Accessing the Inaccessible: Private Equity Investing

Imagine that you just inherited $5 – 10 million dollars and are looking for the right advisory relationship to protect and maximize your new found wealth. Based on your inheritance, you’d now be referred to as a “mid-tier millionaire.” Luckily, the wealth management industry is hard at work scrambling to address this segment of the market. However, shouldn’t the size of your new found portfolio allow for entrée into the best managers and access to the smartest minds on Wall Street? Unfortunately, it does not. Many of the top wealth management firms will tell you that there are many investment choices like venture capital and private equity funds that are either unavailable or too layered with fees to provide any meaningful benefit to your portfolio.

In short, despite the fact that you are now a multi-millionaire, you are still shut out of the types of investments available to pensions like CALPERS and endowments like Yale which benefit from exposure to true private equity.

The investment management industry has done a fantastic job of focusing retail investors on the avoidance of risk and achieving a more balanced portfolio, but in many cases this has been done at the expense of higher returns. As noted by Roger Ibbotson, “Though it may seem counter-intuitive, the addition of a high-risk asset to your portfolio may reduce your total portfolio risk if the high-risk asset has a low correlation with your other investment assets. In this way, you can lower your portfolio risk while at the same time increasing your potential return.”

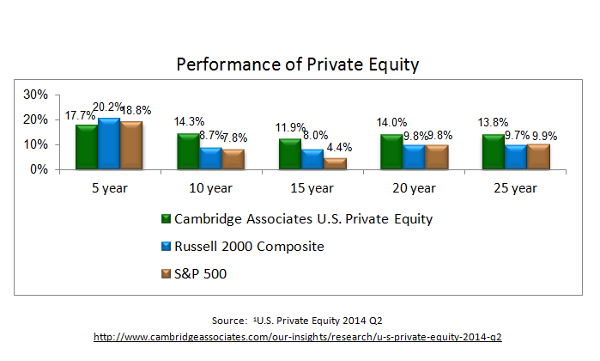

In recent years, with the offerings of firms like Kohlberg, Kravis and Roberts (KKR), The Blackstone Group, Apollo and others, the investing public has become aware of just how compelling private equity returns can be. With returns sometimes exceeding 20%+ per year, how can the smaller retail investor match these “inaccessible returns?”

David F. Swensen, the chief investment officer (CIO) for Yale University’s endowment, has allocated more than a third of the endowment’s assets to private equity for many years and his long-term performance outpaces those of all his peers, including Harvard University. Based on Swensen’s success, not only have his peers in the endowment world followed in droves, but the largest US Public fund, CALPERS (California Public Employees’ Retirement System) reports having earned 30%+ more on its private equity investments than on its public equity holdings.

While these types of returns might seem unattainable, large family offices, ultra-wealthy individuals, and institutions have enjoyed these types of returns for many years. So, how can the average retail investor gain access to the inaccessible? Many private equity firms that are focused on the middle markets (deals that range in size from $50 – 250MM) raise funds from institutional investors and ultra high net worth individuals. Unfortunately, the cost for entrée is often very significant. Realizing many investors want access to this “private club,” at least one firm has found a way to bring this style of institutional investing to the masses. Triton Pacific Group recently launched Triton Pacific Investment Corporation (TPIC), a publicly registered business development company marketed as a private equity focused BDC. With a low minimum of $5,000, TPIC allows average retail investors exposure to pure private equity.

Craig Faggen, Chairman and CEO states, “The BDC structure allowed the governance, transparency, and reporting many broker/dealers and RIAs like to see while at the same time providing a vehicle for individual investors to access what has been historically an institutional only style of investing.”

Launched recently, Triton Pacific Investment Corporation will focus on true private equity style investing while rewarding investors with a current yields along the way.

As I see it, we are the only growth and income oriented non-listed BDC currently available to retail investors. Investors have the ability to access real private equity potential in a fully transparent and private equity focused BDC.

Private equity is not for everyone. While historical returns are compelling, it is a long term investment commitment that not all individual investors are prepared for. However, for those that are, it is promising to see that many investors that did not have access to this asset class now do.

Be sure to check out Brad Blazar on Superior Returns from Private Equity.