Equipment Leasing Fund Updates Advisors on Asset Sales

ICON Leasing Fund Twelve, LLC (ICON Twelve), an equipment leasing fund managed by ICON Capital, LLC, recently notified registered representatives of its most recent portfolio update for the period ending January 31, 2015.

The fund raised about $350 million in equity capital from May 2007 through the end of April 2009 and began its liquidation period in May 2014.

ICON Twelve may dispose of assets or allow investments to complete lease terms during the liquidation period. The fund may also elect to invest in new opportunities if deemed to be beneficial to investors, according to the update. Proceeds from the sale of assets or receipt of rental, finance, or other income will be distributed to shareholders.

During the second half of 2014, ICON Twelve invested in four new assets:

- A loan with a maturity date of 8/27/2019 secured by two platform supply vessels valued at $61 million. The fund’s participation is $21,750,000.

- A lease with an expiration date of 9/30/2017 of mining equipment valued at $6,790,000 to Murray Energy Corporation. The fund’s investment is $3,790,000.

- A loan with a maturity date of 09/24/2020 to Premier Trailer Leasing, Inc., secured by trailers valued at over $272 million. The fund lent $10 million of the $20 million credit facility.

- A loan with a maturity date of 11/13/2017 to NARL Marketing, Inc. secured by a network of bulk fuel storage terminals and gas stations with convenience stores and included fueling equipment, storage tanks, and real estate. ICON Twelve lent $12 million of the $15 million credit facility.

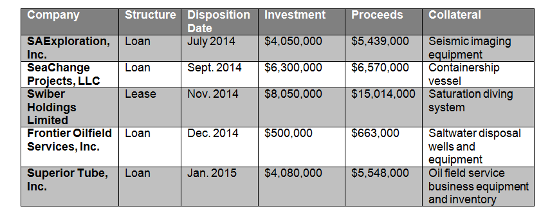

The fund has been busy disposing of assets too, many for more than its original investment as seen in the chart below:

ICON Twelve’s remaining portfolio consists of about 18 other similar investments. To see the fund’s entire portfolio update, click here.