Non-Traded NAV REITs Reportedly Outperform Traded Counterparts

Non-traded real estate investment trusts, as well as their traded counterparts, made gains in the first quarter of 2021, according to investment bank Robert A. Stanger & Company.

Non-traded real estate investment trusts, as well as their traded counterparts, made gains in the first quarter of 2021 as the market continued to recover from the heavy toll that COVID-19 took on real estate securities in the first quarter of 2020, according to investment bank Robert A. Stanger & Company.

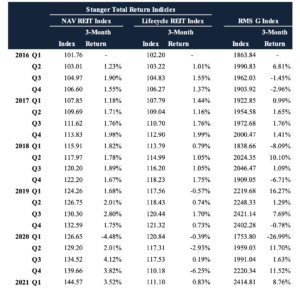

The MSCI US REIT Index Gross Total Return (RMS G), a measure of performance of publicly traded REITs, posted an 8.76 percent return in the first quarter of 2021, and has now bounced back to its pre-COVID level. Over the last 60 months, the total return of this broader REIT market index was 29.6 percent.

Non-traded net asset value REITs posted a 3.52 percent return for the first quarter of 2021, as measured by the Stanger NAV REIT Total Return Index, which recovered to its pre-pandemic level during the third quarter of 2020 and is now at a record high. Non-traded NAV REITs continue to post steady gains, outpacing their traded counterparts with a cumulative total return of 42.1 percent over the last 60 months.

Discussing the impact that stock market volatility plays in the values of traded REIT securities, Kevin Gannon, chairman and chief executive officer of Stanger, said, “This performance highlights the benefits of a non-listed NAV REIT vehicle, that historically has provided a mostly steady real estate-based return without the extreme ongoing volatility of the traded market.”

The Stanger NAV REIT and Stanger Lifecycle REIT Total Return Indices measure the performance of non-traded REITs on a quarterly basis. Stanger began calculating the indices on December 31, 2015, with a base level of 100.

The indices currently include 15 NAV REITs (perpetual entities that offer limited periodic liquidity at net asset value) with a total of 78 separate share classes, and 33 traditional lifecycle REITs (entities anticipating a five- to seven-year holding cycle followed by a liquidity event) with a total of 54 separate share classes.

All NAV REITs with a minimum of one calendar quarter of performance are included in the NAV REIT Index.

Traditional lifecycle REITs are added to the Lifecycle REIT Index in the quarter that their first NAV is announced, and are removed from the index upon listing, merger, or in the case of a liquidation by sale of properties, upon conversion to a liquidation basis of accounting.

Founded in 1978, Robert A. Stanger & Co. Inc. is a national investment banking firm specializing in providing investment banking, financial advisory, fairness opinion and asset and securities valuation services to partnerships, REITs, and real estate advisory and management companies in support of strategic planning and execution, capital formation and financings, mergers, acquisitions, reorganizations and consolidations.