Bluerock Total Income+ NAV Jumps 2.1%

The Bluerock Total Income+ Real Estate Fund (TIPRX, TIPPX, TIPWX, TIPLX), a closed-end interval fund), reported a net asset value per share of $29.50 as of November 30, 2020.

The Bluerock Total Income+ Real Estate Fund (TIPRX, TIPPX, TIPWX, TIPLX), a closed-end interval fund), reported a net asset value per share of $29.50 as of November 30, 2020, an increase of approximately 2.1 percent since September 30, 2020 and an 18 percent increase from its introductory price per share of $25.00

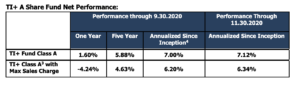

Year-to-date, Bluerock Total Income+ has generated net positive total returns to investors of 0.93 percent (Class A shares, no load), as of November 30, 2020. Since inception in October 2012, Class A shares (TIPRX) generated an annualized net return of 7.12 percent, and a total cumulative return of nearly 75 percent, the company said. With maximum share load of 5.75 percent, Class A shares had annualized returns of 6.34 percent.

The fund has paid 31 consecutive quarterly distributions totaling approximately $11.40 per share, the last 28 at an annual rate of 5.25 percent. The company said that it anticipates paying its upcoming fourth quarter distribution at the same rate.

“Despite the deepest quarterly GDP decline in U.S. history triggered by the onset of the COVID-19 global pandemic, the leading institutional private real estate index1 and Bluerock Total Income+ Real Estate Fund have both posted positive total returns year-to-date 2020 which we believe is a testament to the underlying fundamentals of the asset class,” said Jeffrey Schwaber, chief executive officer of Bluerock Capital Markets.

“We believe TI+ Fund’s strategic allocations into higher performing real estate sectors and investing with best-in-class institutional investment managers has allowed the fund to limit drawdowns and generate positive total returns for our shareholders,” he added.

The company noted that, as of September 30, 2020, nearly 80 percent of the fund’s underlying portfolio is comprised of “strategic sector over-weights” to the industrial, apartment and specialty sectors, which have generally fared better than retail, hotel, and office sectors in 2020 and in the trailing five years.

Additionally, it pointed to “significant investments in private institutional real estate debt providing attractive yields and priority within the real estate capital stack making it more defensive.”

The Bluerock Total Income+ Real Estate Fund is a closed-end interval fund that invests the majority of its assets in institutional private equity real estate securities. As of the third quarter of 2020, the value of the underlying real estate held by the securities in which the fund is invested is approximately $194 billion, including investments managed by Ares, Blackstone, Morgan Stanley, Principal, PGIM, Clarion Partners, Invesco and RREEF, among others. The minimum investment is $2,500 ($1,000 for retirement plans) for Class A, Class C, and Class L shares.

The fund is sponsored by Bluerock and sub-advised by Mercer Investment Management, Inc., an advisor to endowments, pension funds, sovereign wealth funds and family offices with more than 3,300 clients globally and approximately $15 trillion in assets under advisement.

For more Bluerock Real Estate news, click here to visit their directory page.