GWG Announces Interest Rate Changes to L Bond Offering

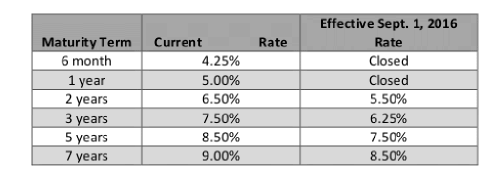

GWG Holdings Inc. (Nasdaq:GWGH), a specialty finance company and purchaser in the life insurance secondary market, released new rates for its L bond offering. In addition, the company will be closing the sale of its short-term L bond debt (maturities of one year or less). The changes will take effect September 1, 2016.

“Many investors are seeking alternative, non-correlated, yield-based investment products – and we are proud that GWG’s L Bond will continue to meet that need,” said chief executive officer Jon Sabes. “The interest rates we offer for the L bond are highly competitive, making the offering a compelling investment opportunity amid challenging market conditions.”

“By lengthening the duration of our financing, GWG is creating a more stable balance sheet that benefits all of our stakeholders,” said chief financial officer Bill Acheson. “Furthermore, the rate changes on the L bond reflect the positive growth and maturation of GWG overall and specifically our portfolio of life insurance which indirectly supports our investment offerings.”

As of March 31, 2016, GWG’s portfolio consisted of more than $1 billion in face value of benefits. Since 2006, GWG has purchased nearly $2 billion in life insurance policy benefits and paid seniors more than $335 million for their policies.

For more GWG related news, please visit their directory page.