The Mainstream Side of “Alternative” Investing: Recession-Resistant Assets

By: Dan Brewer, managing principal of Bridge Capital Management

Most agree the United States is due for a recession. In fact, some believe there is a 100 percent chance we’ll experience a recession in the next few years. It makes sense, then, to consider how to keep your assets safe—and ideally, growing—during an economic downturn. The answer may lie in alternative investments.

Alternative investments are probably the most misunderstood investment type because they vary so widely. The market includes everything from venture-capital and angel-capital start-ups in the tech industry, to investments in energy, commodities, technology, pharmaceuticals, and commercial real estate (CRE). While many alternative investments are considered higher risk than traditional investments like stocks and bonds, many are also incredibly recession-resistant, and could help investors ride out the storm during times of economic downturn. This is especially true when it comes to CRE.

While CRE itself encompasses many areas, from retail to hospitality, the most “mainstream” investments are in areas backed by demographics, social trends, and overall need. The following are a few of the top mainstream alternatives to consider as we head into a period of potential economic uncertainty.

Senior Housing

Need-based investments are often some of the most reliable, and there is likely no greater need right now—or for the next 20 years—than senior housing. Every day, 10,000 Americans turn 65. By 2035, those 65+ will make up nearly 1/3 of our population. Many of our aging Baby Boomers will need increasing medical services and specialty housing, whether they want it or not. Studies show about 2 million senior housing units will need to be constructed to meet demand anticipated by 2040 (ASHA). What’s more, history shows investments in these units are generally quite profitable. In the past 10 years, senior housing has generated annualized total returns of 14.7% versus 8.1% for apartments and 8.4% for all commercial property types in NCREIF’s National Property Index (NPI).

A few caveats:

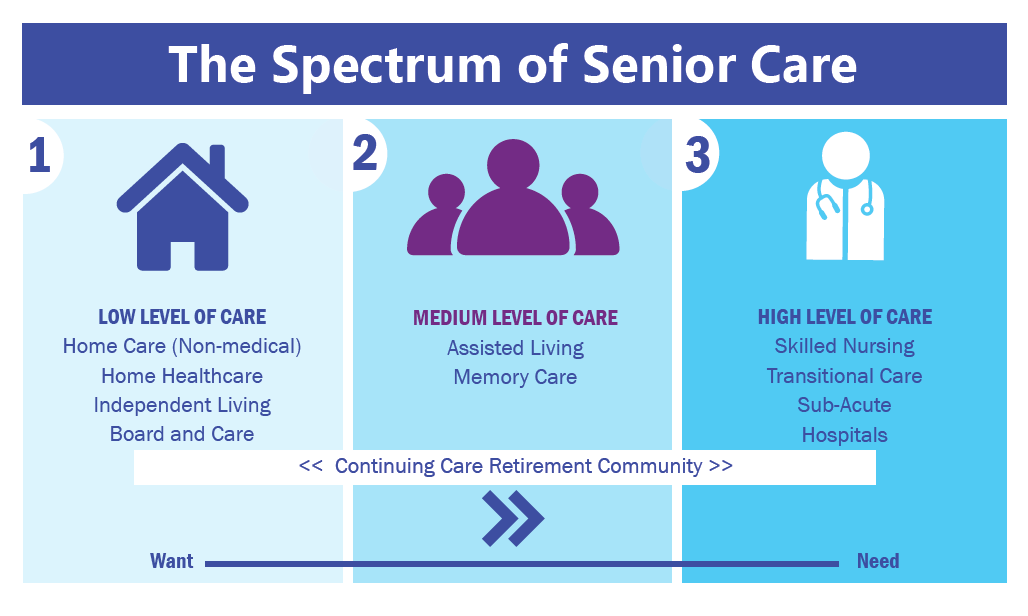

- The senior housing industry encompasses many different types of housing, including assisted living, memory care, and skilled nursing. The level of “need” rises the more complex care services are offered. Take time to understand the full spectrum of care offered in each housing type, or find a Fund Manager who is incredibly familiar with these nuances, before making your investment.

Multi-Family Housing

In times of economic downturn, it makes sense that many families turn to renting smaller condos and townhomes, rather than buying houses of their own. But America’s multi-family housing market is already facing a crisis of availability, even today. Research from the Harvard Joint Center for Housing Studies and Enterprise Community Partners suggests that the rental population in the U.S. will climb by 4 million in the next decade. Some have even called that estimate conservative. With vacancy rates at 7 percent, multi-family housing is already facing a need-based crisis of its own. Smart investors could capitalize on this need in a variety of ways, either through direct investment and property management, or through equity fund and crowd-funding opportunities.

Caveat:

- Half of renters spend more than 30 percent of their salary on housing; 25 percent spent more 50 percent or more. With inflation outpacing the rise of income, it will be important to focus on building affordable housing, rather than just luxury high-rent units.

Self-Storage

If you’re tired of hearing about trendy self-storage investments, join the club. But that doesn’t mean self-storage isn’t a good investment—especially in times of economic hardship. The National Association of REITs (NAREIT) reported that self-storage was the only REIT sector to post a positive total return (5 percent) during the 2008 financial crisis. That might be because—with low overhead—it takes very little to break even on a self-storage investment. Studies show owners need to hit just 40-45 percent occupancy to hit the black. It might also be because in times of economic uncertainty, families tend to downsize, and need extra space to house their personal belongings. Either way, the trendy self-storage craze still seems to have the chops to make a great investment.

Caveat:

- Self-storage has become one of the trendiest ways to invest in CRE, especially via online crowdfunding portals. Be sure to properly vet all companies and fund managers to ensure they have a solid investment history before making your investment.

There are numerous ways to invest in all the above CRE opportunities, from private equity funds and REITs to direct investments. Each carries its own individual level of risk—and potential gain—and each is tied differently to the market in its entirety. Consider how actively you wish to be involved in the investment before deciding which is right for you.

Lastly, remember: the act of investing in alternatives does not diversify your portfolio in and of itself. For instance, if you invest in a multi-housing REIT like Equity Residential (EQR) or Avalon Bay (AVB) and then choose to invest in a multi-housing equity fund, your portfolio is far from diverse. To create a truly diverse portfolio, you need to carefully strategize each individual investment. A market investment in Facebook (FB) or Tesla (TSLA) could be balanced with a private equity investment in senior housing, just as an investment in Amgen (AMGN) could be nicely paired with a crowd-funding opportunity in self-storage. In the end, that pairing is up to you.

Dan Brewer serves as managing principal of Bridge Capital Management, based in Lenexa, Kansas. He has nearly 25 years of experience in residential and commercial real estate (CRE) investment, capital acquisition, and business consulting. Dan has significant experience in capital and fund management, especially in the field of recession-resilient asset classes, and speaks frequently at conferences nationwide on trends impacting the CRE sector.

The opinions in the preceding commentary are those of the author alone and do not necessarily reflect the views of The DI Wire.