NAV REITs Post Cumulative 64% Total Return Over Past 5 Years

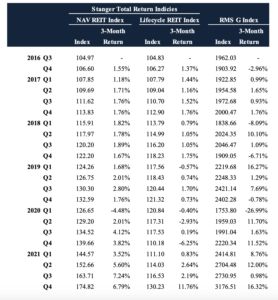

Non-traded net asset value real estate investment trusts posted a 6.79 percent return for the fourth quarter of 2021, as measured by the Stanger NAV REIT Total Return Index.

Non-traded net asset value real estate investment trusts posted a 6.79 percent return for the fourth quarter of 2021, as measured by the Stanger NAV REIT Total Return Index.

According to investment banking firm Robert A. Stanger & Co, the index took a moderate dip in early 2020, recovered to its pre-pandemic level during the third quarter of 2020, and has continued to rise steadily.

Stanger noted that non-traded NAV REITs returns approximated those of their traded counterparts with a cumulative total return of 64 percent over the last 60 months.

The momentum of the MSCI US REIT Index Gross Total Return, a measure of performance of publicly traded REITs, slowed in the third quarter with a 0.98 percent total return, and increased to 16.32 percent in the fourth quarter. Over the last 60 months, the total return of this broader REIT market index was 66.8 percent.

According to Stanger, the graph below illustrates the impact that stock market volatility plays in listed REIT values relative to non-traded REITs.

“This performance highlights the benefits of a non-listed NAV REIT vehicle, that historically has provided a mostly steady real estate-based return without the extreme ongoing volatility of the traded market,” said Kevin Gannon, chairman and chief executive officer. “This strong performance is the driving force behind $36.5 billion of NAV REIT fundraising in 2021, and we expect this trend to continue in 2022.”

The IPA/Stanger Monitor tracks the individual performance of 40 non-traded REITs with a combined market capitalization of more than $89 billion. The data revealed that over the last 12 months, the top performing non-traded NAV REIT was Cottonwood Communities (Class A at 78.16 percent), and the top performing traditional lifecycle REIT was Resource REIT (67.27 percent).

Over a five-year period, the top performing NAV REIT was Hines Global Income Trust (Class AX at 10.21 percent annualized), and the top performing traditional REIT was Resource REIT (15.62 percent – annualized).

The IPA/Stanger Monitor, which is sponsored by the Institute for Portfolio Alternatives and authored and published by Stanger, also covers 12 non-traded business development companies, with a combined market capitalization of $15 billion.

Founded in 1978, Robert A. Stanger & Co. Inc. is a national investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, REITs, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations and consolidations.