Capital Square 1031 Buys Amazon Distribution Facility for DST Offering

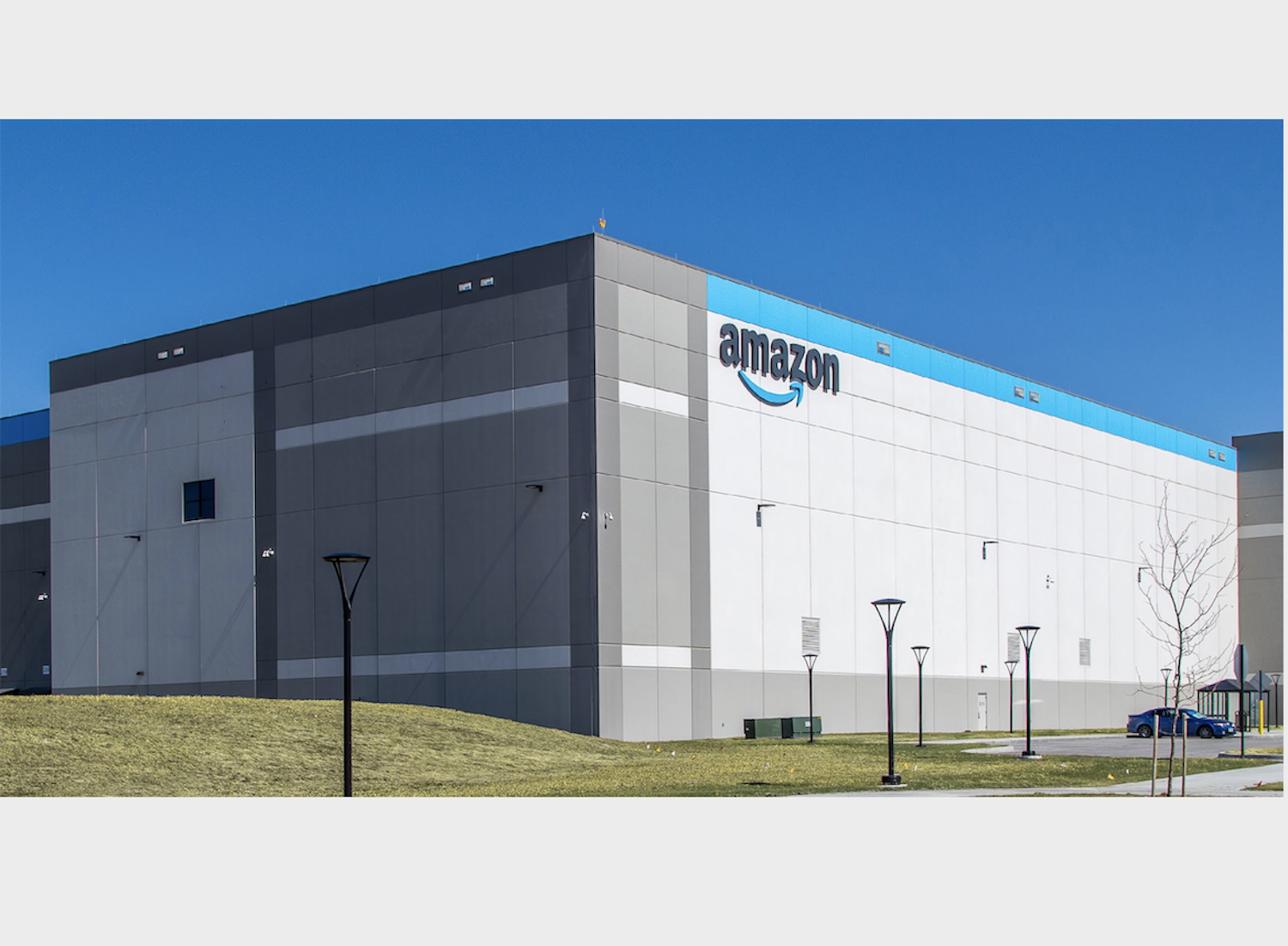

Capital Square 1031, a sponsor of Delaware statutory trust offerings, has purchased a 2.7 million-square-foot distribution facility located in Iowa and leased to Amazon.com.

Capital Square 1031, a sponsor of Delaware statutory trust offerings, has purchased a 2.7 million-square-foot distribution facility located in Iowa and leased to Amazon.com Inc. (Nasdaq: AMZN).

The facility was purchased on behalf of CS1031 Zero Coupon Fulfillment Center DST, a private placement offering that seeks to raise $52.2 million in equity from accredited investors.

The 169.6-acre property is adjacent to U.S. Route 65 and Interstate 80 in Bondurant, Iowa, an industrial submarket in Greater Des Moines. The four-story structure was completed in the fourth quarter of 2020.

According to Capital Square, the building was designed by Amazon “with the most recent technological advances and high-grade materials” and can process nearly one million packages per day by implementing both robotics and human labor to maximize efficiencies.

The property is leased on an absolute net basis and is guaranteed by Amazon, which has an investment-grade credit rating of AA from by Standard & Poors.

“Structured to be highly tax efficient, this acquisition includes a dual loan system that shields investors from phantom income,” said Whitson Huffman, chief strategy and investment officer. “The lease also enjoys unsurpassed creditworthiness from the full guaranty of Amazon and its investment-grade corporate credit.”

As of February 2022, Amazon ranked as the world’s fifth largest company by market capitalization, and the fourth largest in the United States at nearly $1.52 trillion.

Capital Square acquired the property from Mesirow Realty Sale-Leaseback Inc.

Capital Square is a national real estate firm specializing in tax-advantaged real estate investments, including Delaware statutory trusts for Section 1031 exchanges and qualified opportunity zone funds for tax deferral and exclusion. Since 2012, Capital Square has completed more than $4.9 billion in transaction volume. The firm’s related entities provide a range of services, including due diligence, acquisition, loan sourcing, property/asset management, and disposition, for high net worth investors, private equity firms, family offices and institutional investors.

For more Capital Square news, please visit their directory page.