Independent Broker-Dealers and RIAs Expect Higher Revenues in 2019

ADISA, a trade association representing the retail alternative investment space, has released the results of its inaugural market prediction survey, which was conducted with the participation of due diligence officers from dozens of independent broker-dealer and registered investment advisor firms.

ADISA, a trade association representing the retail alternative investment space, has released the results of its inaugural market prediction survey, which was conducted with the participation of due diligence officers from dozens of independent broker-dealer and registered investment advisor firms.

Results of ADISA’s survey indicate that all but 6 percent of due diligence officers predict an increase in revenue at independent broker-dealer and RIA firms during 2019, with more than 30 percent of respondents expecting growth of more than 20 percent.

Additionally, ADISA said that more than 90 percent of respondents expect their firm to expand the use of alternative investments in 2019.

“The results of ADISA’s inaugural market prediction survey are compelling and provide beneficial insight as well as a statistical representation of what alternative investment products are held by independent broker-dealer and RIA firms,” said ADISA executive director and CEO John Harrison. “ADISA will conduct its market prediction survey at the beginning of each year, and we look forward to sharing next year’s results with industry constituents in 2020.”

Survey respondents indicated the following sales projections by product type for 2019:

Approximately half of respondents predict that REIT preferred stock offerings will have an increase in sales.

Roughly 40 percent of respondents predict more than a 10 percent increase in tax-advantaged fund sales.

Approximately 20 percent of respondents predict an increase of less than 10 percent in opportunity zone fund sales, and another 20 percent predict growth of more than 10 percent.

Private equity and private debt sales are projected to increase approximately 10 percent.

Closed-end funds and interval funds are expected to have a moderate increase in sales, projected at approximately 9 percent.

Oil and gas, non-traded REITs, infrastructure, hedge funds and asset lending/leasing programs are all expected to remain relatively flat.

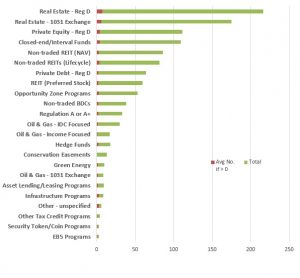

Through calculating the number of programs actively held in total by respondents, ADISA noted that they could measure the popularity of the various types of alternative products.

Through calculating the number of programs actively held in total by respondents, ADISA noted that they could measure the popularity of the various types of alternative products.

Real estate – Reg D programs were the most popular, with respondents holding an average of approximately eight programs on their platforms. Section 1031 exchange offerings were the second most common, with private equity – Reg D and closed-end/interval funds succeeding them.

ADISA also surveyed if respondents would “definitely allow” fee-based investments into client accounts. Approximately 80 percent of respondents would definitely allow NAV non-traded REIT, preferred stock non-traded REIT, lifecycle non-traded REIT, private debt (Reg. D), non-traded BDC and private equity (Reg. D) programs.

Approximately 60 percent of respondents would definitely allow hedge funds, Section 1031 exchange offerings and infrastructure programs. Fewer than 50 percent would definitely allow energy, asset lending/leasing, opportunity zone, conservation easement and cyber coin programs.

The Alternative & Direct Investment Securities Association bills itself as the nation’s largest trade association representing the non‐traded alternative investment space. ADISA’s members are typically involved in non-traded real estate investment trusts, business development companies, master limited partnerships and private and public funds (LPs/LLCs), 1031 exchange programs (DSTs/TICs), energy and oil and gas interests, equipment leasing programs, or other alternative and direct investment offerings.

The association was founded in 2003 and has approximately 4,000 members, representing more than 220,000 professionals throughout the nation – including sponsor members who have raised in excess of $200 billion in equity and serve more than 1 million investors.