Bluerock’s Interval Fund Reports $3 Billion in AUM, New Record Equity Raise for September

Bluerock Total Income+ Real Estate Fund, a closed-end interval fund, has reportedly surpassed $3 billion in net assets under management in September.

Bluerock Total Income+ Real Estate Fund, a closed-end interval fund, has reported that it surpassed $3 billion in net assets under management in September. The fund also set a monthly record for new equity capital in September with nearly $128.7 million raised, following its previous monthly record of $121.3 million in August.

According to Bluerock, the fund posted record-setting monthly shareholder returns in August of 3.10 percent for its Class A shares (TIPRX) and 3.13 percent for Class I shares (TIPWX).

“The fund reported leading risk-adjusted performance generating the highest Sharpe and Sortino Ratios (key risk-adjusted return metrics) of all 6,200+ domestic ‘40 Act funds in the trailing three-year, five-year, and since inception time periods as of August 31, 2021,” the company said, citing Morningstar Direct data.

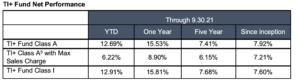

Since inception in 2012 through September 2021, the fund had annualized net returns of 7.92 percent and a 97.68 percent cumulative net return for Class A shares with positive net returns in each calendar year and all 12-month periods, Bluerock said.

Bluerock added that from the trough of the pandemic in September 2020, the fund’s total net returns to shareholders was 15.43 percent for Class A shares as of September 30, 2021, with a 95 percent up period percent (i.e. daily returns positive to neutral) with a 1.68 percent standard deviation over the same period.

The fund paid its 35th consecutive quarterly distribution in September bringing total distributions to approximately $13 per share to its shareholders since inception (Class A shares), or approximately 52 percent on the $25 per share inception share price.

Adam Lotterman, co-chief investment officer of Bluerock Fund Advisor, said they maintain a bullish outlook for institutional real estate, particularly in the industrial, apartment, and life sciences sectors, which comprise approximately 85 percent of the fund’s investments.

The maximum sales charge for the Class A shares is 5.75 percent. The fund’s inception date is October 22, 2012, and the inception date of Class I shares is April 1, 2014.

The Bluerock Total Income+ Real Estate Fund (Tickers: TIPRX, TIPPX, TIPWX, TIPLX) invests the majority of its assets in institutional private equity real estate securities. Net assets under management totaled approximately $3.06 billion, as of September 30, 2021.

As of the second quarter of 2021, the value of the underlying real estate held by the securities in which the fund is invested is approximately $239 billion, including investments managed by Ares, Blackstone, Morgan Stanley, Principal, Prudential, Clarion Partners, Invesco and RREEF, among others. The minimum investment is $2,500 ($1,000 for retirement plans) for Class A, Class C, and Class L shares.

For more Bluerock Real Estate news, please visit their directory page.