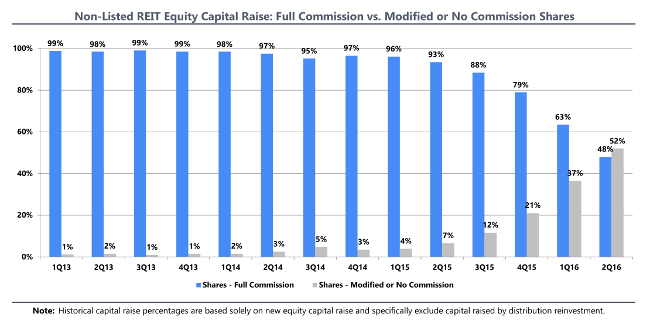

No- and Low-Commission NTR Shares Outsell Full Commission Shares for the First Time in 2Q16

Non-listed REITs reached a milestone in the second quarter with sales of modified commission shares surpassing full-load shares for the first time ever, according to the Non-Listed REIT Equity Capital Raise report issued by Summit Investment Research.

During the second quarter, modified commission shares such as class T shares, and no commission shares such as class I shares, represented a record 52 percent of non-traded REIT equity raised. Last quarter, Summit predicted that full commission class A shares would eventually lose the top spot in 2016, as modified and no commission share classes become the industry standard in response to the regulatory changes under FINRA 15-02.

From 2013 through the first quarter of 2015, the sale of modified commission shares or no commission shares was limited to daily NAV non-traded REITs, which struggled to gain any significant traction in the market. The implementation of FINRA 15-02 has been a primary driver for the rapid rise of equity sales for the low- and no-load shares.

Summit points to three trends driving the increase in sales over the last three quarters. First, Jones Lang LaSalle Income Property Trust, a daily NAV non-traded REIT, gained increasing market share and established itself as the leader among daily NAV non-traded REITs that offer a variety of modified commission or no commission share classes.

Second, most new non-traded REITs now offer class A shares and class T shares. Class T share commission structures vary, but they generally have a lower 2-3 percent upfront commission with a capped commission trail. The ratio of sales between class A and class T shares varies significantly, but recent trends point to higher percentages of class T shares in the future. However, Summit noted that this specific dual share class structure has inherent conflicts of interest that should result in future changes that could mean the death of the class A share for non-traded REITs.

Third, certain REITs are only offering Class T shares. Griffin Essential Asset REIT II established itself as a market leader with its transition to only offering Class T shares back in November 2015.

Summit predicts that modified and no commission share classes will continue to increase their market share in the future.

Summit Investment Research has been active since April 2016 and covers non-traded REITs, business development companies, interval funds, and listed REITs (that acquired non-traded REITs or were once non-traded). The company’s research can be utilized by a variety of industry clients including financial advisors, registered investment advisors, broker-dealers, sponsors, service providers like law firms, due diligence firms, industry organizations, and news organizations, and institutions.