million in lifecycle and $46 million in NAV REIT sales), aided by the recycling of distributions from its liquidation of Industrial Property Trust. Starwood Capital Group raised $374 million, followed by LaSalle Investment Management ($172 million) and Hines Interest ($115 million).

Stanger’s survey of top sponsors of alternative investments revealed $10.6 billion in funds raised year-to-date through April 2020 via the retail pipeline. Alternative investments included in the survey are publicly registered non-traded REITs, non-traded business development companies, interval funds, non-traded preferred stock of traded REITs, as well as Delaware statutory trusts, opportunity zone and other private placement offerings.

The top alternative investment sponsors identified by Stanger are Blackstone Group ($4.36 billion), Black Creek Group ($839 million), Griffin Capital ($568 million), Bluerock Capital ($434 million), Owl Rock Capital ($395 million), Starwood Capital ($374 million), Inland Real Estate ($292 million), LaSalle Investment Management ($195 million), CION Investments ($185 million) and GWG Holdings ($164 million).

Robert A. Stanger & Co., Inc., founded in 1978, is a national investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, REITs and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations and consolidations.